Halal Pesa

This is the first Shari’ah compliant, digital financing product powered by MPESA in partnership with Gulf African Bank Ltd.

How it works

This product was designed to cater to our Muslim customers who stay out of other lending products since they don’t adhere to Shari’ah law. Shari’ah law does not support/allow taking loans/borrowing money from banks or individuals where interest is charged.

Since the Halal Pesa product is based on Shari’ah principles, it operates under the Tawarruq model: which basically means that the customer is given a facility and not a loan. To verify the Shari’ah compliance of the product and other product details please visit www.gulfafricanbank.com .

Halal Pesa is currently not available for new registration and facility requests. The relevant menu to register or request for a new facility are not available. However, customers who had already opted in and taken some facilities will be able to repay back.

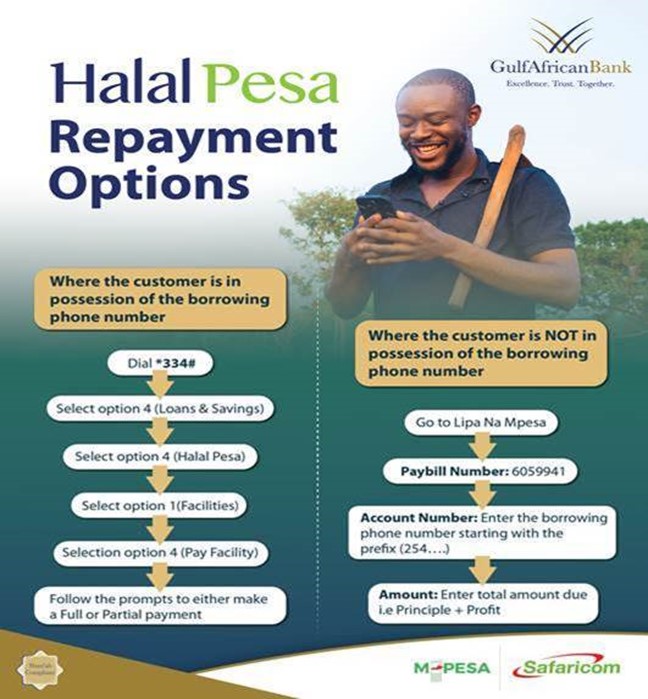

How to Pay Existing Facility

Please refer to the guide below on how existing facilities shall be paid.

, how can I help you today?

, how can I help you today?