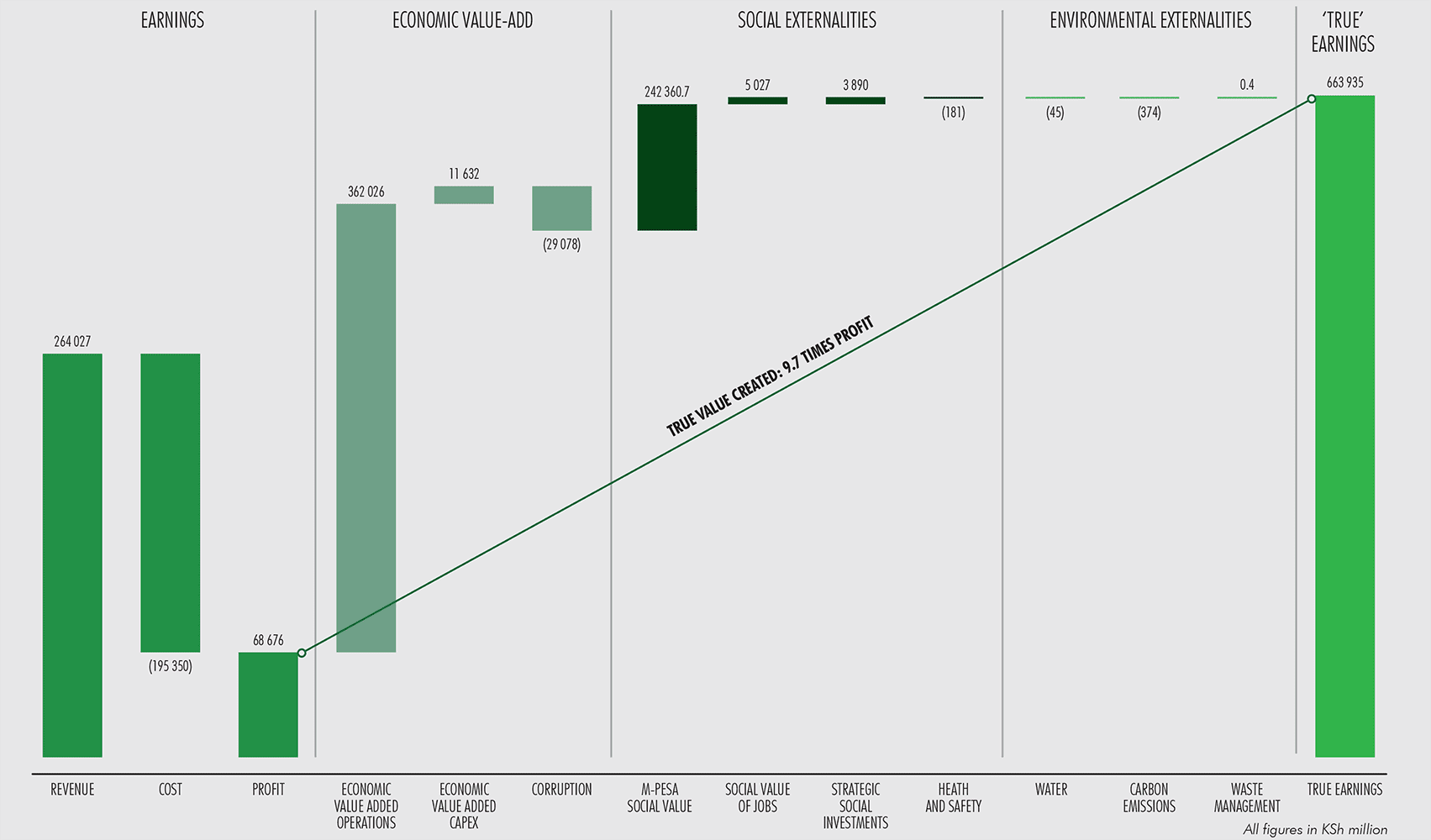

We continuously monitor and measure our contribution to Kenyan society. One of the ways in which we evaluate our role is by assessing the significant indirect value contribution we make to the economy, society and environment in Kenya. Since 2015, we have used a structured impact modelling tool – the KPMG “True Value” methodology – to quantify the positive and negative impact of our organisation on society, the environment and the economy in monetary terms. The following “True Earnings” bridge highlights our resilience as a business and strong fundamentals by showing that the total value we created for Kenyan society in FY21 was KSh 664 billion, approximately ten times greater than the financial profit we made during the year, and that we sustained over 190 273 direct and indirect jobs.

DEFINITIONS

True Value: A three-step methodology that enables companies to (i) assess their ‘true’ earnings including externalities, (ii) understand future earnings at risk and (iii) develop business cases that create both corporate and societal value.

True Earnings: The first step of the True Value methodology, which quantifies and monetises the material externalities of a company.

Total Economic Value: The nature and magnitude of the contribution to the Kenyan economy made by Safaricom.

Induced economic impact: Operational and capital expenditure by Safaricom creates additional employment and also benefits the employees of our suppliers. A share of the additional income generated in this way is spent on the consumption of goods and services, which, through linkages and multiplier effects, positively impacts the broader economy by stimulating additional demand for the products and services produced within that economy.

We remain committed to our purpose of transforming lives. Our latest True Value Report indicates that the true value to Kenyan society created by Safaricom (the cumulative outcome of the economic, social and environmental impacts highlighted on the True earnings bridge) increased by 1.5 per cent from FY20 to FY21, and we contributed a total of 5.2 per cent to the gross domestic product (GDP) of the country. As we embark on our journey to become a purpose-led technology company, we continue to leverage the power of mobile technology to deliver shared value propositions that disrupt inefficiencies and impact lives positively in the health, agriculture and education sectors.

The following is an independent analysis of Safaricom’s True Earnings by KPMG.

TRUE VALUE: IMPACT ON SOCIETY

The True Value assessment calculates that Safaricom sustained over 190 273 direct and indirect jobs during the year and, if the wider effects on the economy are included, this number increases to over 1 003 669 jobs.

Impact on society

9.7 x profit (profit of KSh 68.7 billion generated)

Total True Earnings (⇧1.5%)

Economic value added through operations

KSh 362 billion (⇧1.0%)

Social value M-PESA

KSh 242.4 billion (⇧3.5%)

Environmental externalities

KSh 418.97 million (⇧3.1%)

HOW WE ARRIVE AT THESE NUMBERS

KPMG first performed a “True Earnings” exercise for Safaricom in 2015 to identify the most material socioeconomic and environmental impacts of Safaricom and to quantify them in financial terms. During that year, Step 1 of the True Value methodology was carried out to estimate the True Earnings of Safaricom for the year in question. Primary research enabled us to complete this exercise and to ascertain the social value created by M-PESA, in particular. To quantify this social value, principles from the Social Return on Investment (SROI) methodology were used. SROI is an open-source, principles-based method used to account for social change.

More detail regarding the 2014/15 True Earnings exercise can be accessed at: https://home.kpmg/content/dam/kpmg/pdf/2016/07/case-study-safaricom-limited.pdf

Since 2014/15, Safaricom has used True Earnings as a way of understanding and expressing the value that the company creates for society. As the operating context and product offering have changed over time, various assumptions and adjustments that are utilised for the assessment needed to be updated to reflect these changes. In 2020/21, the primary research was reperformed to ensure that our assessment incorporates the impacts experienced by Kenyan society most accurately. Furthermore, the model utilises informed assumptions which are based on primary and secondary research. These assumptions are interrogated internally and confirmed to be the most appropriate within the specific Kenyan context.

In future, we will need to continue to revise and update the model at specific intervals to reflect the changes in the operating context and the evolution of the Safaricom product offerings.