OUR PRINCIPAL SHAREHOLDERS

This Annual Report is the primary report of Safaricom PLC (the Company) and its subsidiaries (together, the Group) to its stakeholders, and is a concise, material, and honest assessment, reviewed and authorised by our Board of Directors (the Board) of how we create long-term value and how we deliver on our purpose of Transforming Lives. The report provides an overview, in terms of the six capitals of our strategy and business model, risks and opportunities, operational and governance performance and activities for the financial year 1 April, 2022 to 31 March, 2023.

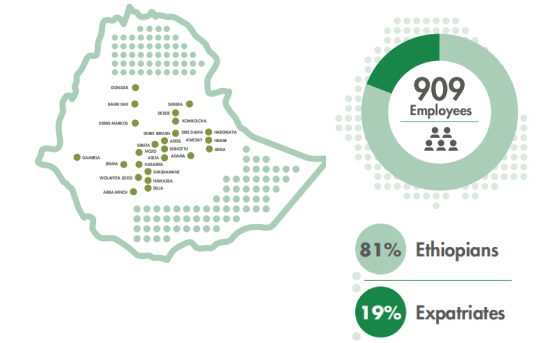

The Ethiopian cities we cover as at end of March 2023

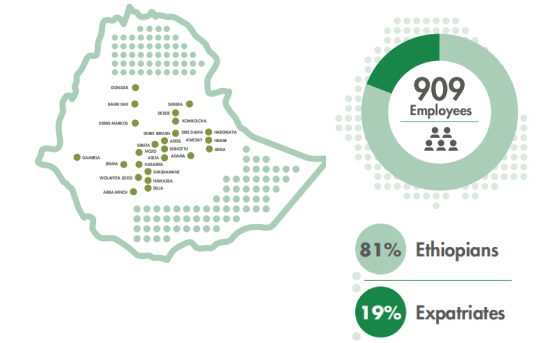

The Ethiopian cities we cover as at end of March 2023

The Spirit Of Safaricom

Download PDF