Mwaka jana ulikuwa na changamoto kwa biashara duniani kote. Licha ya ukuaji wa kiuchumi uliokuwa na matumaini, uwezo wa kununua wa watumiaji ulibakia chini ya shinikizo kubwa, na kulazimisha Wakenya kufanya maamuzi magumu zaidi ya kila siku.

Kudorora huko kwa uwezo wa kununua, pamoja na mahitaji ya kodi yanayoongezeka huku Serikali ikifuatilia kuongeza fedha zaidi kutoka kwa sekta hii ndogo ya ICT, kulichangia kutuwama kwa ukuaji wa huduma kama vile za kauli na za ujumbe. Licha ya haya, sekta ya utoaji huduma iliendelea kusajili utendaji thabiti, ikiungwa mkono na ukuaji wa biashara kama hii yetu zilizo katika ICT, pamoja na biashara ya jumla na ya rejareja, usafiri, utalii na ujenzi wa nyumba.

Huku upenyaji wa kasi wa huduma za simu ukikaribia kufukia wateja milioni 50 katika nchi hii yenye watu takriban milioni 52, hivyo basi kuna haja ya kutafuta njia mbadala za kuendeleza ukuaji. Vichocheo vya ukuaji vya jadi (kauli na ujumbe) vinaendelea kudhihirisha ukuaji duni wa tarakimu moja, hii ikiashiria umuhimu wa kuimarisha biashara hii yetu ili kufikia mahitaji ya watumiaji. Hii itahitaji uwekezaji zaidi na wa makini katika uvumbuzi, yote haya yakihitaji kuwepo kwa mazingira ya udhibiti kanuni unaosaidia ili kufanikiwa.

Tumebainisha kwa wasiwasi mkubwa kuweko kwa majaribio ya kusimamia sekta hii kupitia sheria na kanuni zinazopendekezwa ambazo zinataka kulazimisha kupangwa upya kwa muundo wa uendeshaji wa makampuni kama hii yetu, ambayo ukuaji wake umetokana na utekelezaji kwa njia bora wa mkakati wa biashara. Hatua kama hizi zinaweza kupunguza pakubwa uwezo wa biashara hizi wa kuwekeza, kubuni na kubadilisha maisha, jambo ambalo ndio undani hasa wa shughuli za Safaricom.

Ni matumaini yetu kuwa suala hili litashughulikiwa kwa njia ya ushauri zaidi, ikiwa ni pamoja na kuwepo majadiliano ya kufaa baina ya wahusika wote ili kuja na suluhu bora zaidi ya kuleta manufaa kwa wadau wote.

Kenya ni soko lenye nguvu, lilio na nafasi ya kutosha kwa wahusika wengi kuingia na kushindana kwa njia ya haki katika kufuatilia ukuaji wa biashara na upendo wa chapa. Kwa hiyo jambo kuhimiza kuona hali ya ushindani ikibadilika kutokana na kuungana kunakoendelea kati ya wahusika wawili katika soko letu. Tunaamini hii itasababisha kuweko kwa uvumbuzi na ufanisi zaidi kwa manufaa ya wateja.

Safaricom wanakaribisha ushindani wa haki katika mazingira yaliyo na usawa, ambapo uwekezaji, mkakati, uvumbuzi na ahadi ya chapa ziwe ndio ufafanuzi wa kweli; kinyume na kutegemea kutumia udhibiti kanuni kama njia ya kutarajia mafanikio.

Zaidi ya miaka 18 iliyopita, Safaricom imejenga biashara iliyoanzishwa kwenye nia yetu ya kutaka kubadili maisha kwa kutumia teknolojia ya simu. Tumeweza kufanya hivyo kwa kuzingatia mkakati wetu, kuendelea kutambua vyema mahitaji ya wateja wetu na kuzidi kubuni ili kuwashughulikia, na kusisitiza ufuatiliaji wa madhumuni yetu.

Hata hivyo hakuna hata moja ya haya yangeweza kufanikiwa bila ya imani yenu isiyotikisika katika maono yetu. Kwa niaba ya Bodi ya Wakurugenzi, ningependa kusema asanteni. Uvumilivu wenu, uaminifu na usaidizi unatupa moyo wa kutekeleza mengi zaidi: kutafuta fursa mpya za ukuaji ambazo zitazalisha faida kubwa kwa wanahisa, na kuwasilisha thamani kwa wadau wetu wa msingi.

Tulianza robo ya 2 ya 2020 kwa masikitiko kufuatia kufariki kwa Mkurugenzi Mkuu Mtendaji wetu, Bw. Bob Collymore, tarehe 1 Julai 2019 baada ya kupambana na ugonjwa wa kansa. Alikuwa mtu mwenye busara ambaye alikuwa na maono ya ajabu kwa ulimwengu, na kwa Safaricom. Kwa miaka tisa Bw. Collymore aliongoza biashara hii yetu hadi kuweza kufikia hatua muhimu tajika, ikiwa ni pamoja na kuongeza zaidi thamani kwa wanahisa na kuimarisha ndani yetu hisia ya kusudi ambayo imekuwa kiashiria cha undani wa shughuli zetu hapa Safaricom. Dhamira hii, ya kubadilisha maisha, ndiyo sababu kuwepo kweti leo. Kuheshimu urithi wake tutaendelea kujitolea kumaliza kazi aliyoanza. Tutaendelea kuzingatia kwa haki madhumuni yetu, na kutumia teknolojia ya simu za mkononi kuzidi kuboresha maisha ya Wakenya, na watu wengi wengine tunaoweza kuwafikia kote ulimwenguni.

Ingawa biashara yetu inakabiliwa na changamoto kadhaa, tuna imani katika uwezo wetu wa kusimamia mashaka hayo na kuhakikisha kuwepo kwa ukuaji endelevu, unaongozwa na Kamati ya Utendaji yenye uwezo zaidi sasa ikiwa inaongozwa na Bw. Michael Joseph, aliyechaguliwa na Bodi ya Wakurugenzi kuwa Mkurugenzi Mtendaji wa muda mfupi wa mpito. Tukitazama mbele, tutaendelea kuimarisha upya biashara yetu, kuwekeza katika maeneo mapya ya ukuaji, na kuimarisha vipaumbele vya kuiweka Safaricom katika nafasi ya biashara inayofaa hadi katika siku zijazo.

Nicholas Nganga | Mwenyekiti

"Kifo hakiwezi kuhepukwa na nimeamua kutofikiria sana kuhusu kifo kwa vile kitakuja tu hatimaye. Japo mimi sijui kitakuja wakati gani. Nimechagua kuzingatia mambo yaliyo muhimu zaidi kwangu. Sasa nimejuwa ni jambo lisilowezekana kwa mtu kuishi kwa miaka 200.

Lakini kitu muhimu sana ni kwamba unapokuwa na kansa wazo la kifo huwa liko karibu, na hivyo basi haifai kuwa kitu cha kushangaza, kinyume na wewe uliye na afya nzuri lakini kifo kinaweza kukujia dakika yoyote au hata kesho asubuhi."

Bob Collymore

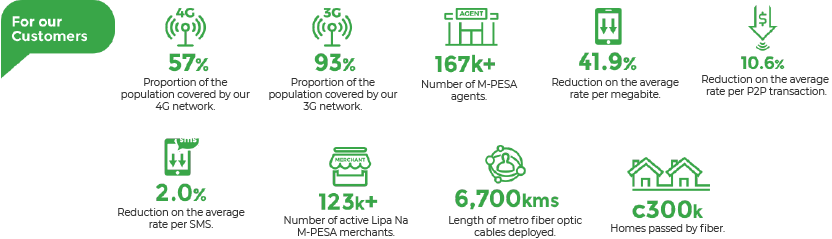

GSM: We focus on providing customers with affordable segmented offerings on voice, messaging and mobile data by progressing the use of CVM and data analytics. We are providing enablers for our customers' digital lifestyles including: enhancing our 3G and 4G coverage currently at 93% and 57% respectively; providing the market with affordable 4G smartphones and other use cases such as Cloud, Self Service Channels, Internet of Things and VoLTE.

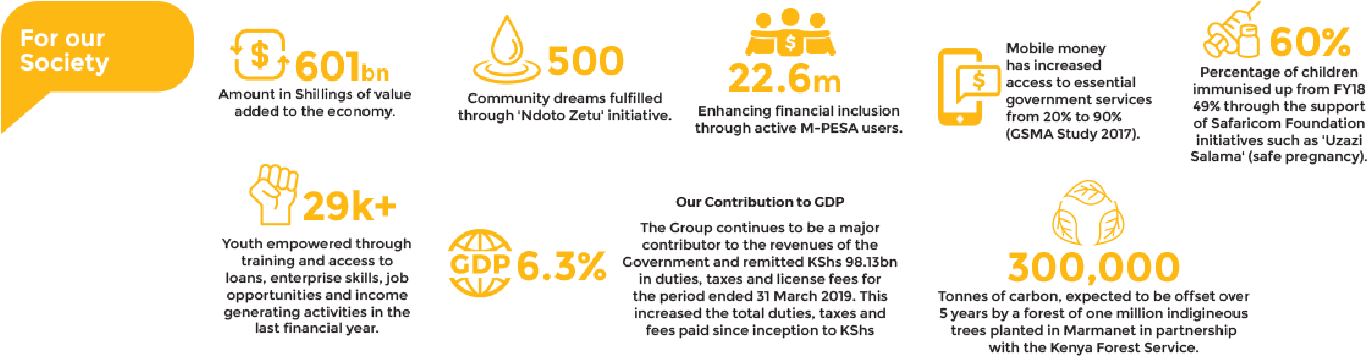

Financial Services: M-PESA not only allows for P2P transfers and withdrawal but also payment options, connectivity to formal banking and credit access. It has also facilitated international transactions and deepened financial inclusion in the country.

Fixed Service: As we drive digitisation for our consumer and enterprise customers, we have laid more than 6,700 kilometers of fibre and connected close to 300,000 homes and 2,400 businesses. We continue to increase usage through affordable tiered pricing. We see future opportunity in converged service of data, content, smart home and fixed mobile. New Platforms: In line with our purpose to transform lives, we continue to leverage in the power of mobile technology to deliver on shared value propositions that disrupt inefficiencies and impact lives positively and we have launched two platforms to achieve this. The platforms include; our E-Commerce platform ‘Masoko’ that has the ambition of taking Africa to the world and DigiFarm a platform connecting farmers to knowledge, quality and affordable inputs, credit and insurance and market opportunities

M-PESA now contributes 31.2% of service revenue while mobile data is now contributing 16% thereby reducing the reliance on voice and messaging revenues. Fixed data contributed 0.7ppts of the 7% service revenue growth. Though a relatively new line of business, fixed data is now contributing 3.4% of service revenue.

We have over the years successfully managed to expand the portfolio which builds resilience and strength to our business model.

M-PESA now contributes 31.2% of service revenue while mobile data is now contributing 16% thereby reducing the reliance on voice and messaging revenues. Fixed data contributed 0.7ppts of the 7% service revenue growth. Though a relatively new line of business, fixed data is now contributing 3.4% of service revenue.

We have over the years successfully managed to expand the portfolio which builds resilience and strength to our business model

We have achieved significant results in limiting cost growth by focusing on digitising and driving efficiencies. The company now has a cost culture which helps maximise returns.

Thanks to some strong cost controls and capex monetisation, underlying EBIT margin improved by 1.9ppts and capex intensity improved by 0.7ppts respectively on an underlying basis.

Effective and efficient capex investment has been complimented by successful commercial monetisation and revenue growth. As a result, despite increasing capex investments, capex intensity has reduced. This has resulted in superior shareholder returns.

Our resulting strong cash flow helps us to maintain a high level of capital re-investment, primarily in our network infrastructure to maintain a leading position in network coverage, call quality and data speed in the market. We have also focused capital spend on our new billing system as we look forward to a transformative digital company.

In addition to investing in the future prosperity of the business, cash generated from our business allows us to maintain our progressive shareholder returns, guided by our dividend policy of paying dividends each year out of net income reported in that specific year.

The technical and managerial skills, productivity and wellbeing of our people – coupled with a company culture and governance systems that foster innovation and compliance – are critical to our long-term success. Investing in our people is one of the most significant costs to our business, impacting short-term financial capital, but generating longer term returns in all capital stocks. The anticipated changing nature of work and the increasing role of digital and Artificial Intelligence may result in some pressure on certain traditional job functions.

Key InputsA positive brand and quality relationships with customers, regulators, investors, suppliers and communities is the foundation of our ability to generate revenue. We believe in maintaining strong partnerships with all our stakeholders.

We see our role in society as positively contributing to a sustainable future with a focus on education, health and security. Investing in social capital often requires short and medium-term financial capital inputs, but generally generates positive returns across most capitals.

Key InputsOur network infrastructure, data centres, distribution infrastructure and software applications are an important source of competitive differentiation. Investing in building and maintaining this infrastructure requires significant financial capital and appropriate levels of human and intellectual capital, as well as certain natural capital inputs and outcomes. Over the long term, the investments in manufactured capital typically generate net positive outcomes.

Key InputsWhich includes shareholders’ equity, debt and reinvested capital – is a critical input in executing our business activities and in generating, accessing and deploying other forms of capital.

Balancing the short-term interests of investors with longer-term growth objectives and with some of the interests of other stakeholder groups, remains a critical objective and often involves balancing certain trade offs.

Key InputsWe require natural capital such as land and energy to deploy and operate our manufactured capital. Accessing these inputs diminishes financial and natural capital, the impact of which is lowered through energy efficiency initiatives and site sharing.

Key inputsThe Kenyan lawmakers are currently discussing two Data Protection Bills; one is at the Senate House and the other is at a Ministerial Taskforce on Privacy and Data Protection.

The Senate Bill proposes that the Kenyan National Commission of Human Rights oversees data protection enforcement while the Ministerial Taskforce, proposes the establishment of a new institution to oversee data protection in Kenya.

Possible impacts to the industry include:

© 2025 - Safaricom