Aspects from the Macro Economic Environment

Regulatory Implications

In addition to macro-economic impacts, regulatory changes, particularly to the

mobile termination rate (MTR), have had the following impacts on our business:

• The revised MTR and fixed termination Rate (FTR) of KShs 0.58 from KShs 0.99, (an interim

rate for 12 months as the Authority conducts a Network Cost Study) came into effect

from 1 August 2022.

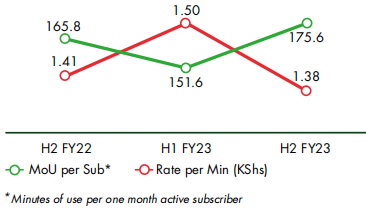

This reduction in rate has impacted our interconnect revenues to the value of

KShs 2 billion, with FY2023 interconnect revenues for Kenya declining by 22.5% YoY to

KShs 5.3 billion.

• The previous rate of KShs 0.99 was applicable for only four months of H1 FY2023, with a

larger impact felt in H2. The total loss was KShs 2.0 billion in FY2023, based on the MTR

decline to KShs 0.58.

Tax Implications

We saw a number of tax implications during the year under review:

• The Finance Act 2022 imposed a 10% excise duty on the importation of cellular phones, 25%

import duty on phones as part of the EAST African Community External Tariff (CET) and as

well KShs 50 excise duty on every imported ready-to-use SIM card. These taxes have increased

the cost of smartphones and slowed down our initiatives to drive 4G device penetration in

the year. The three sets of taxes on the purchase of mobile phones and SIM cards add a new

layer of taxes to users who already pay a raft of other levies on the services they access

on their devices.

• The three sets of taxes on the purchase of mobile phones and SIM cards add a new layer of

taxes to users who already pay a raft of other levies on the services they access on their

devices.

• The use of telephone and internet data services already attracts duty at the rate of 20%

of excisable value which includes the 16% value-added tax (VAT).