INNOVATION

Technology is constantly evolving, and new technological capabilities are regularly changing what can be done and how it can be done. Every company needs to innovate and keep abreast of technological developments and disruptions, but, as a technology-based company, we run an even greater risk of not keeping up with the needs of our customers and ahead of our competitors if we are not constantly innovating. Many of our customers are quick to embrace new technologies, becoming ever more sophisticated and demanding, and each generation expects to accomplish more. If we do not keep up with the needs of our customers, we run the risk of being impacted by decreased market share and revenue.

As part of our ongoing commitment to the SDGs, we know that our ongoing innovation is key to broadening and deepening the impact that we have on all of our stakeholders. For this reason, we have continued to align our focus on innovation with three of the goals this year: promising to create innovative products and services (SDG9) that transform and empower the lives of our customers (SDG8); and partnering with other organisations to avoid duplication of effort and ensure our innovations are aligned with the ambitions set out in the goals (SDG17).

Innovation is central to achieving our strategic objectives, retaining our competitive edge and ensuring that we continue to grow.

KEY FOCUS AREAS DURING THE YEAR

• Brand trust

(billing transparency, balance notifi cations and campaigns to increase trust)

• Safaricom Alpha

(establishing of new innovation hub)

• Technology for Development (T4D)

(renaming of social innovation and transitioning of successful pilots to the business for scaling)

• Masoko

(launch of the portal to stimulate the nascent e-commerce market in Kenya)

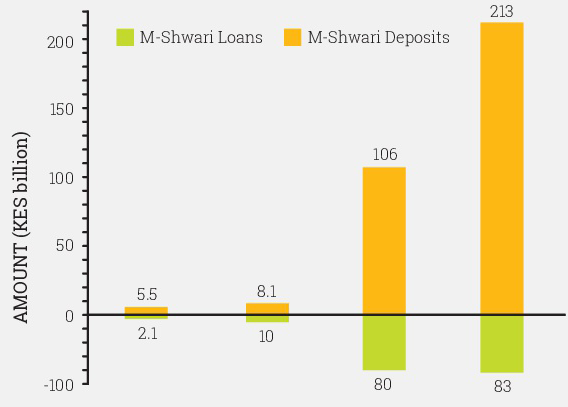

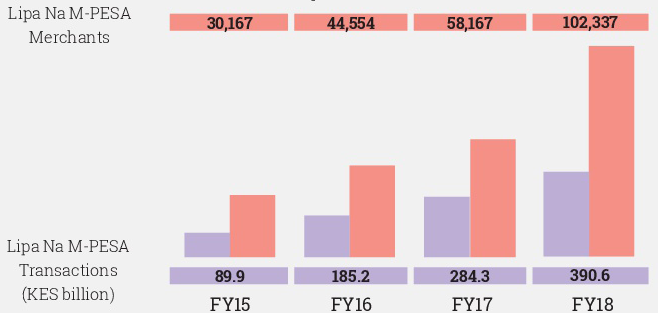

• M-PESA

(improving security and convenience, while deepening financial inclusion)

• Mobile data

(campaigns to stimulate use of 4G, expansion of 4G network and 4G-enabled

devices)

MONITORING AND MANAGING INNOVATION

Innovation is a multi-dimensional material topic. At a strategic level, we manage and monitor this aspect of our business using several sets of indicators, including:

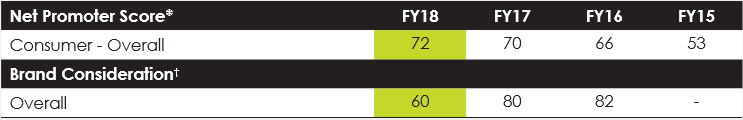

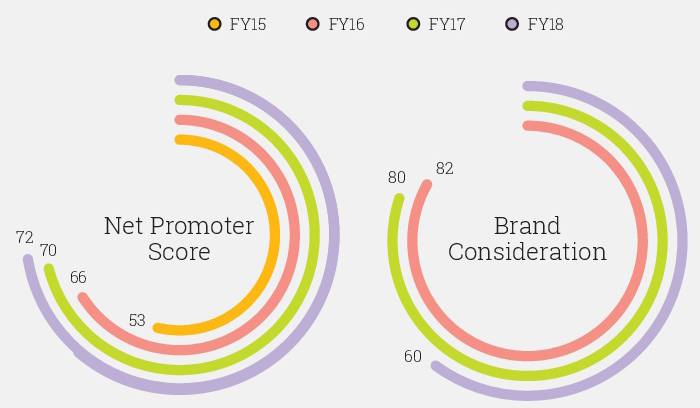

• Net Promoter Score (NPS) and Brand Consideration (BC) score

(tracking customer satisfaction with, among other things, our new products and services)

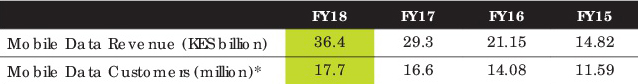

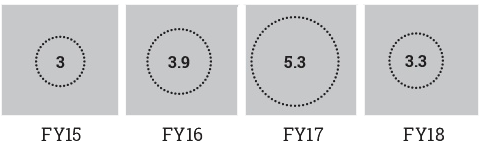

• Mobile data usage and revenue

(tracking how well data-related product & service innovations are being adopted and used)