M-PESA

Revenue growth during the year was attributable mainly to M-PESA, mobile data and fixed revenues.

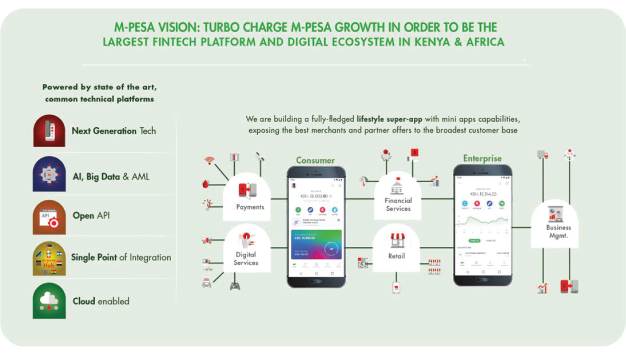

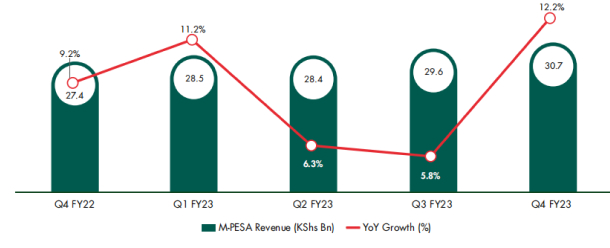

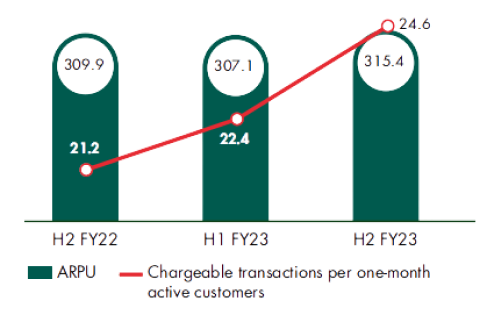

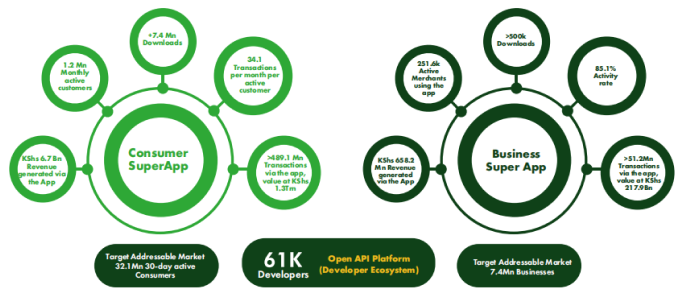

- M-PESA revenue was up 8.8% YoY, supported by increased usage and growth of chargeable transactions per customer.

- Mobile data grew double digit by 10.6% driven by increased usage evidenced by a 53.8% growth in the average Gigabytes per user to 3.57GB.

- Fixed Enterprise and Fibre-to-the-Home (FTTH) revenues grew 21.4% and 17.9% YoY respectively driven by growth in customers and usage.

- Our rate per MB has declined by 24.5% in the year to 6.7 cents driving affordability for our customers.

- As we focus on growing penetration of 4G devices, we are delighted to see that of the smartphone users that grew by 10.0% to 20.3 million, 65.1% or 13.2 million are active on 4G devices.