REINFORCING OUR RESPONSIBILITY TO KENYAN SOCIETY

Good corporate governance practices are essential to the delivery of long-term, sustainable stakeholder and shareholder value. The ability to generate long-term value is based on good corporate governance which helps to regulate risk.

Implementing strong governance structures including a governance code, an ethical culture and a robust risk management framework are foremost in our minds as a responsible corporate citizen. Our focused adherence to governance and ethics underpins our risk management framework.

We also work beyond our own business to stand together with society and drive behavioural change through effective collective action initiatives.As examples, our business partners are included in ethics training.

We also play an active role in collaborative advocacy action that promotes ethics and integrity through quarterly fraud forums for financial institutions. In FY21 these forums were attended by 233 participants.

Our priorities in terms of governance, business ethics and risk in FY21 were as follows:

- Further embedding a positive risk culture across our organisation

- Customer obsession

- Data privacy and protection

- Cyber security

- Crisis management

- A coordinated COVID-19 response (described on pages 8-10 of this report).

OUR REGULATORY ENVIRONMENT

PRIORITISING REGULATORY COMPLIANCE

The regulatory environment is constantly shifting within the landscape of changing economic and socio-political issues. In order to ensure that we remain connected and understand these issues, we assess our strategies, programmes and future plans against all applicable laws and regulations on an ongoing basis and proactively engage with our regulators on wide-ranging issues.

We managed to maintain this during the COVID-19 crisis period. We also strengthened our stakeholder dialogue, engaging closely with the GSMA, East Africa Com and AfricaCom among others by making use of virtual platforms. We participated in numerous webinars, panels, workshops and keynote addresses on the role of policy in the new normal.

SURPASSING THE REGULATORY QUALITY OF SERVICE SCORE

In 2018, the Communications Authority (CA) of Kenya launched a new Quality of Service (QoS) Framework, to be implemented over three years. The revised framework, against which we are now reviewed, has broadened the services under assessment to include SMS and mobile internet services. The new Quality of Service Monitoring System (QSMS) is based on three key components:

- End-to-end quality of service (measured through drive tests and walk tests, where the threshold is 80%)

- Network performance (measuring stability and availability using data automatically submitted from operator systems)

- Quality of Experience (QoE) (using surveys to establish customer satisfaction with the performance of the network).

The end-to-end QoS measure accounts for 60% of the score awarded to operators, while network performance and customer experience account for 25% and 15%, respectively. Operators have to score an overall 80% to meet the standards and avoid penalties. In FY21, we surpassed the regulatory QoS score of 80% by attaining 92% in the QoS assessment conducted by the Authority. Pleasingly, we continued the four-year trend of no fines or sanctions for non-compliance with regulations and no legal actions lodged for anti-competitive behaviour.

ENVIRONMENTAL IMPACT MONITORING AND EVALUATION

The number of Environmental Impact Assessments (EIAs) decreased year-on-year because our technology team onboarded external vendors to carry out the EIAs of the base stations which reduced our involvement. The reason for the significant increase in Environmental Audits in FY21 is that we completed a total of 1 460 special audits known as Self-Environmental Audits which we intend to undertake every three years. In addition, we completed 318 initial Environmental Audits at our new sites.

KEEPING THE COUNTRY CONNECTED

During the COVID-19 crisis, we successfully lobbied the Regulator to delay the implementation of fees related to the allocation of a new range of number prefixes to cushion subscribers from the adverse effects of increased costs in a period where households had lost income. As the majority of the Kenya workforce began working from home which caused a spike in data demand, we also successfully engaged with the Communications Authority (CA) to allocate additional spectrum. The frequency allocated was 10MHz in the 2 100 band (3G) for nine months until May 2021. We have requested an extension of the spectrum allocated as the majority of the population is continuing to work from home. To enhance our engagement with the CA, we now report on a quarterly basis to this body on Network Redundancy, Resilience and Diversity (NRRD).

PILOTING 5G

Our theme, ‘Standing Together: Going Beyond’, among other things, reflects our aim of standing together with our stakeholders to connect them to opportunities. 5G is one such opportunity. At its most basic, 5G offers much faster data download and upload speeds that ultimately ease network congestion.

What’s more, 5G era networks are expected to support the massive rollout of intelligent IoT connections for a multitude of scenarios and provide an enhanced platform to support widespread adoption of critical services. 5G could, for example, enable remote patient diagnostics and monitoring; access to education; fast detection of natural disasters and smart city infrastructure, among other things. 5G will also potentially accelerate the digitisation and automation of industrial practices and processes (including supporting Fourth Industrial Revolution goals).

In a key development, we re-farmed spectrum for Fixed Wireless Access service (WiMax) to offer the 5G technology to our customers. We are currently rolling out Kenya’s first fifth generation (5G) mobile internet services targeting major urban centres. We started with six pilot sites in Nairobi, Kisumu, Kisii and Kakamega.

We moved forward into the future to trial 5G technology for our customers at these six sites with the aim of empowering them with super-fast internet at work, at home and when on the move, supplementing our growing fibre network. 5G technology can easily act as an alternative to home fibre and fibre for business services, targeting customers in places where we have yet to roll out our fibre network. Our subscribers who want to use the service will need to acquire new handsets that are compatible with 5G before they can enjoy the superfast Internet.

Securing statutory approval for the 5G trial sites was challenging as we were met with scepticism from certain sectors of the public who were concerned about the impact of 5G on human health, especially its link to the Coronavirus pandemic. The stalemate was addressed through training, developed by GSMA, of the concerned parties on electromagnetic fields (EMFs) and 5G. Our efforts make us the first technology company in Kenya to launch 5G technology.

OUR PLATFORMS

OUR NETWORK

Our network is our core platform and a foundational enabler on which other platforms are anchored. There was a significant increase in demand for mobile data, driven by our customers continuing to work from home and needing to stay in touch during the pandemic., We increased 4G coverage of the Kenyan population from 77% to 94%, enabling access to high speed connectivity for customers who reside in areas where fibre is yet to be rolled out, thus enabling our customers to work remotely.

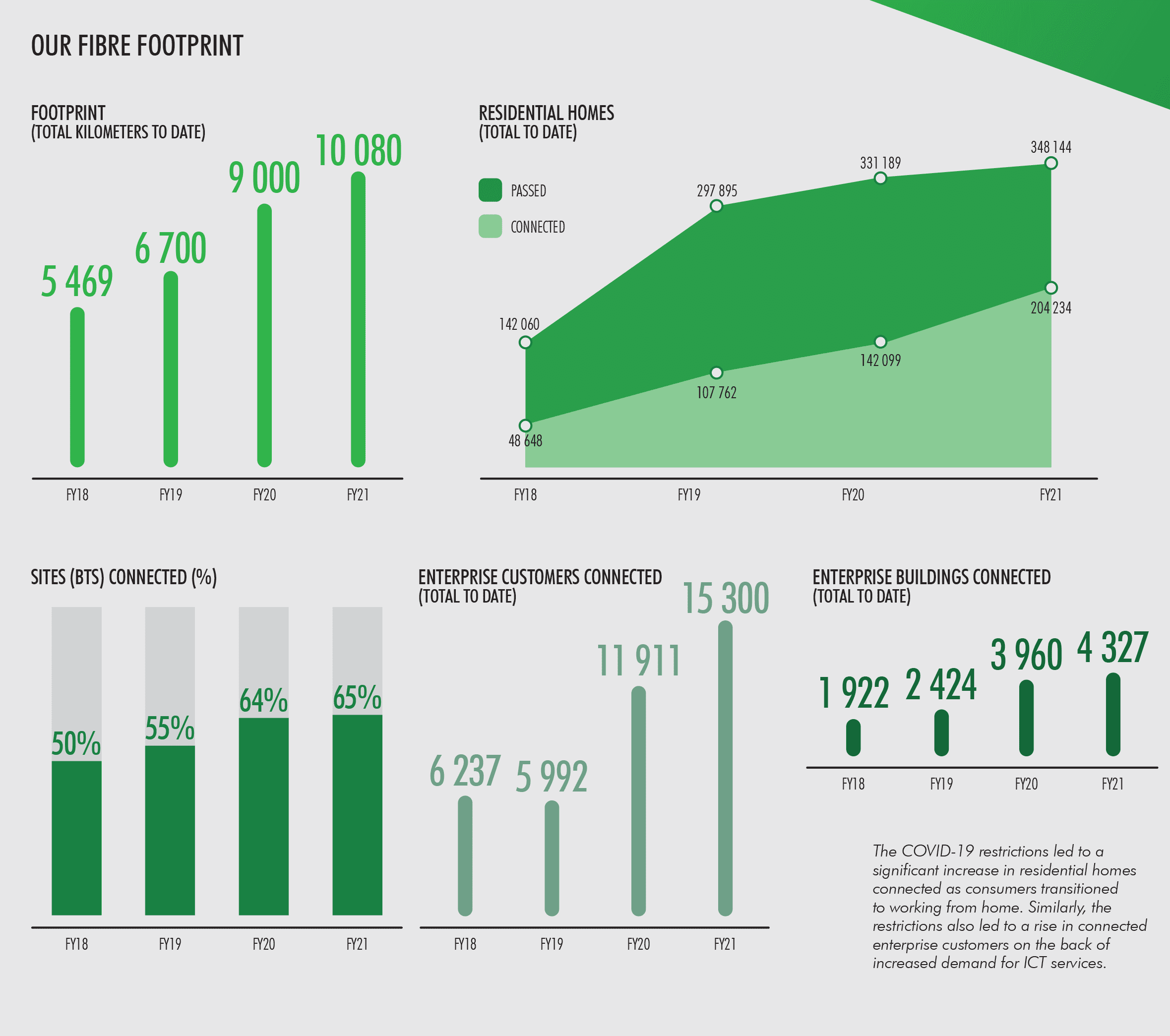

We also expanded our footprint by 1 080 kilometres to close the year at 10 080 kilometres. This enabled us to supply more homes and businesses with high speed connectivity. Capacity has multiplied almost four times on the Nairobi-Mombasa connection, and we can carry total traffic from sites connected via fibre to the home or mobile. This has had the added advantage of ensuring we are future proofed against the anticipated growth in traffic and well positioned for the provision of other supplementary services.

We delivered a state-of-the-art core network Subscriber Database Management (SDM) platform that’s not only highly resilient against network disturbances but is also future-proof, offering robust support for up-coming technologies such as 5G and improved support for existing ones. This has provided improved performance and increased capacity, thus establishing a solid foundation for the future evolution of our network. This will enable our sites to carry more traffic and hence give our data customers a better network experience.

OUR M-PESA PLATFORM

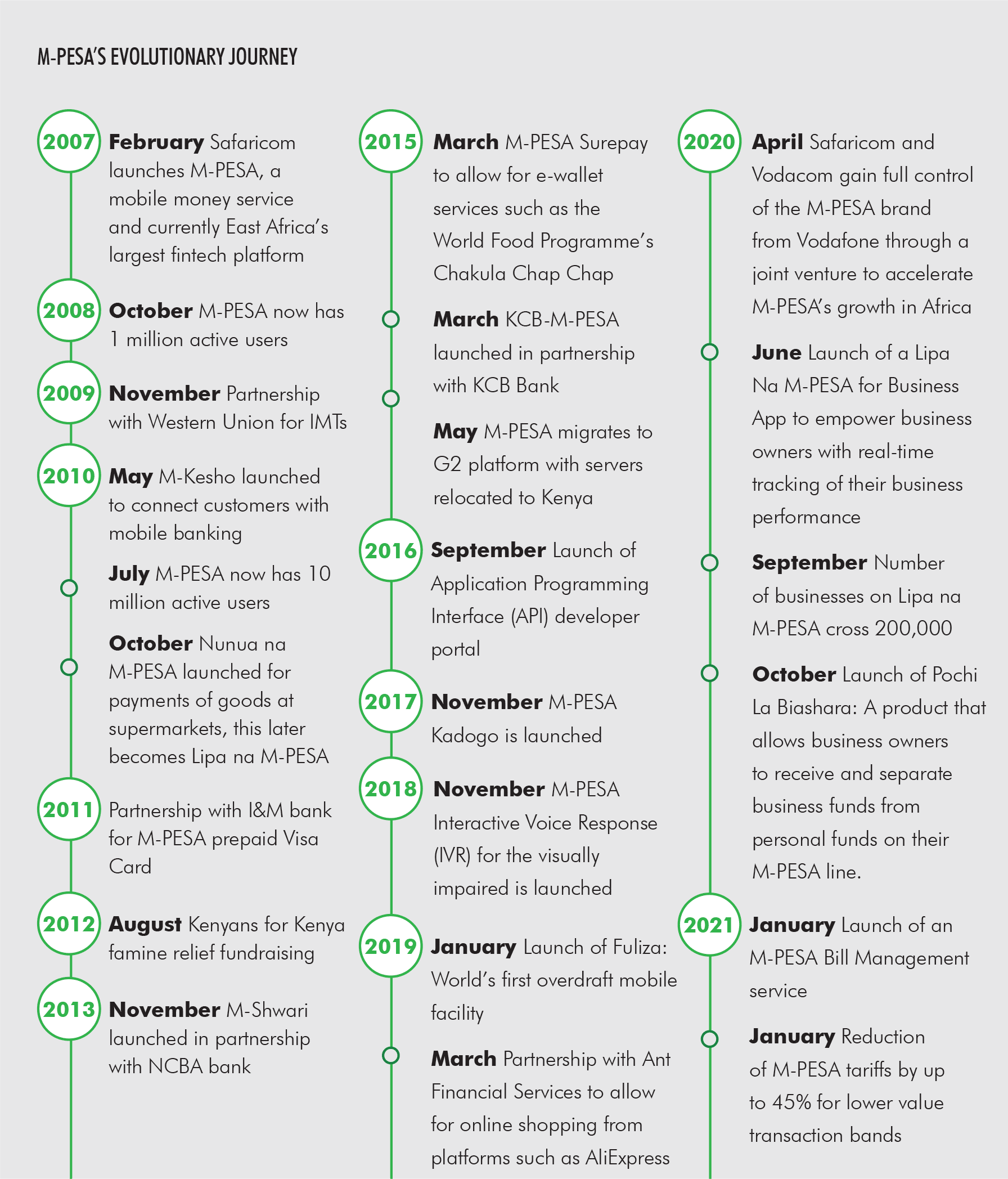

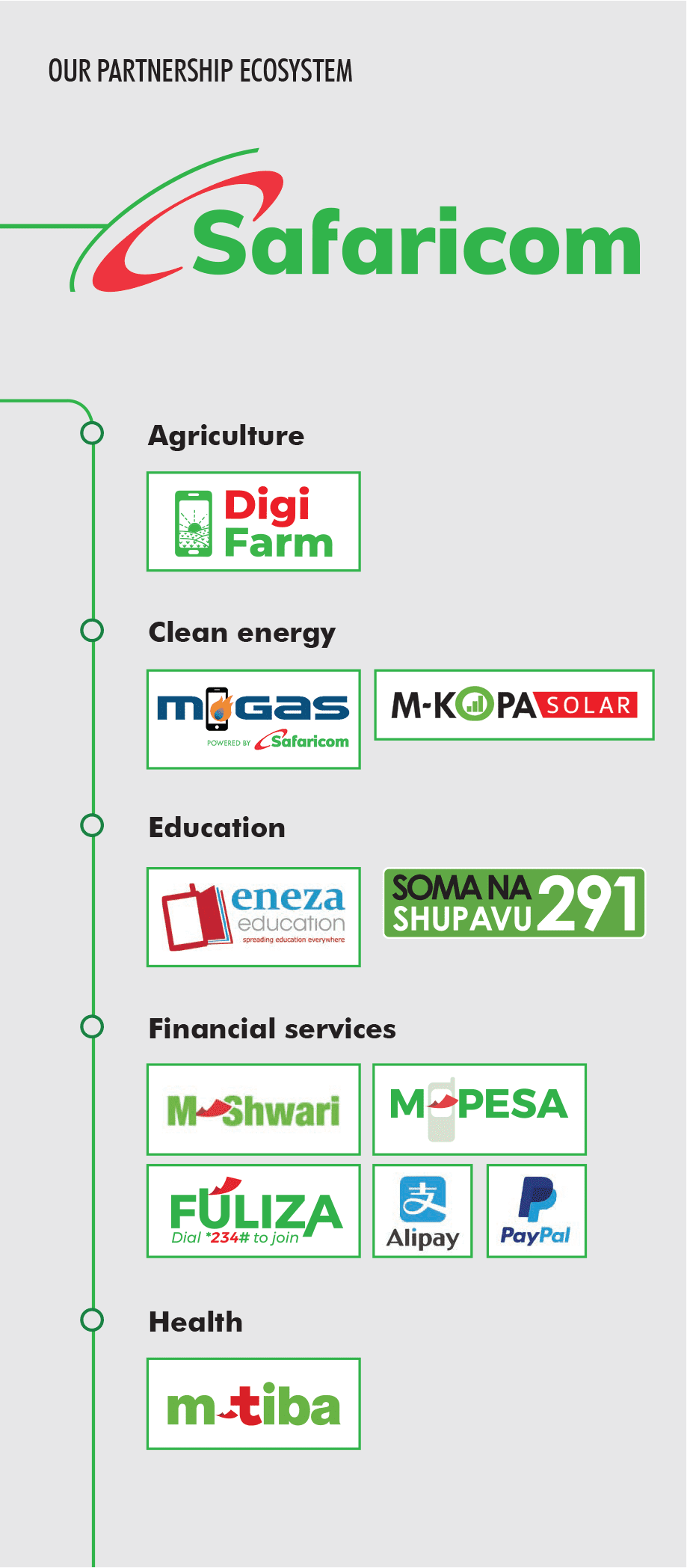

M-PESA is a mobile financial services platform that provides money transfer, payments and access to credit for individuals and organisations. Our M-PESA platform incorporates numerous offerings which enhance financial inclusion and enable the transformation of lives.

Our M-PESA services include, amongst others, a range of core and financial services across select customer groups. Our core services comprise domestic and international transfers, converting cash to e-money and vice versa, retail payments, bill and tax payments, and airtime and data purchases. Financial services range from loans, savings, and overdraft facilities to wealth management, insurance and bank transfers (where money can be transferred from M-PESA wallets to bank accounts in real time). We continuously innovate and form partnerships to improve and increase our service offering in a number of other sectors for more than 28 million customers in Kenya.

M-SHWARI is a mobile savings and loan service offered to M-PESA customers that enables them to open and operate an M-SHWARI bank account through their mobile phones. An increasing number of Kenyans are making use of this service, as indicated by the fact that deposits have more than doubled over the last four years.

OUR DIGIFARM PLATFORM

Farming in Kenya accounts for a third of annual economic output and more than half of the workforce. At Safaricom, we did on-the-ground research and discovered that many smallholder farmers did not know why they farmed particular crops or whether they were suitable for a particular area. They also battled with issues such as quality of inputs and insurance.

Accordingly, in 2017 we developed DigiFarm – an integrated platform that offers farmers convenient, one-stop access to a suite of products, including financial and credit services, quality farm products and customised information on farming best practices. Since launch, DigiFarm, has registered over 1.4 million users and currently has 14 000 active users. We have partnered with iProcure to guarantee access to high quality inputs, and are working with FarmDrive to provide affordable credit. In addition, we provide farmers with access to relevant information in partnership with Arifu.

ENVIRONMENTAL STEWARDSHIP

MANAGING AND MITIGATING OUR ENVIRONMENTAL IMPACT

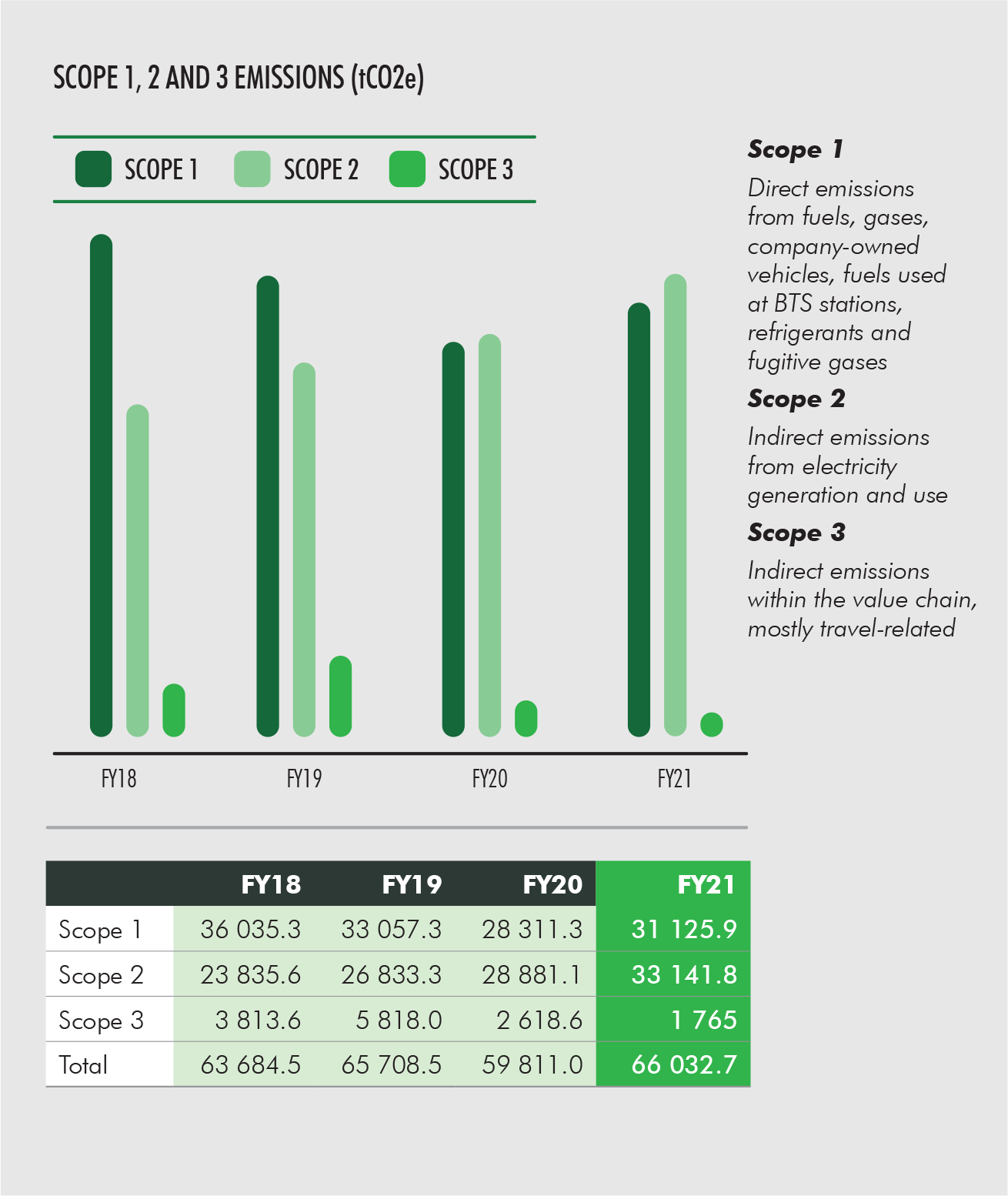

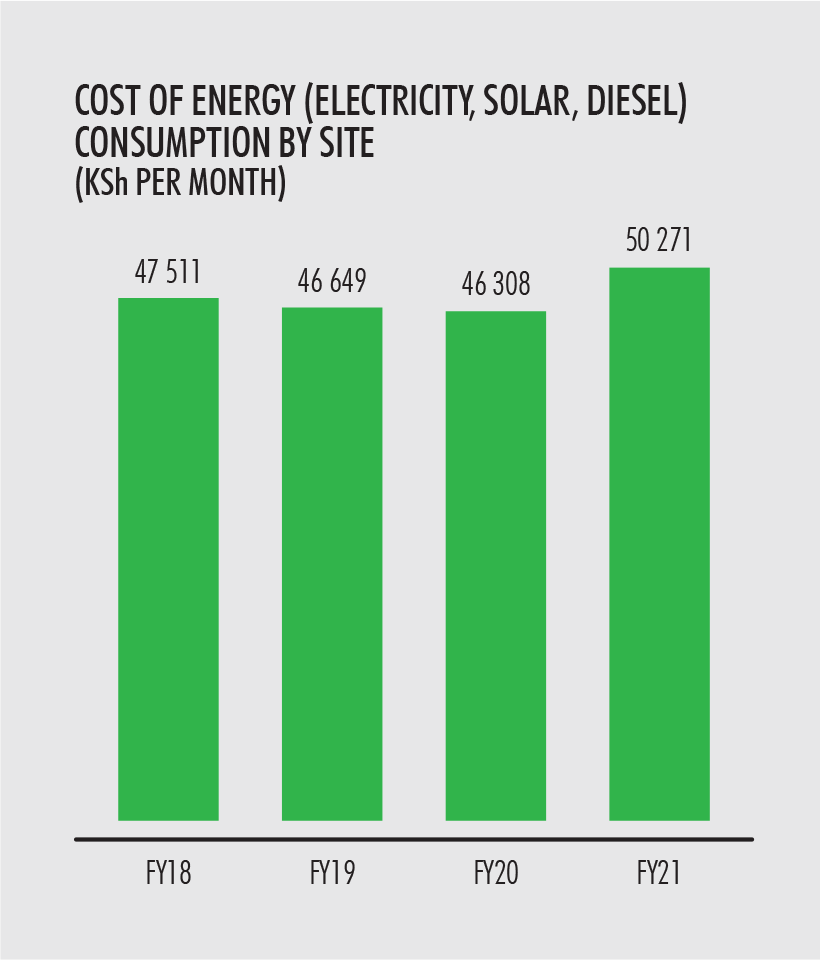

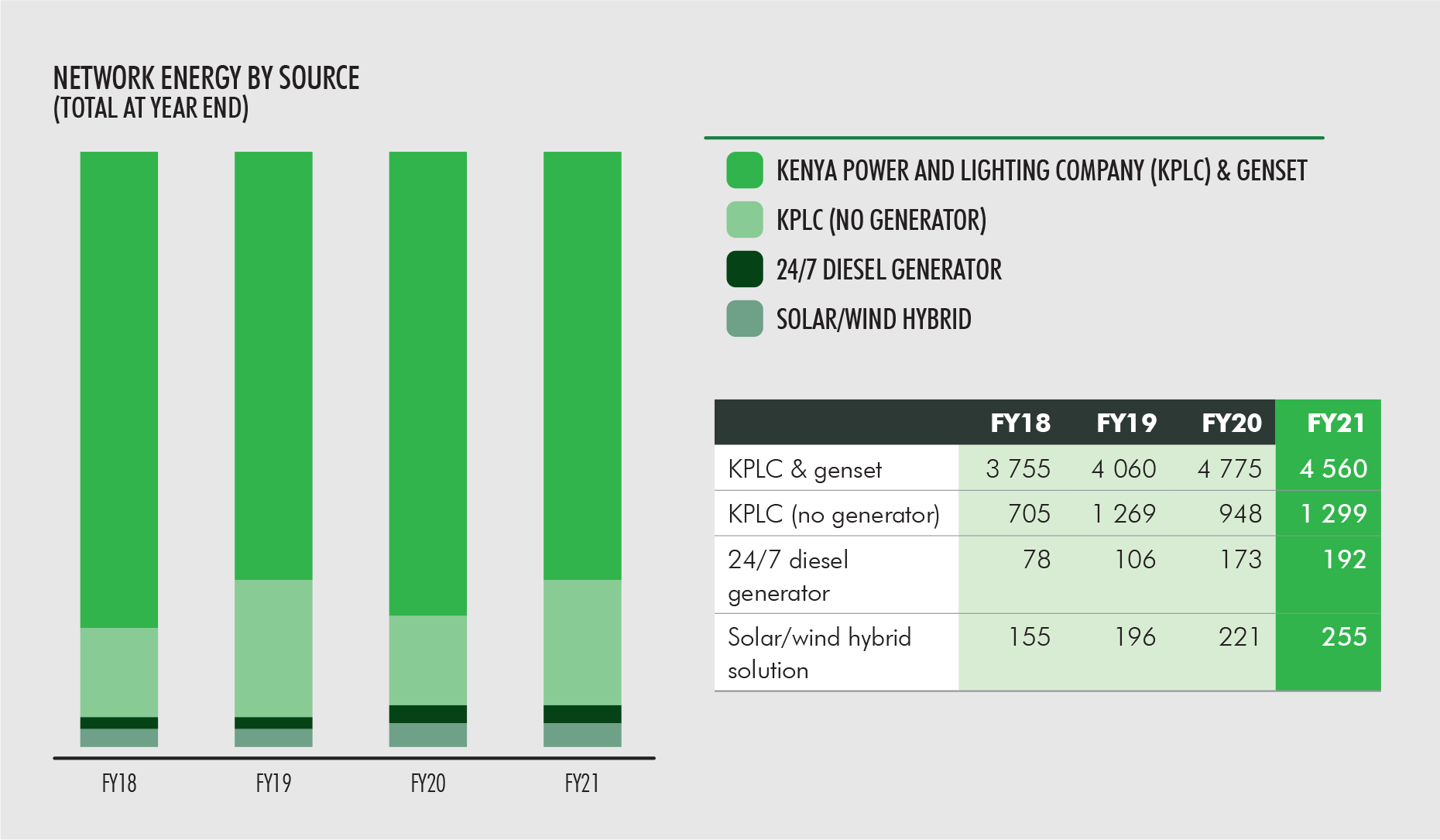

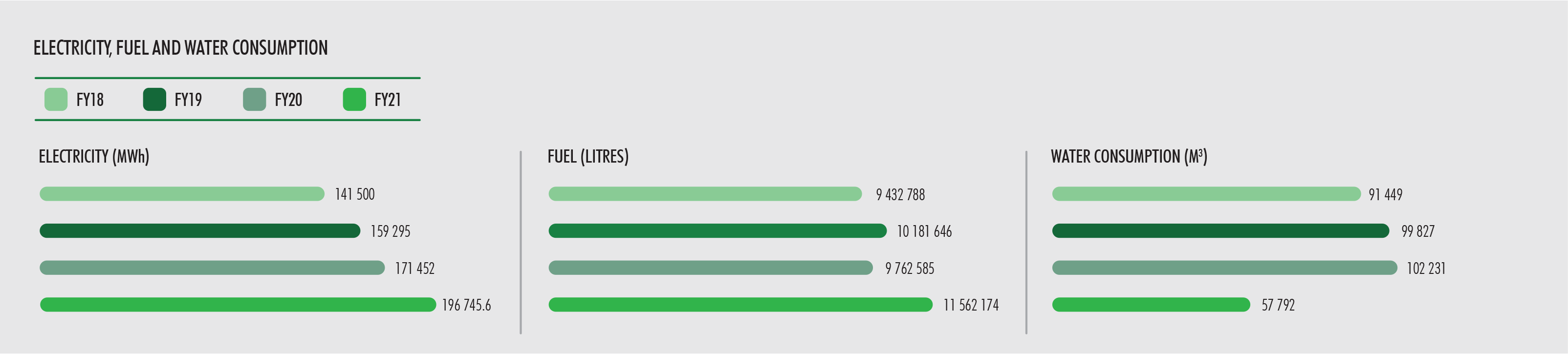

We track greenhouse gas (GHG) emissions; energy efficiency, consumption and cost; waste and e-waste; and emission reduction, constantly monitoring our progress. We also make use of environmental impact assessments and audits, together with international third-party standards such as the ISO 14001 environmental and ISO 50001 energy management systems in order to establish both negative and positive impacts and implement mitigation measures where required.

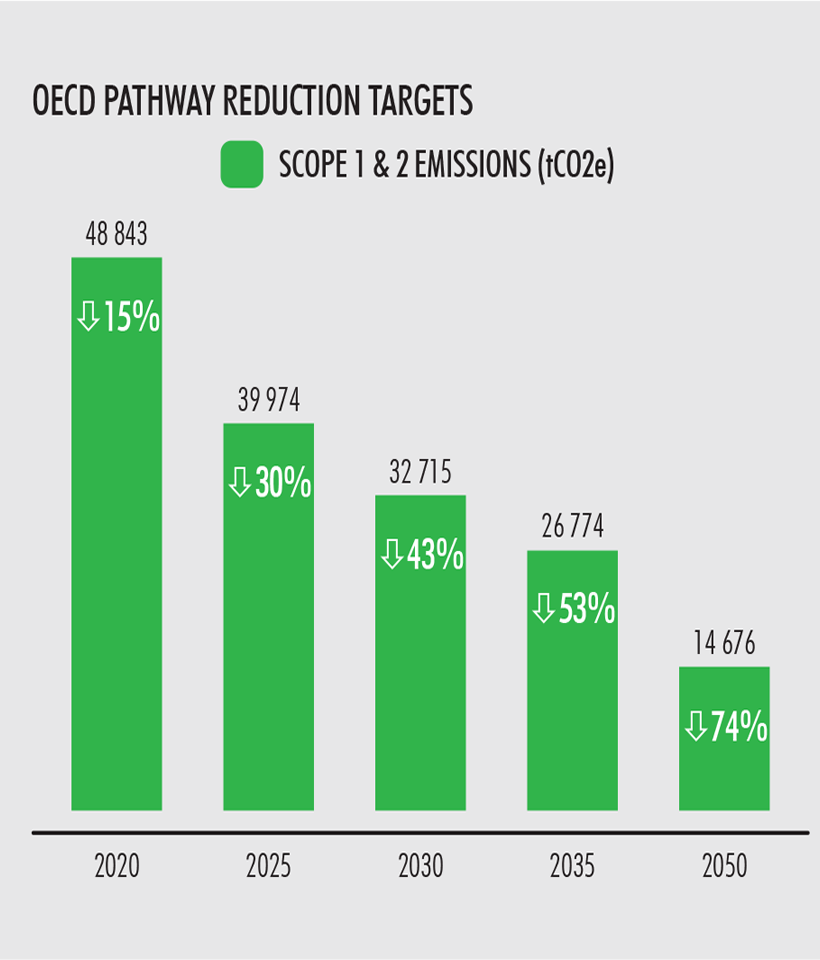

“We participate in the United Nations Global Compact (UNGC) Action Platform on Climate Ambition whose strategy is to halve emissions by 2030 and achieve net zero by 2050; establish climate related targets and develop mitigation actions linked to inequalities exacerbated by climate change in the areas of resilience, health and a just transition.”

INNOVATION AND PARTNERSHIPS

INNOVATION UNDERPINS OUR GROWTH AMBITIONS

Innovation is central to achieving our ambition of becoming a purpose-led technology company, retaining our competitive edge and ensuring that we continue to grow. Constant innovation is an important aspect of ensuring that we not only anticipate and meet customer needs, but also that we meet our commitment to the SDGs. Our approach to innovation is defined by the needs of our customers and the business imperative to respond to the needs of our society. Our business plays an important role in the lives of society, whose members look up to us for solutions to their most pressing challenges.

The teams liaise closely with the Customer Obsession Stream to gather business insights into areas that matter most to customers and to guide the business in new areas of opportunity. These insights are complemented by predictive models to drive smarter business decisions and actions, together with training. In FY21, for example, we trained staff to enable them to offer best-in-class Cloud Services and also held Cloud training sessions for MSMEs and start-ups. The training was provided to all enterprise staff trainees who interact with Cloud customers.

Before launching or further developing a new product, we solicit our customers’ insight and feedback. Cocreating solutions with customers in this manner, refines and ensures congruence between customer requirements and value offered. This reinforces loyalty to our brand, helping us retain and expand our customer base. We want our customers and potential customers to see our commitment to excellence as a brand differentiator.

PARTNERSHIP WITH THE HELB ON AN

EDUCATION E-WALLET

The Higher Education Loan Board (HELB) disburses in excess of KSh 15 billion to over 200 000 beneficiaries annually. In March 2021, we partnered with the HELB to roll out a smart mobile payment solution for students at tertiary institutions to access and utilise their loans and bursaries. The solution will enable HELB to promote responsible spending as funds can be locked for specific allocations, such as tuition or library fees only accessible to the specific Paybill account of the recipient’s university or Technical and Vocational Education and Training (TVET) institution. From the students’ perspective, their upkeep allowance can now be transferred into their M-PESA wallets for everyday use. The portal gives them the capability to receive notifications and plan their finances. In addition, those who have graduated can track their loan repayments.

SDG4: QUALITY EDUCATION

During the COVID-19 pandemic, we partnered with UNESCO and Eneza’s Shupavu 291 solution to give students access to mentors and information on Science, Technology, Engineering and Mathematics (STEM) subjects via SMS. Over an 11-week period, over 40 radio stations and a local TV channel aired the live shows during which students were encouraged to send questions via SMS to 40291. The mentors and facilitators of the show then sent responses to each question. Approximately 600 000 of our customers participated in the initiative.

INTERNET OF THINGS (IOT) SOLUTIONS FOR OUR

ENTERPRISE CUSTOMERS

IoT makes everyday objects (things) ‘smart’ by enabling them to transmit data and automate tasks, without requiring manual intervention. By supporting key sectors, IoT has the potential to enhance efficiencies and improve productivity through reduced reliance on manual inputs. We continue to expand our range of IoT business solutions for use in areas such as telematics, asset management and tracking and utilities. One example is the telematics solution we provided for the National Transport Safety Authority (NTSA). This was implemented in 15 000 matatus (public service vehicles) to track various aspects of driver activity. The solution, which operates throughout Kenya, tracks adherence to speed limits, thereby enhancing safety. At year-end, we had provided 726 100 IoT connections, representing growth of 5.7%.

TELEMATICS

CONNECTIONS

Use cases such as fleet management e.g. remote monitoring of PSVs

CONNECTED COOLER

CONNECTIONS

Partnership with Kenya Breweries Limited

MACHINE-TO-MACHINE

Such as M-Gas

SIM MANAGEMENT

Use cases such as smart metering

PARTNERSHIP WITH GOOGLE TO MAKE SMART DEVICES AFFORDABLE

We partnered with Google to provide access to smartphones through a device financing project known as ‘Lipa Mdogo Mdogo’– which is roughly translated from Swahili as “pay in installments”. Our numbers showed that of our 23.77 million mobile data customers, only about 8.5 million own 4G devices, while 8.2 million have 3G capable devices. One of the most significant barriers to access to smart devices has always been that of smartphone affordability. Through Lipa Mdogo Mdogo qualifying customers can buy 4G-enabled smartphones and pay through daily installments of KSh 20 over a period of 12 months. Eligibility for the plan is based on a customer credit score and a history with the Safaricom network going back one year. By year end, there had been an uptake of over 247 379 devices, with over 60% of our customers upgrading from 2G and 3G to 4G devices.

SUPPORTING SMES AND MSMES THROUGH FINANCIAL SERVICES

SMEs and MSMEs are the heart of our society and the lifeblood of Kenya’s economy given that they contribute to over 40% of all economic activity. For this reason, it’s important for businesses like ours to support small businesses so that they grow and thrive as part of our economic recovery from the COVID crisis.

- Pochi La Biashara, is a product that allows owners of businesses such as food vendors, small kiosks, boda-boda operators and second-hand clothes dealers, to receive and separate funds received from business transactions from their personal funds on their M-PESA line. This provides convenience in managing and accounting for the funds received. A total of 1.01 million SMEs and MSMEs had signed up for this service at the close of the year.

- M-PESA Bill Manager targets schools, landlords, utilities and other businesses with repeat payments, offering a platform where they can present and receive pending payments from customers, and issue electronic receipts. For M-PESA customers, the service offers a single point where they can view all their bills, receive reminders and automate payment of bills. The Bill Manager enables institutions like schools to customise different type of fee such as tuition, lunch, transport and school trips among others, and also to send fee reminders. We onboarded 375 000 merchants, of whom there were 212 000 (56.7%) actively using the service. Through M-PESA Bill Manager, we hope to empower businesses in Kenya to digitize their businesses beyond collecting payments.

- The M-PESA for Business App gives our Lipa na M-PESA merchants access to real-time statements, the ability to export statements and to track their business performance on the go. Through the app, business owners are able to transfer funds from Lipa na M-PESA to their M-PESA accounts, bank accounts or at an agent outlet. The app also enables business owners to make payments to other businesses, pay wages or suppliers and receive detailed reports on till activity from the convenience of their smartphones. The app eliminates the tedious, manual process of accessing funds paid through a merchant till. At the close of the year over 800 merchants had signed up for the service with transactions valued at KSh 63 billion.

- The M-PESA Merchant Transacting till is an enhancement of the existing Lipa Na M-PESA Buy Goods till that enables business owners to collect payments on the till and use the money collected to conduct other transactions directly from their till. This till is ideal for businesses in retail, such as supermarkets, restaurants, hardware, pharmacies, boutiques, salons etc. that collect money from customers regularly as part of their business. There were one million transactions to value of KSh 70 billion.