STAKEHOLDER ENGAGEMENT

| SOCIETY | REGULATORS

| SHAREHOLDERS |

MEDIA | CUSTOMERS | BUSINESS PARTNERS | EMPLOYEES |

60

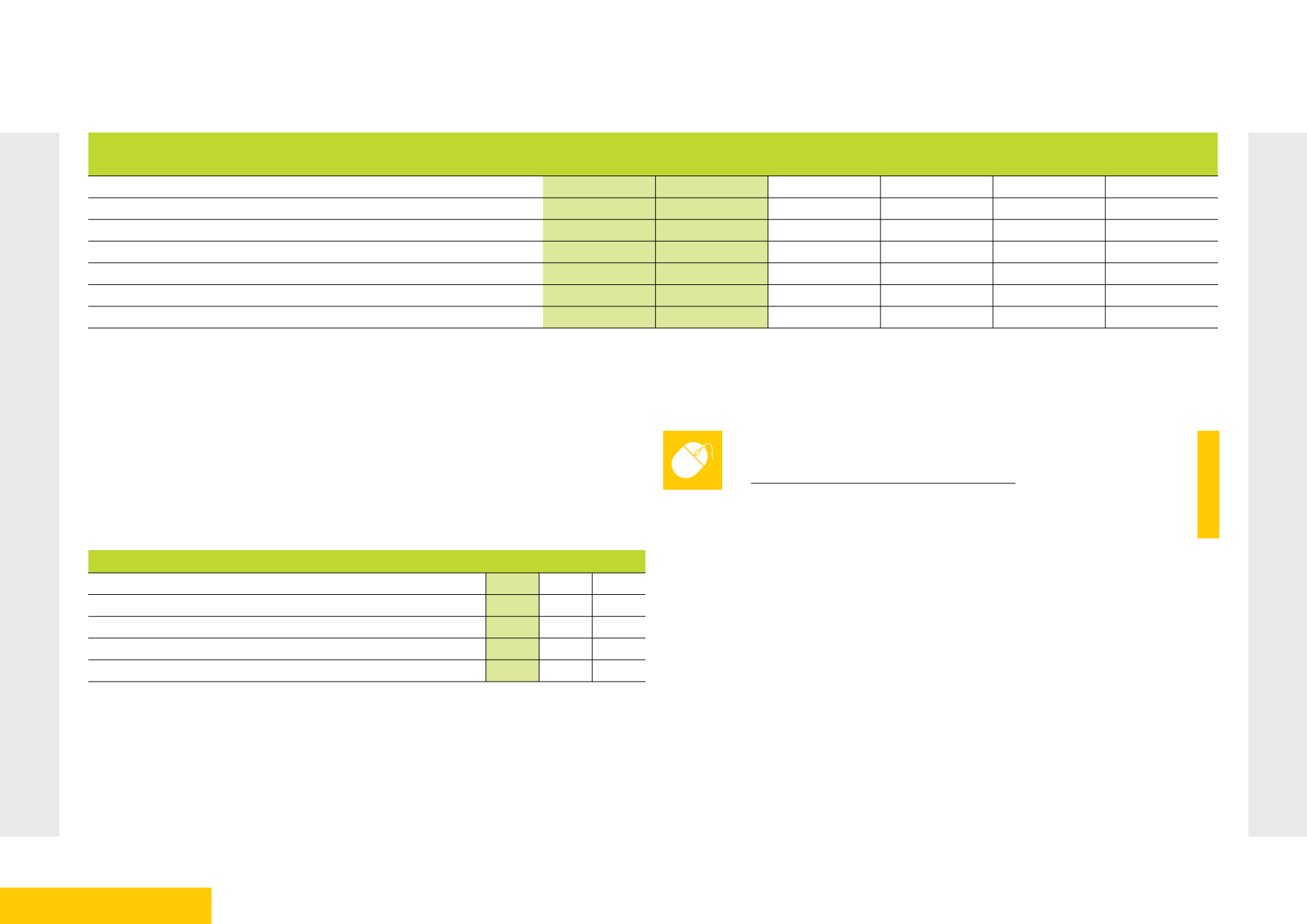

SHAREHOLDERS BY SHAREHOLDING BAND (VOLUME OF SHARES HELD)

FY17

FY16

FY15

No.

%

No.

%

No.

%

1 to 1,000

377,352

64.75%

386,151

64.27%

397,215

63.67%

1,001 to 10,000

182,116

31.25%

189,837

31.60%

200,039

32.06%

10,001 to 100,000

20,771

3.56%

22,234

3.70%

23,954

3.84%

100,001 to 1,000,000

1,854

0.32%

1,955

0.33%

2,066

0.33%

1,000,001 to 10,000,000

492

0.08%

465

0.08%

428

0.07%

10,000,001 to 100,000,000

179

0.03%

176

0.03%

161

0.03%

Over 100,000,000

11

0%

13

0%

13

0%

The preceding table shows that 95% of our shareholders hold a maximum of 10,000 shares and are mostly comprised of the local individuals.

FY17 HIGHLIGHTS

We continue to monitor our performance and deliver value to our investors

through our strong financial performance and through how we engage and

communicate with them. We delivered strong financial performance yet again

this year, which has resulted in further dividend growth and share appreciation.

FY17 FY16 FY15

EBITDA (KES billion)

103.6 83.1 71.2

EBIT (KES billion)

70.4 55.1 45.6

Net Income (KES billion)

48.4 38.1 31.9

Dividend per Share Proposition

0.97 0.76 0.64

Free cash flow (KES billion)

43.5 30.4 27.5

During the year, our net income grew by 27.1% to KES 48.4 billion, up from KES 38.1

billion in FY16. This includes a once-off payment of KES 3.4 billion from the Kenyan

government for the National Police Service Project. Our free cash flow also

increased from KES 30.4 billion in FY16 to KES 43.5 billion. We also achieved an EBIT

of KES 103.6 billion, up from KES 83.1 billion in FY16.

We continue to engage with individual investors, fund managers, analysts and

other members of the investment community actively. On a regular, ongoing

basis, we deliver value to these important stakeholders by ensuring that we are

available to them and respond to their telephonic, email and message-based

enquiries swiftly. We also publish an annual report to keep investors updated

on financial and non-financial performance, and we hold an annual general

meeting, which provides a forum for discussion and debate with shareholders.

We also disseminate information about financial results, reports and upcoming

events to them via press releases and other communiqués. In addition, we will

invite shareholders and other members of the investment community to briefings

and workshops as required.

Please refer to the Safaricom Annual Report at

https://www.safaricom.co.ke/annualreport_2017/ for more

detailed information and discussion regarding our financial performance.