Ziidi

Grow your money daily with ZIIDI Money Market Fund

Ziidi Money Market Fund (MMF) allows M-Pesa customers to invest in a money market fund from as low as KSH 100 from their M-Pesa and earn competitive daily interest.

Funds can only be invested or withdrawn via M-pesa with invested funds instantly accessible.

Why should you invest in ZIIDI?

- Easy sign-up: Sign up for Ziidi MMF effortlessly on your mobile phone with no paperwork needed. Start investing and earning right away! Ziidi MMF is accessible on any type of handset for your convenience.

- Secure: Your Ziidi MMF investment is protected with your M-PESA PIN. You’ll need your PIN when signing up and to complete every transaction. For security, DO NOT SHARE YOUR M-PESA PIN WITH ANYONE!

- Competitive Interest: Make your money in the M-PESA wallet work for you. Transfer your funds to Ziidi MMF for free, and earn daily interest.

- Easy Access: With as little as KES 100, you can start your investment journey. No maximum transactional limits but M-PESA daily limits apply.

- Zero transaction costs: Ziidi MMF is zero-rated, meaning you won’t be charged any transaction fees for deposits or withdrawals. Ziidi MMF has no maintenance fees.

- Easy tracking: Ziidi MMF offers you the investor visibility/transparency of your daily earnings to help you in your financial planning and tracking.

- Real time access: Withdraw your funds from Ziidi MMF and instantly receive them on your M-PESA account. You don’t have to wait for days or hours for your request to be processed. There are also no limits on the number of withdrawals you make in a day.

How to Access ZIIDI

As an M-PESA registered customer, you may access your ZIIDI MMF investment account through the M-PESA App or by dialing *334#. This ensures that you can invest from any type of handset you have, whether it is a smartphone or a feature phone.

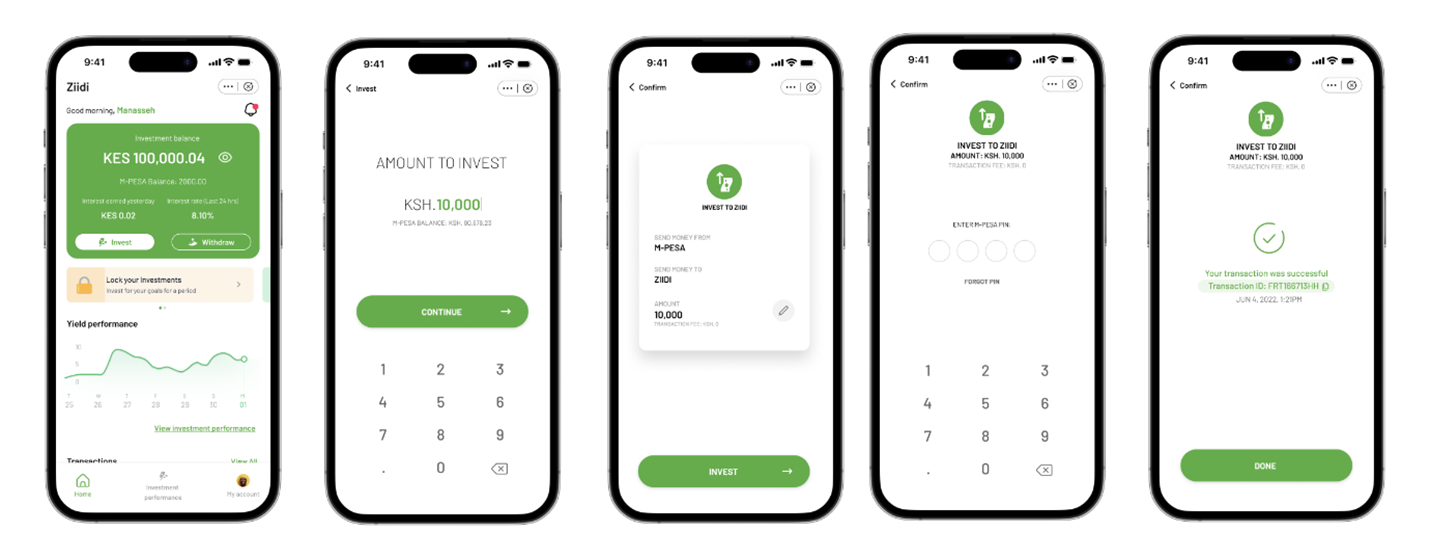

M-PESA APP

How to access the Ziidi MMF on the M-PESA App

- Download M-PESA App from your app store

- Log into the App

- Go to financial services on your M-PESA App

- Tap on the ZIIDI icon to begin your investment journey

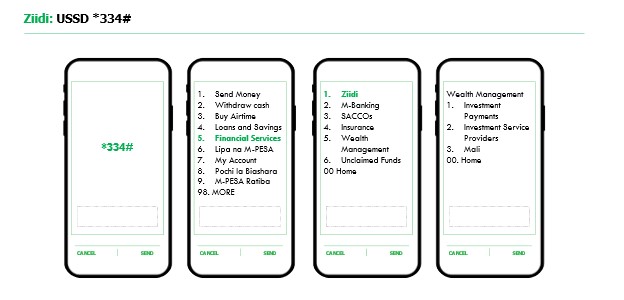

USSD *334#

- Dial *334# on your phone

- Select Financial Services

- Select ZIIDI to begin your investment journey

Frequently Asked Questions

As currently approved by the Capital Markets Authority, Ziidi MMF is an individual investment fund, however, we are working to add other options in the near future which may bring in chamas and businesses.

As currently approved, Ziidi MMF is an interest earning money market, however we are working on a Shariah compliant option that will be unveiled soon.

This is a Money Market Fund where the funds are invested in government securities such as T-bills as well as interest earning accounts. The rate therefore changes daily. The interest earned on your investments is computed daily and an indicated rate given to you on the M-PESA App and on *334#. Your funds start working for you just 24 hours after depositing. It’s the perfect way to make your money grow effortlessly!

Yes, the fund management fee is 2% interest per annum. However, the return indicated is a net return.

Yes, Like all other interest earning investments, the Ziidi MMF income is subject to 15% withholding tax.

No, All transactions to and from your M-PESA wallet to the Ziidi MMF Fund are completely free.

Enjoy giving you a worry-free convenience to manage your money.

No, For now, all deposits and withdrawals are via your M-PESA account.

The minimum amount to invest is KES 100 and the minimum amount you can withdraw is KES 10. There is no maximum investment. However, the daily M-PESA transaction limit of KES.500,000 per day and KES. 250,000 per transaction are applicable.

You can view and track your investment and earnings on the Ziidi mini app homepage under Investment performance or on *334#.

Next of Kin is the person whose details you update on the ZIIDI mini app and in the event of incapacities such as sickness, mental instability, or death they can have access to your funds.

In the event of a claim, the Next of Kin will provide the following documents:

- A duly filled ZIIDI Next of Kin claim of funds form.

- Identification document (ID)

- Death Certificate

- Grant of Probate/Letter of Administration

- Letter from local Administration ascertaining the heir.

As a Next of Kin, you’ll be required to visit the nearest Safaricom Retail shop or Care Desk for assistance with processing the claim.

You cannot change ownership of your Ziidi account. If you need to change the ownership of your Ziidi account, you will need to withdraw all your funds and opt out of Ziidi. Then, follow the current process for changing the ownership of your mobile number and account details. We are here to help you through each step!

- Locking funds is a smart way to set aside money and avoid unplanned spending.

- It adds an extra safety layer and control, helping you stay on track with your financial goals.

- While the locked funds will not earn additional interest for now, you are taking a positive step towards financial discipline and security.

There is no fixed period for locking your funds on the Ziidi MMF. Lock them for as long as you like using the Ziidi Mini-App on the M-PESA App or USSD 334#. Plus, you can easily top up your locked funds anytime.

Your funds will be available 72 hours after unlocking. Kindly note that you can only unlock the entire locked amount, not just a portion of it.

No, there’s no limit to the amount that can be locked or unlocked. However, the amount to be locked should be less than or equal to the amount in the Ziidi MMF wallet. No fees will be charged for locking and unlocking of invested funds.

The interest earned will be the same, however locking your funds helps you overcome impulsive spending building financial discipline.

For support and inquiry, please contact Safaricom Customer Care Center

- Pre-Pay: Call 100 (Chargeable) or +254 722 002100 (Chargeable) or email

This email address is being protected from spambots. You need JavaScript enabled to view it. - Post-Pay: Call 200 (No Charge) or +254 722002100 (Chargeable) or email

This email address is being protected from spambots. You need JavaScript enabled to view it. - You can also send us a Direct Message on our Social Media Channels: X: @Safaricom_care and @safaricomPLC or Facebook: @safaricomPLC

- Visit the Safaricom Retail Center/ Customer Care Desk.

, how can I help you today?

, how can I help you today?