Our operational overview

- We entered into nine strategic partnerships with the government, including one under contract with the Ministry of Health

- For customers we reduced technology demand by 44%

- Led NPS scores by more than 10 points ahead of our competitors in:

- Fixed: 61

- Network: 78

- Enterprise: 43

Our strategic objectives

- Lower the cost-to-serve, to allow for assessment of product and service cost and understanding of Safaricom’s cost-to-serve/cost-to-carry

- Delivery of segmented low-cost product interventions – To help attract and maintain customers whose disposable income has been depressed by challenging social and macro-economic conditions

- 5G capability – To trial the 5G core and accelerate 5G rollout

- Drive Innovation and New Product Development

- Fostering tech-co capabilities – supporting the Decode 2.0 event that brings together the digital engineering community to ensure we have an enriched pipeline of talent across the industry that will play a key role in the positioning of Safaricom as a technology partner of choice for enterprises and the government

- Embrace Secure and Sustainable Technology Solutions

- Digitisation – Improving service delivery, efficiency and savings on man-hour costs

Measuring our performance

| Target | How we performed | Status |

|---|---|---|

| Enterprise Revenue KShs 65 billion | KShs 55.18 billion at February 2024 |  |

| To be recognised as technology partner of choice in Government | Nine live, one initiated |  |

| Implement Operation Excellency on Capex and Opex |

IT opex: KShs 3.62 billion Network opex: KShs 18.93 billion Capex at KShs 47.47 billion |

|

| Network NPS >80 (Connectivity and data) | #1 at 78 (15-point lead) |  |

| Customer pain reduction (tech-driven demand) | 44% reduction, 14% within monthly target |  |

| A cyber-security score of 4.0 | Cyber Security baseline (CSB) at 3.96 |  |

| Health, safety and wellness (HSW) – zero fatalities, HSW Maturity Level 4 | Level 3 – advancing |  |

| Five home-developed solutions commercialised externally | Five solutions developed |  |

| 800 5G sites | 803 5G sites as at March 2024 |  |

![]() Achieved or on track

Achieved or on track ![]() Partially achieved

Partially achieved ![]() Not achieved

Not achieved

Our key investments

Our total capital expenditure for the year amounted to KShs 22.5 billion

- Limuru Data Centre Build

- Over 700 sites upgraded to 5G technology

- Phase I CBS refresh

- 1,000+ 4G upgrades

- Fixed – 92K+ homes passed

- Support for the migration of government services to our internal Cloud

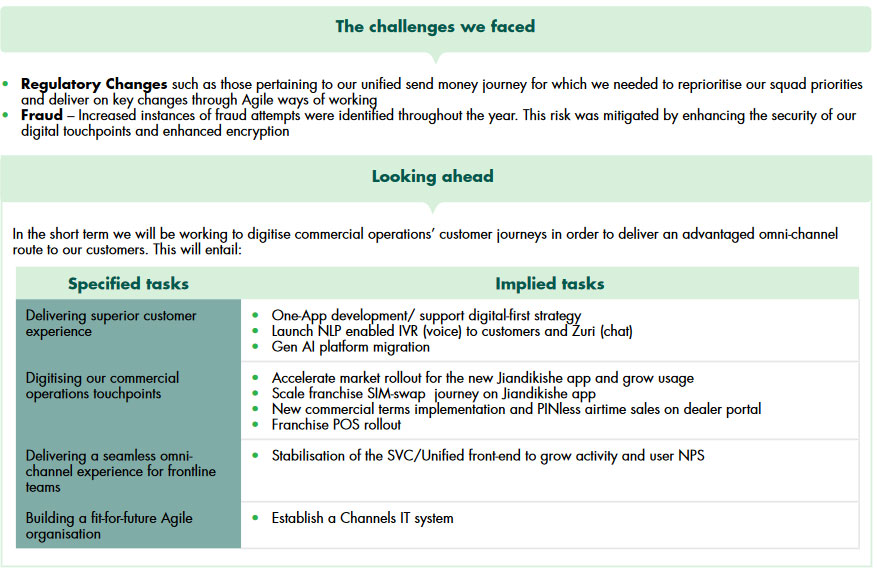

The challenges we faced

- Rising cost of fuel – solarising of sites to meet at least 20% of demand

- Forex depreciation – Local currency payment to all services offered locally

In addition we made several enhancements including investing in a data privacy protection tool that will assist in the discovery and protection of our PII data.

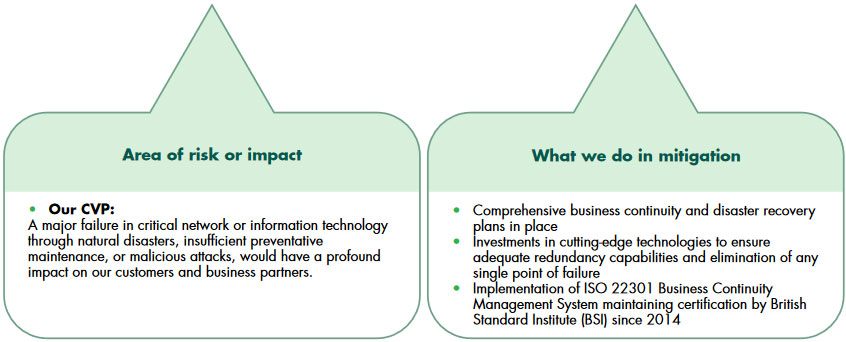

The risks we have identified

Although many positive impacts are attributed to recent technological changes, over the longer term, technological advances, including generative AI, will enable a range of access to an extensive breadth of knowledge that will underpin the conceptualisation and development of new disruption and malware tools.

For more on our management of risk, click here.

CSI

As part of our commitment to responsible corporate citizenship, we supported:

- The Safaricom Foundation in 20 initiatives

- Customer service week

For more on the Safaricom Foundation, click here

Looking ahead

In the short-, medium- and long-term we will need to address:

- Increasing fraud within financial services sector as we seek to ensure the security of customer funds and the education of customers so that they can identify social engineering tactics by fraudsters

- Early loading of budgets to ensure that equipment and hardware are purchased early, to facilitate sound planning

- Prior itising of Tech for Good initiatives to increase our NPS and foster the realisation of the Safaricom Purpose of transforming lives

- Sustainable business through investments in new growth areas such as health-tech and agri-tech.

- Capacity-building of staff through tech certifications in growth areas to capacitate our employees

- The retirement of 3G technologies in the medium term and 2G in the long term while taking into account the challenge of legacy mobile phone sales in the market, an issue which Safaricom cannot contain alone

- The entry of new players such as Starlink into the market, thereby increasing competition to our enterprise and fixed products

- Currency fluctuation, which has the capacity to impact our capex, as a significant portion of our radio network spend is in foreign currency

Our operational overview

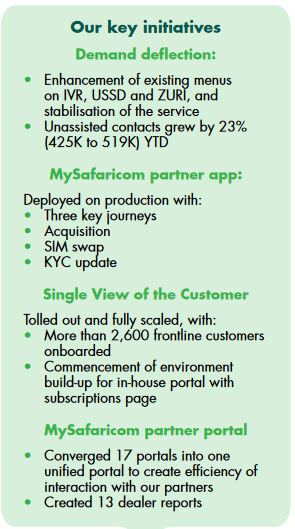

The Digital Channels tribe is part of the Channels Division, and our specified tasks for the year under review were to:

- Grow APP, Web, ZURI (BOT), USSD and IVR usage (Monthly Active)

- Digitise channels organisation

- Implement the Single View Of Customer platform

- Facilitate cost efficiencies through digitisation

- Ensure fit-for-purpose Channels organisation

Our strategic objectives

Our strategic objectives shifted during the year under review from growing digital channel and self-service usage to digitising more of our trade operations and activities, this translated into the imperative to:

- Digitise Customer Journeys in order to deliver an advantaged omni-channel route

to customer by end of FY24, with a key focus on:- Digitising trade and partner ecosystem operations and visibility through

relevant reports - Growing digital channel usage on App, Web and Zuri

- Growing digital transactional net promotor score (tNPS)

- Digitising trade and partner ecosystem operations and visibility through

Measuring our performance

| KPI | Actual Performance |

|---|---|

| Grow total self-service interactions | 564,000 |

| Grow monthly web (safaricom.com) users | 730,000 |

| Single View of the Customer (Unified Front-end) deployment |

New portal deployed |

| Digital channel tNPS | 36 |

| Demand reduction | 2,800 calls reduced |

| NLP – Smart IVR | 38 journeys developed |

| Device financing – Lipa Mdogo Mdogo enhancements to grow 4G attachment | 5 new devices added System stabilisation done |

| Partner portal/Dealer portal | Converged 17 portals |

| Automated 13 dealer reports | |

| New Jiandikishe app | Deployed new Jiandikishe App |