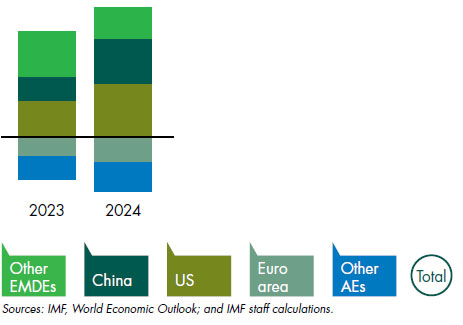

Global growth forecast

World real GDP growth revision

(vs. Oct 2023 WEO; percentage points)

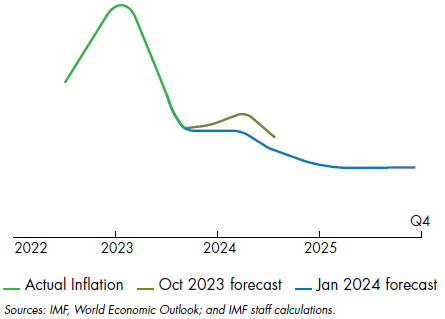

Global headline inflation

(percentage; quarterly; y/y)

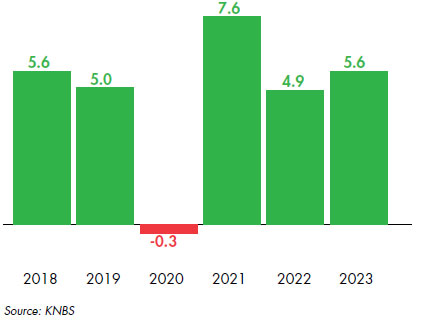

The domestic picture

After Kenya’s strong rebound from the Covid-19 crisis at 7.6 percent in 2021, and GDP growth of 4.9% (revised) in 2022, economic performance bounced back to 5.6 percent in 2023, driven by a recovery in the agricultural sector.

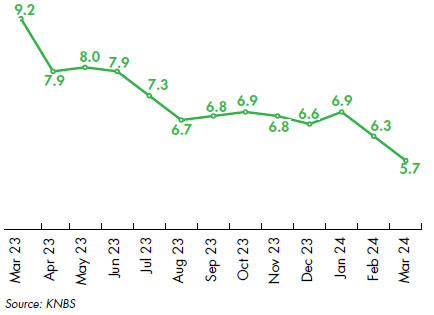

Inflation declined to 5.7% in March 2024 from a high of 9.2% in March 2023 due to a significant decline in fuel and food prices. Credit growth in the private sector stood at 7.9% in March 2024 while the Non-Performing Loans (NPL) ratio for the entire banking sector rose to 15.7% during the same month. The country also saw high interest rates and a tight monetary policy, with the Central Bank Rate (CBR) at 13.0% in March 2024 (cumulative increase of 3.5% since March 2023).

Inflation rate (%)

Increased regulatory oversight by the Data Protection Commissioner

The office of the Data Protection Commissioner increased compliance oversight in the industry by issuing several penalties during the year under review, for those posting pictures and videos of both adults and minors without their consent.

In addition, in February 2024, Central Bank of Kenya (CBK) directed the industry to discontinue all services that allowed payments to unregistered numbers. This has enhanced compliance in AML monitoring and KYC requirement in the industry.

Nonetheless, the year under review saw a generally supportive regulatory environment. While there was a reduction in excise duty on telephone and internet data services, we also saw:

- A reduction in mobile termination rates (MTR)

- Increased excise duty rates on mobile money transfer services

- The introduction of a housing levy

The Finance Act 2023

This piece of legislation than came into force in July, and includes the zero-rating of VAT on exported services that was previously impacting pricing on wholesale services from Kenya to the region. The act also zero-rated VAT on locally assembled devices and zero-rated excise duty for inputs required to assembly handsets.

Kenyan economic developments

Customers experienced a decline in food prices, although their constrained purchasing power impacted business across the economy, exacerbated by an increasing cost of borrowing, high energy tariffs and volatile fuel prices.

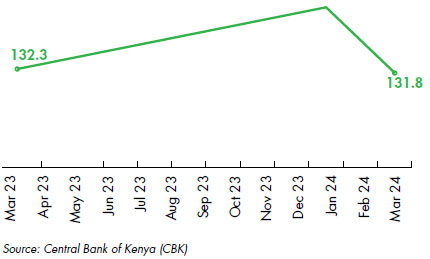

The Kenya shilling strengthened by 15.5% against the US dollar in the first quarter of 2024 compared to a depreciation of 26.8% in 2023, mainly supported by increased dollar inflows into the country after the Eurobond issuance by the government. In February 2024, the country raised US$1.5 billion in a new Eurobond to partly meet the maturity of the US$2 billion sovereign bond that matured in June 2024.

USD/KShs exchange rate

Kenyan mobile network devices

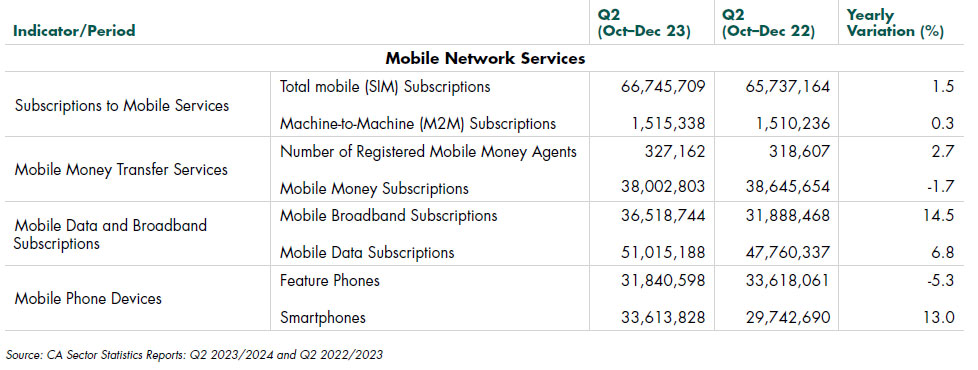

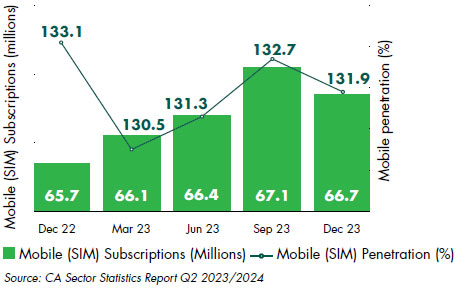

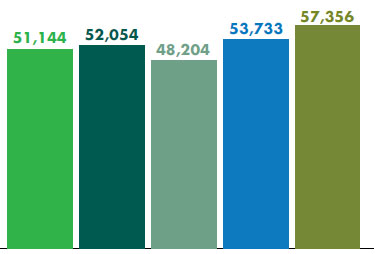

During the second quarter of the year under review, the number of mobile subscriptions dropped from 67.1 million in the previous quarter to 66.7 million. This was attributable to high churn with respect to acquisitions with the mobile penetration rate declining by 0.8 percentage points to 131.9%.

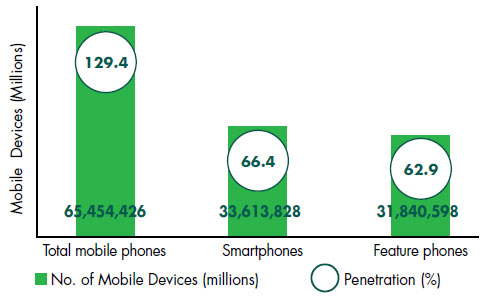

Total mobile phone devices stood at 65.45 million as at 31 December 2023 translating to device penetration rate of 129.4 percent. Penetration rates for feature phones and smartphones stood at 62.9 percent and 66.4 percent respectively.

Source: CA Sector Statistics Report Q2 2023/2024

There were 65.45 million mobile phone devices owned in Kenya as at 31 December 2023, a number that translates into a device penetration rate of 129.4%. Penetration rates for feature phones and smartphones stood at 62.9% and 66.4% respectively.

Number of mobile (SIM) subscriptions and penetration rate

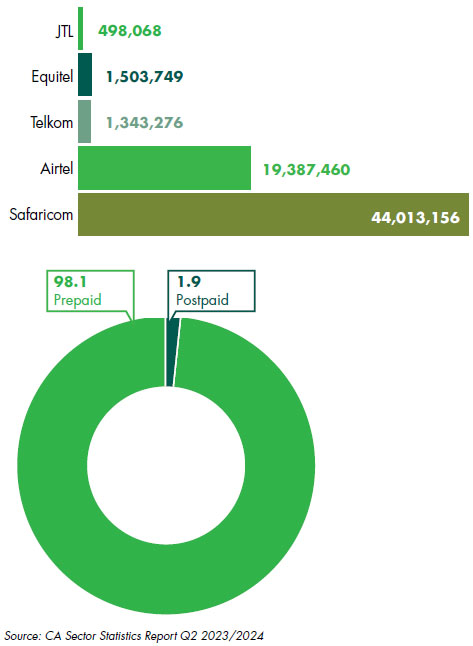

Number of mobile (SIM) subscriptions per contract type

Mobile subscriptions per operator

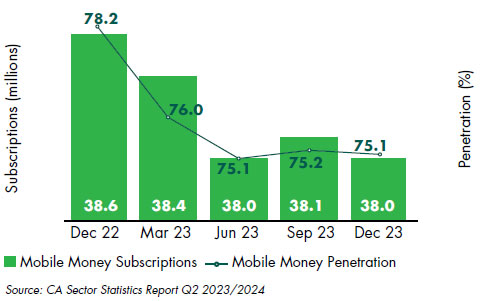

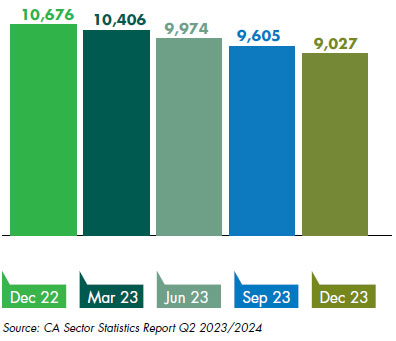

As of 30 December 2023, mobile money subscriptions fell, standing at 38.0 million, which reflects a penetration rate of 75.1%. This decline was attributed to the fall in the of number of mobile subscriptions.

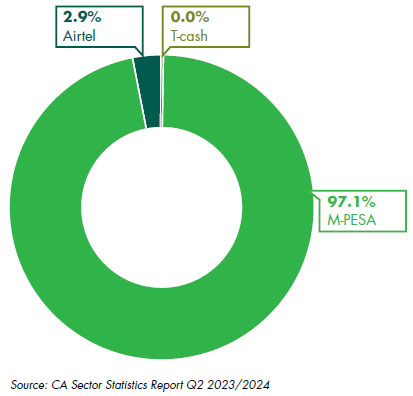

Mobile money services

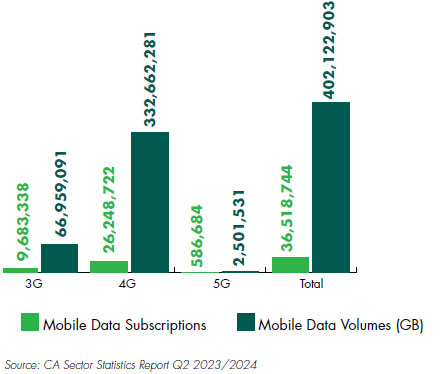

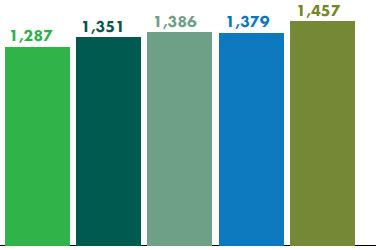

During the year under review, 4G technology continued to gain popularity among mobile data services consumers, contributing up to 51.5 percent of total mobile data subscriptions. Mobile data volumes within the 4G network accounted for 82.7% of total data volumes. network population coverage of 4G currently stands at 97%, with 2G and 3G still ahead at 98%.

Mobile broadband subscription and consumption

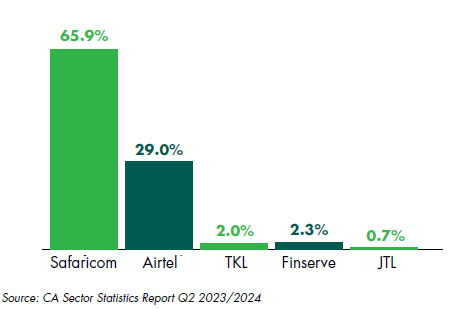

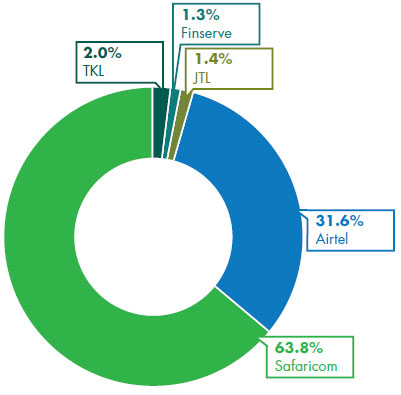

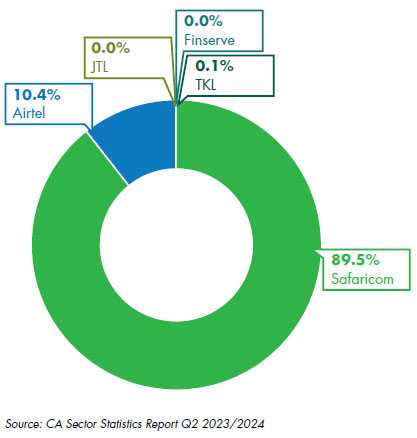

Market share in mobile services subscriptions

Mobile (SIM) subscriptions

Mobile Broadband subscriptions

Mobile money subscriptions

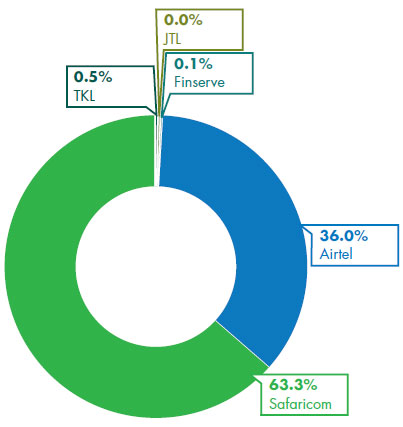

Domestic mobile and SMS market share

While there was intensified competition, we maintained our customer market-share at 65.9% (from 65.7%) by end of December 2023.

Voice

SMS

Fixed voice subscriptions

Competition within the fixed connectivity space continued to evolve as medium-sized players gained ground in key urban and residential areas through low-cost, medium-speed propositions.

Fixed voice VoIP subscriptions grew by 6.7% in Q2 of 2023, reflecting an increase of 11.5% from Q1.

Our voice market-share declined slightly from 64% to 63% for the same period.

Fixed VOIP

Fixed wireless

Fixed line

Fixed data subscriptions by operator

| Service Provider/Indicator | Number of data subscriptions | Market share (%) |

|---|---|---|

| Safaricom PLC | 487,924 | 36.7 |

| Jamii Telecommunications Ltd | 315,819 | 23.7 |

| Wananchi Group (Kenya) Limited* | 261,723 | 19.6 |

| Poa Internet Kenya Ltd | 169,738 | 12.8 |

| Mawingu Networks Ltd | 26,907 | 2.0 |

| Dimension Data Solutions East Africa Limited | 16,465 | 1.2 |

| Vilcom Network Limited | 13,852 | 1.0 |

| Liquid Telecommunications Kenya | 10,979 | 0.8 |

| Vijiji Connect Limited | 5,131 | 0.4 |

| Other Fixed Service providers | 23,475 | 1.8 |

Source: CA Sector Statistics Report Q2 2023/2024

*Includes Wananchi Group, Wananchi Telecom, ISAT and Simbanet