The Commercial Value We Deliver

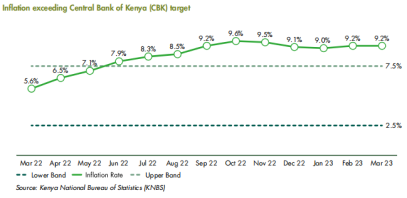

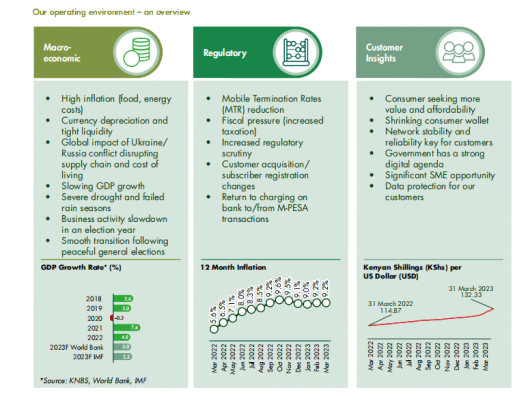

Our Operating Environment

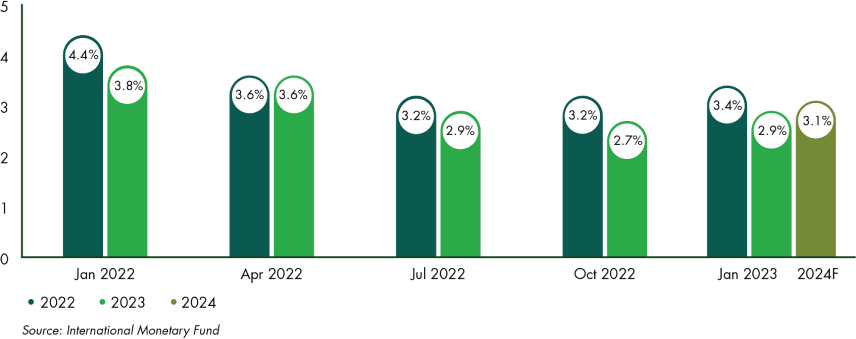

The global economic picture

During the year under review, the echoes of the COVID-19 pandemic continued to impact economies around the globe worldwide. Just as the benefits of emerging from the crisis were becoming apparent, however, a new one established itself in the form of the war triggered with Russia’s invasion of Ukraine. This had an immediate impact on the supply of food and energy, increasing insecurity, with many developing countries particularly exposed. High inflation continued to affect disposable income globally, with the rising cost-of-living exacerbating poverty and economic pressure. With local weather patterns increasingly disrupted by global warming, heat waves, wildfires, floods, and hurricanes have triggered significant humanitarian and economic challenges, and in addition, the year saw a perceptible uptick in the possibility of a debt crisis in developing countries. The result has been a worsening of material prospects emanating from weaker external demand and tighter financing conditions in emerging economies, with economic activity and per-capita income growth forecast to be slow in direct proportion to levels of poverty.