STAKEHOLDER ENGAGEMENT

| SOCIETY | REGULATORS

| SHAREHOLDERS |

MEDIA | CUSTOMERS | BUSINESS PARTNERS | EMPLOYEES |

59

SHAREHOLDERS

Our shareholders expect us to remain a high-performing company that balances

delivering consistent and sustainable financial returns against ethical and

environmentally responsible operation. As a reflection of this, they expect us to

retain a stable, experienced and proven management team and to uphold the

very highest standards of corporate governance and practices.

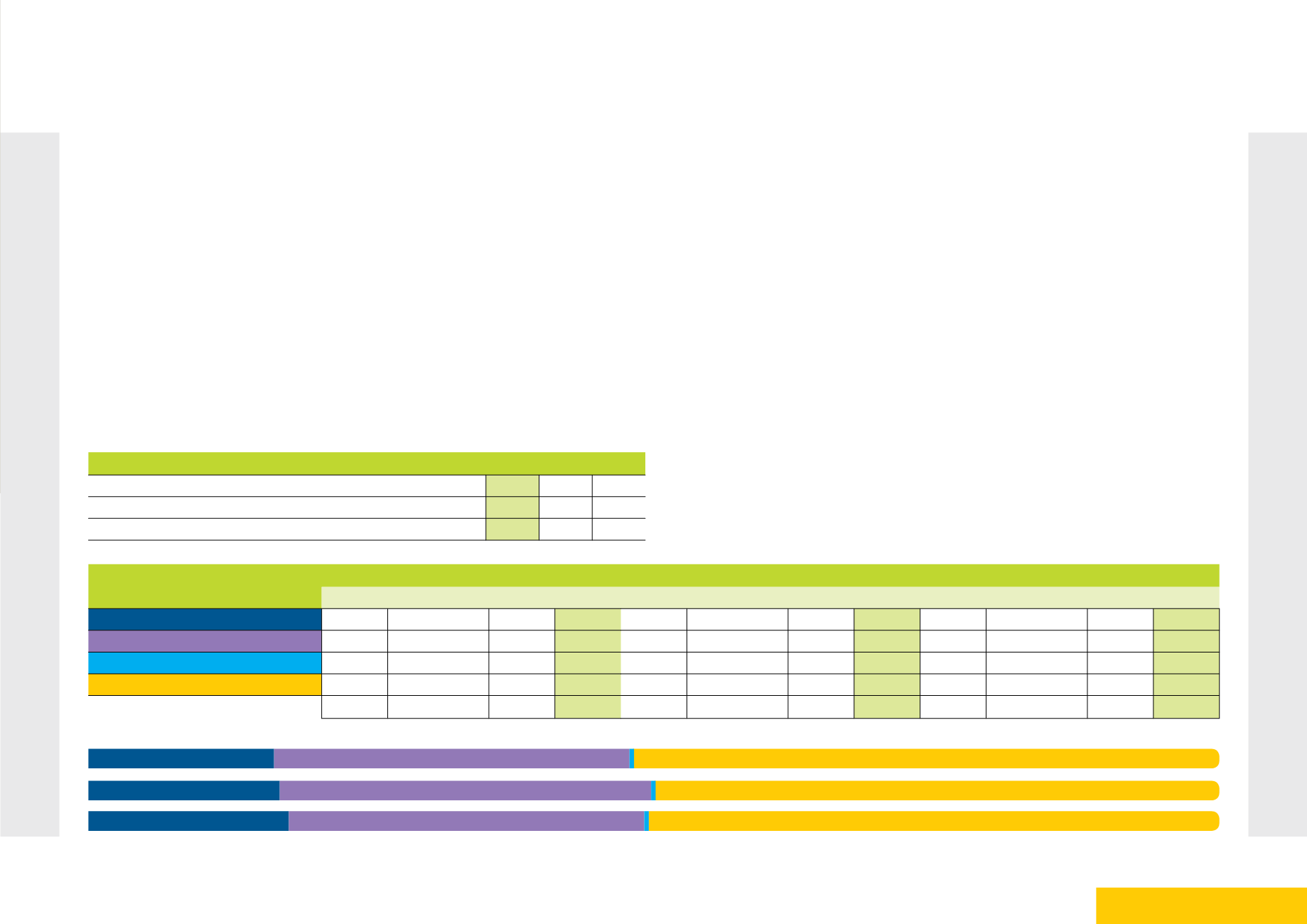

SHAREHOLDING STRUCTURE

Our shareholding structure remained unchanged during the year and continues

to be composed of the Government of Kenya (35%), Vodafone (40%) and free

float (25%).

SHAREHOLDERS

FY17 FY16 FY15

Vodafone

40% 40% 40%

Government of Kenya

35% 35% 35%

Free Float

25% 25% 25%

CATEGORY

FY17

FY16

FY15

No.

Share Value

% % Value No.

Share Value

% % Value No.

Share Value

% % Value

East African Individual

563,956 1,645,340,605 96.8% 16.4% 581,417 1,696,263,381 96,8% 16,9% 603,920 1,782,312,461 96.8% 17.7%

East African Corporate*

16,878 3,155,545,824 2.9% 31.4% 17,481 3,291,772,051 2.9% 32.8% 18,092 3,154,925,327 2.9% 31.4%

Foreign Individual

1,573

42,201,584

0.3% 0.4% 1,601

41,233,651

0.3% 0.4% 1590

42,181,444

0.3% 0.4%

Foreign Corporate

366 5,199,767,407 0.1% 51.8% 330 5,013,586,337 0.1% 49.9% 272 5,063,436,188 0.0% 50.4%

* Excludes VF shares - 16bn and GoK - 14bn

582,775 10,042,855,420

100.0% 100.0%

600,831 10,042,855,420

100.0% 100.0%

623,874 10,042,855,420

100.0% 100.0%

While the overall shareholding structure hasn’t changed, we have noticed a

decline in retail shareholders and an increase in corporate shareholders within

the ‘free float’, especially foreign corporates. The following table presents the

movements in proportions of our shareholder categories from March 2015 to

March 2017.

As the table below illustrates, foreign corporates hold the highest proportion of

the free float, approximately 52%. While the number of local companies holding

shares in Safaricom has been on a decline, the proportion of shares they hold

has also been decreasing and, currently, these companies hold 31.4% of the

free float. Holdings by both retail and corporate local investors have been on a

decline. We attribute this partially to profit taking as the share rose to new levels.

Holdings by both individual and corporate foreign investors have been on an

increase as they take positions in Safaricom attracted by its performance and

strong fundamentals.

FY17

FY16

FY15