Last year was a challenging one for businesses around the country. Despite reported positive economic growth, consumer wallets remained under pressure, forcing Kenyans tomake tougher spending decisions every day.

This lower discretionary spending, coupled with increased tax demands as the Government sought to raise more funds from the ICT sub-sector, contributed towards the plateauing in growth of a number of services including voice and messaging. Despite this, the service industry continued to register sturdy performance, supported by the growth of businesses such as ours in ICT, as well as wholesale and retail trade, transport, tourism and real estate

As mobile penetration has deepened to reach close to 51 million subscribers in a country of about 52 million, so has the need to find alternative means of sustaining growth. Traditional growth drivers (voice and messaging) continue plateauing, pointing to the urgency of reinventing our business to meet changing consumer needs. This will require more calculated investment and innovation, both of which can only succeed in a supportive regulatory environment. We have noted with concern, attempts to regulate the industry through proposed legislation and regulations that seek to forcefully reorganise the operating structure of companies such as ours, whose growth has been the result of well-executed business strategy.

Such actions would severely limit the ability of businesses to invest, innovate and transform lives, which is what Safaricom exists to do. It is our hope that this matter will be handled in a more consultative manner, including meaningful discussions between all concerned parties in order to come to a more considered outcome, that's beneficial to all stakeholders.

Kenya is a dynamic market, with enough room for multiple players to compete fairly in the pursuit of business growth and brand love.

It is therefore encouraging to see the competition landscape changing, owing to the ongoing merger between two market players. We believe this will result in greater innovation and efficiencies for the benefit of customers. Safaricom welcomes fair competition on a fair playing ground, where investment, strategy, innovation and brand promise are the true differentiators; as opposed to the use of regulatory support as a means to success.

Over the last 18 years, Safaricom has built a business founded on our innate desire to transform lives using mobile technology. We have been able to do this by focusing on our strategy, continuously anticipating the needs of our customers and innovating to meet them and staying true to our purpose.

However, none of this would have been possible without your unwavering belief in our vision. So on behalf of the Board of Directors, I would like to say, thank you. Your patience, loyalty and support inspire us to do more: to seek out new growth opportunities that will generate considerable shareholder wealth, and deliver shared value to a broader stakeholder base.

We began Q2 FY2020 on a sad note following the passing of our CEO, Mr. Bob Collymore, on 1st July, 2019 after a long battle with cancer. He was a remarkable man who had an extraordinary dream for the world and for Safaricom.

For nine years, Mr. Collymore led our business to achieve notable milestones, including significantly increasing shareholder value and instilling in us a sense of purpose that has become the hallmark of what we do at Safaricom. This purpose, to transform lives, is the reason we exist today. To honour his legacy, we will remain committed to completing the work he began. We will stay true to our purpose and to using mobile technology to make life better for Kenyans and as many people as we can reach across the world.

Although our business is up against a number of challenges, we are confident in our ability to manage these risks and ensure continued growth, guided by a very able Executive Committee now headed by Mr. Michael Joseph, who was appointed as the interim CEO by the Board of Directors.

Looking ahead, we will continue to reinvent our business, invest in new areas of growth and realign our priorities to position Safaricom as a business that is fit for the future.

Nicholas Nganga | Chairman

The last month has been a difficult one for the Safaricom family, including our partners, following the passing of Bob Collymore. He was a great man, not just because he was a dear friend of mine, but because of what he was able to achieve in the nine years he spent at the helm of Safaricom. While we are still trying to come to terms with this loss, I believe that focusing on preserving and honouring Bob’s legacy will help us to eventually heal.

To guide the business through this transition, I have been appointed by the Board of Directors as Interim CEO. In this role, I will be taking care of the business to ensure that we stay on course with our strategy while the Board identifies a suitable candidate to lead this great company.

Until then, my focus for the foreseeable future will be to rally the team and guide the various business divisions in the execution of our business strategy, which will mean continued focus on putting the customer first, delivering relevant products and services and enhancing our operational efficiency.

We see a number of viable opportunities that have the potential to lead our business to greater heights. As a member of the Board, I am aware that the business has already outlined a number of focus areas for the current financial year, including providing additional support to the business units that are emerging as key revenue drivers, such as Financial Services.

I am particularly keen to work closely with the team to deliver the regional expansion strategy, something I know Bob wanted to achieve this year. Data also remains a key priority for the business, which needs to find a way to create balance between growth of data consumption and revenue growth.

So far, we have been making significant investments in this area and have a vision to become the best 4G+ network for everything from gaming and entertainment to social networking and I look forward to collaborating with a cross-functional team to make this happen.

Growth in this area will support our evolution into a digital lifestyle enabler, which will position us favourably to grow new revenue streams from non-traditional products and services such as DigiFarm, Masoko and other innovations in the pipeline. We believe that these initiatives, together with the investments we’re making in our network, will enable us to maintain our industry position, defend our market share and increase our Net Promoter Score not just based on the variety and quality of the products and services we sell, but on what our customers feel and say about us, because our business exists to transform their lives.

We have a vision to become the best 4G+ network for everything from gaming and entertainment to social networking.

This purpose is in our DNA, it’s what makes Safaricom great and I look forward to working with all our stakeholders to bring it to life, while at the same time delivering enhanced value for our shareholders.

Michael Joseph | Chief Executive Officer (Interim)

"Death is innevitable and I have made the decision not to cling on the thought of it because it will eventually come. I just do not know when. I have chosen to focus on the things that are more important to me. Now I know it's kind of impossible for somebody to live for 200 years.

But something very important is that when you have cancer, the idea of death is near and so it doesn't surprise, unlike you who is healthy but death could be coming in the next minute or tomorrow morning."

Bob Collymore

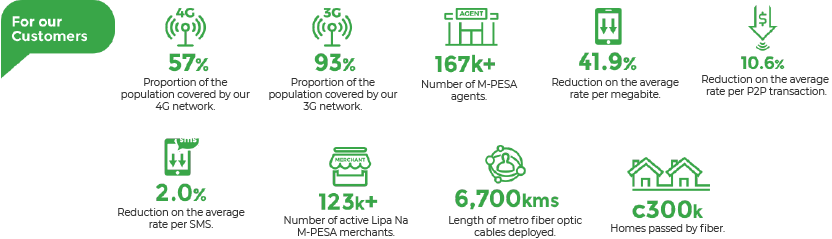

GSM: We focus on providing customers with affordable segmented offerings on voice, messaging and mobile data by progressing the use of CVM and data analytics. We are providing enablers for our customers' digital lifestyles including: enhancing our 3G and 4G coverage currently at 93% and 57% respectively; providing the market with affordable 4G smartphones and other use cases such as Cloud, Self Service Channels, Internet of Things and VoLTE.

Financial Services: M-PESA not only allows for P2P transfers and withdrawal but also payment options, connectivity to formal banking and credit access. It has also facilitated international transactions and deepened financial inclusion in the country.

Fixed Service: As we drive digitisation for our consumer and enterprise customers, we have laid more than 6,700 kilometers of fibre and connected close to 300,000 homes and 2,400 businesses. We continue to increase usage through affordable tiered pricing. We see future opportunity in converged service of data, content, smart home and fixed mobile. New Platforms: In line with our purpose to transform lives, we continue to leverage in the power of mobile technology to deliver on shared value propositions that disrupt inefficiencies and impact lives positively and we have launched two platforms to achieve this. The platforms include; our E-Commerce platform ‘Masoko’ that has the ambition of taking Africa to the world and DigiFarm a platform connecting farmers to knowledge, quality and affordable inputs, credit and insurance and market opportunities.

Value for shareholders: EPS up 14.7% to KShs 1.58 in the year 2019.

Value for Kenyan society

The foundation of our growth is the sustained investment we make centered around customer experience. We have continued investing heavily and strategically in 4G and now have more than 5,000 sites. Our fibre roll out now covers more than 6,700kms opening up opportunities for content, smart home and enterprise propositions in the medium term.

We strive to complement the quality of network experience with personalised products and pricing offers resulting in customers getting much more to use by paying a little more. These personalised offers drove reduction of our average rate for data and voice (outgoing) by 42% and 10% respectively. Average rate per megabyte is down 67% over the last four years as we focus on improving the value we offer to our customers. Our overall customer growth momentum remained solid, with close to 2.3 million more subscribers joining Safaricom in the year.

M-PESA now contributes 31.2% of service revenue while mobile data is now contributing 16% thereby reducing the reliance on voice and messaging revenues. Fixed data contributed 0.7ppts of the 7% service revenue growth. Though a relatively new line of business, fixed data is now contributing 3.4% of service revenue.

We have over the years successfully managed to expand the portfolio which builds resilience and strength to our business model.

We have achieved significant results in limiting cost growth by focusing on digitising and driving efficiencies. The company now has a cost culture which helps maximise returns.

Thanks to some strong cost controls and capex monetisation, underlying EBIT margin improved by 1.9ppts and capex intensity improved by 0.7ppts respectively on an underlying basis.

Effective and efficient capex investment has been complimented by successful commercial monetisation and revenue growth. As a result, despite increasing capex investments, capex intensity has reduced. This has resulted in superior shareholder returns.

Our resulting strong cash flow helps us to maintain a high level of capital re-investment, primarily in our network infrastructure to maintain a leading position in network coverage, call quality and data speed in the market. We have also focused capital spend on our new billing system as we look forward to a transformative digital company.

In addition to investing in the future prosperity of the business, cash generated from our business allows us to maintain our progressive shareholder returns, guided by our dividend policy of paying dividends each year out of net income reported in that specific year.

The technical and managerial skills, productivity and wellbeing of our people – coupled with a company culture and governance systems that foster innovation and compliance – are critical to our long-term success. Investing in our people is one of the most significant costs to our business, impacting short-term financial capital, but generating longer term returns in all capital stocks. The anticipated changing nature of work and the increasing role of digital and Artificial Intelligence may result in some pressure on certain traditional job functions.

Key InputsA positive brand and quality relationships with customers, regulators, investors, suppliers and communities is the foundation of our ability to generate revenue. We believe in maintaining strong partnerships with all our stakeholders.

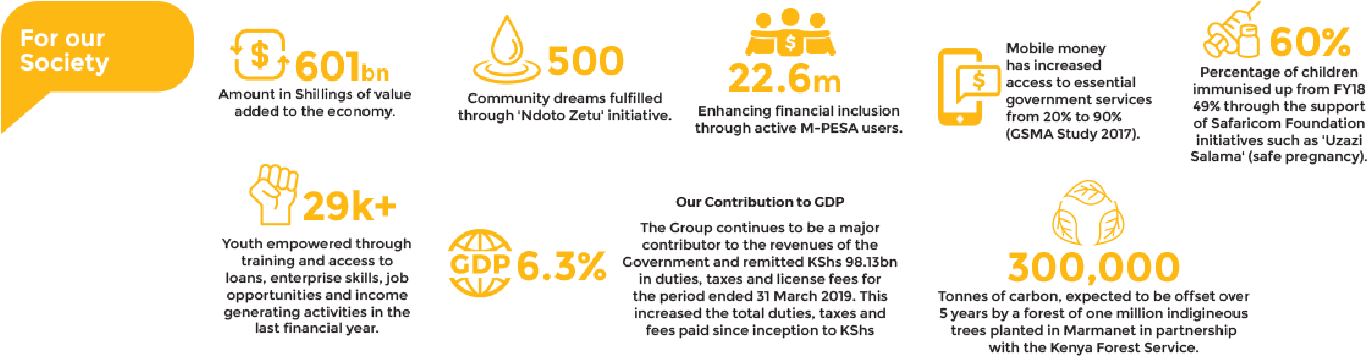

We see our role in society as positively contributing to a sustainable future with a focus on education, health and security. Investing in social capital often requires short and medium-term financial capital inputs, but generally generates positive returns across most capitals.

Key InputsOur network infrastructure, data centres, distribution infrastructure and software applications are an important source of competitive differentiation. Investing in building and maintaining this infrastructure requires significant financial capital and appropriate levels of human and intellectual capital, as well as certain natural capital inputs and outcomes. Over the long term, the investments in manufactured capital typically generate net positive outcomes.

Key InputsWhich includes shareholders’ equity, debt and reinvested capital – is a critical input in executing our business activities and in generating, accessing and deploying other forms of capital.

Balancing the short-term interests of investors with longer-term growth objectives and with some of the interests of other stakeholder groups, remains a critical objective and often involves balancing certain trade offs.

Key InputsWe require natural capital such as land and energy to deploy and operate our manufactured capital. Accessing these inputs diminishes financial and natural capital, the impact of which is lowered through energy efficiency initiatives and site sharing.

Key inputsOur industry is witnessing enhanced volatility. This trend is similar across Sub-Saharan Africa as the market confronts challenges of affordability. Other detractors specific to the Kenyan market include delayed rains causing inflationary pressure on our consumers' wallet, tax revisions and regulatory risk.

Opportunities that continue to support our growth include forecast of high single-digit GDP growth, stable currency, political environment and growth in smart phone penetration. These opportunities and risks are reflected in our strategy.

The regulatory landscape has been a changing topography over the past year. Key issues that have shaped the regulatory environment include:

Data Protection and Privacy

The Kenyan lawmakers are currently discussing two Data Protection Bills; one is at the Senate House and the other is at a Ministerial Taskforce on Privacy and Data Protection.

The Senate Bill proposes that the Kenyan National Commission of Human Rights oversees data protection enforcement while the Ministerial Taskforce, proposes the establishment of a new institution to oversee data protection in Kenya.

Possible impacts to the industry include:

Competition Study

On 5th March 2019, the Parliamentary Departmental Committee on Communication tabled its report on ‘Legislative and Regulatory Gaps Affecting Competition in the Telecommunications sub-sector in Kenya’.

The following amendments were adopted on 3rd April 2019: Parliament tasked CA to conduct a study on Mobile Money Termination Rates with a view of lowering the cost to mobile subscribers and to review the market every 2 years for the existent of a dominant player and to utilise the universal service fund to build base transmission stations for access by all mobile operators in the underserved counties. CA and CBK were tasked with formulating regulations on mobile money transactions and ensuring lending rates conform to those of banks. We look forward to being actively engaged in the formulation of the policies and await the final outcome of the Communications Authority competition study.

Taxation

As affordability is already a key concern for our consumers, we opted to absorb the Excise Duty revisions for data bundles as this threatened to slow down digital transformation. The result of this was short-term impact on our revenue, but it allowed us to regain our leadership as a trusted company. We also saw our brand consideration, usage and Net Promoter Scores increase, tripling our customer growth rate between H1 and H2 to propel us to over 31 million customers growth in the long run. This action also supported the strong increase in mobile data usage per subscriber per month, which has grown by 73% year on year from 421 MBs to 728 MBs. This usage increase offset the reduction in rate thus minimising the impact to average revenue per user.

On 12th February 2019, Telkom Kenya Ltd and Airtel Kenya Network Ltd announced the signing of an agreement to merge and operate under a joint venture.

The merger is subject to approval from various regulators and if approved, this will significantly alter the industry profile, giving customers a stronger player.

FY19 witnessed a heightened competitive environment with price being the key proposition to customers. The industry witnessed an increase in dual SIM usage. The increased competitive intensity slowed down our GSM business as our Net Promoter Score and brand consideration parameters came under pressure. Initiatives such as “Nawe Kila Wakati” enabled us win back trust and consideration and remain the force that propels Safaricom as the industry thought leader.

Interoperability continues to be a strategic priority for the industry, to increase velocity of transactions within the ecosystem. In FY19, we implemented mobile money wallet interoperability and have connected two players in the industry, improving transactions in terms of customers getting a choice to move money around.

We have remained net receivers due to the expansive agent network and use cases available within our ecosystem.

Armed with valuable lessons from twelve years of providing Kenyans with safe, reliable and affordable mobile money transfer and payments services, we sought to enrich our ecosystem further by adding more use cases including:

Two main factors are behind the rise in mobile internet in emerging markets; the continued decline in prices of smartphones and a affordability of mobile data plans as a result of reduced average rate per megabyte.

martphones becoming more affordable has increased their uptake in Kenya significantly. Increasingly, people want to stay connected on social media platforms to keep up with global and local trends. Sub- Saharan Africa continues to be the largest non-internet population in the world, with rural coverage still a major challenge along with other barriers.

We, being at the forefront of the digital transformation in Kenya, have been powering the digital lifestyle through offering affordable 4G smartphones like Neon Kicka and growing our 4G sites with a plan to nearly double them in FY20.

© 2025 - Safaricom