STAKEHOLDER ENGAGEMENT

| SOCIETY | REGULATORS | SHAREHOLDERS | MEDIA

| CUSTOMERS |

BUSINESS PARTNERS | EMPLOYEES |

65

In order to serve the needs of our consumer customers better, we classify these

customers into four main market segments: the Youth, the Masses, Hustlers, and

Discerning Professionals. While we are pleased to report that we exceeded our

target in the Hustlers segment, which we ascribe to the popularity of the FLEX

product launched during the year, we failed to achieve our targets in the other

three segments because it was our first year of targeting these new segments

and our customer classification rules changed during the year (as we learnt more

about our customer segments). We have learnt much and have streamlined

customer targets and classifications for the year ahead. Despite not reaching

our overall target for Youth customers, we made good progress during the year

and our BLAZE platform already enjoys 1.6million subscribers. Both the Youth

and Mass segments have grown significantly during the year and we have also

seen a satisfying spike in Consumer NPS as well

(see table on page 42 for more

information)

.

ENTERPRISE CUSTOMERS

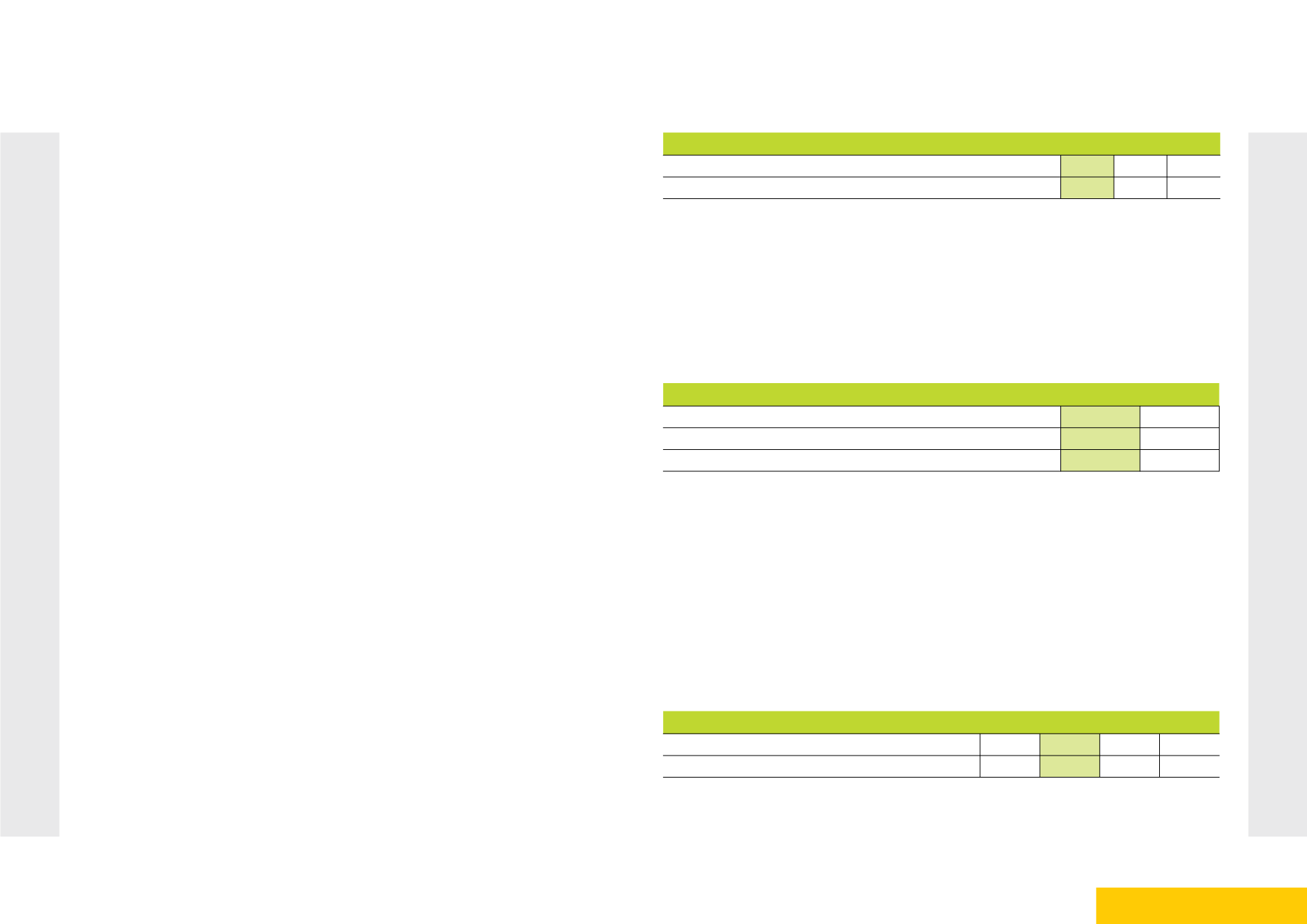

Enterprise customers are split into four major groups: Large Enterprises; Public

Enterprises; Small-to-Medium Enterprises (SMEs); and Small Offices-Home Offices

(SOHO). We currently have a presence in 96,712 enterprise customers, which

represents an increase of 12,712 from the previous year. Most of this growth is

attributable to our significant acquisitions in the SME segment.

FY17 FY16 FY15

Number of Enterprise Customers

96,712 84,000 67,925

Market Share by Revenue

61% 54% 49%

While the SME segment has seen solid growth during the year, large enterprise

customers still account for most of enterprise customer revenue and so our focus

has remained on nurturing long-term relationships and up/cross-selling in this

market segment. We are pleased to report that we grew large enterprise revenue

specifically by 44% in FY17 and now enjoy 61% market share overall in terms of

revenue in the Kenyan enterprise space.

Enterprise Market Share by Segment (% Customers)

FY17

FY16

Large Enterprises (Public and Private Sector)

99%

99%

SMEs

20%

13%

SOHOs

11%

5.2%

MONITORING OUR PERFORMANCE

We continue to use the Net Promoter score (NPS) to monitor customer satisfaction.

NPS measures the likelihood that a customer would recommend Safaricom to

other businesses or friends, based on their overall experience. NPS is measured

separately for consumer and enterprise customers. Our ongoing NPS targets are

to be the number one integrated communications service provider by a margin

of 5% for consumer customers and 10% for enterprise customers, relative to our

nearest competitors. The following table presents a breakdown of our NPS.

NPS RESULTS

TARGET FY17 FY16 FY15

Consumer NPS (Competitor Margin)

5% 8% 10% 4%

Enterprise NPS (Competitor Margin)

10% 20% 19% 28%