Kenya Performance Review

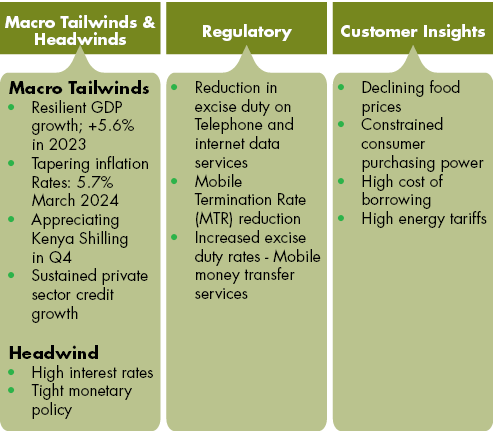

Operating context and key macro factors that impacted our performance

The Kenya economy is forecasted to have expanded by 5.6% in 2023 from 4.8% in 2022, with Q3 2023 closing at 5.9% growth. The World Bank estimates Kenya’s GDP to grow by 5.2% in 2024 supported by continued recovery in the agricultural sector, public sector spending and resilience in the services sector.

See the GDP growth rate chart here.

We are encouraged by the resilience the Kenyan economy demonstrated in the year under review. Significant recovery in currency appreciation against the dollar was recorded after a series of continued depreciation since January 2023. The Kenyan shilling depreciated by 0.4% YoY, to exchange at KShs 131.80/USD at end of March 2024 compared to KShs 132.33 (March 2023). The continued sharp weakening of the shilling is expected to keep the cost of imported goods high while firms are grappling with heavy forex losses.

Inflation rate declined to 5.7% in March 2024 from a high of 9.2% in March 2023. Inflation remains within the Central Bank of Kenya’s target band of 2.5%–7.5%. Inflation is expected to decline further, supported by easing food and energy prices, strengthening currency and the impact of monetary policy actions which continue to filter through the economy.

The Central Bank continues to maintain a restrictive Monetary Policy, retaining the CBR at 13.0% in March 2024 (cumulative increase of 3.5ppt since March 2023). CBK has maintained this citing the positive impact of strong monetary policy, including easing inflation and exchange rate appreciation.

The Finance Act, 2023 (the Act) was signed into law by the President on 26 June 2023. It introduced a raft of tax measures, amendments and repeal of other provisions to the Income Tax Act, Value Added Tax Act, Excise Duty Act, Tax Procedures Act, Tax Appeal Tribunal Act and other miscellaneous changes. Among the changes that impacted our business, the Finance Bill introduced Excise duty at 15% (previously 20%) and VAT at 16% for GSM services and 15% (previously 12%) for M-PESA services/Financial services. Exported services like roaming and interconnect revenues were zero rated as per the new Finance Act 2023. Other services that can’t be categorized as telephone or financial services were subjected to VAT at 16%. These would include services like Cloud, IoT, Handset sales, project related revenues, Connection revenues etc.

Please refer to graphs from here.

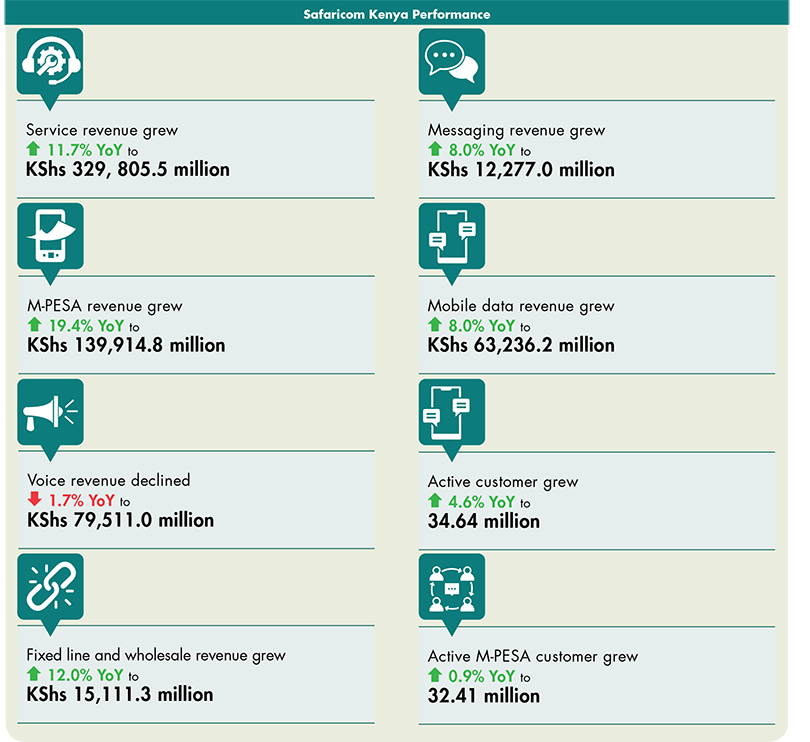

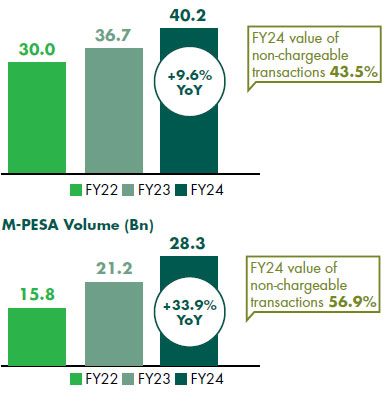

Our Kenyan business recorded impressive results, supported by strong growth in M-PESA, Mobile Data and Fixed revenue growth. Traditional GSM business continues to perform in line with global trends.

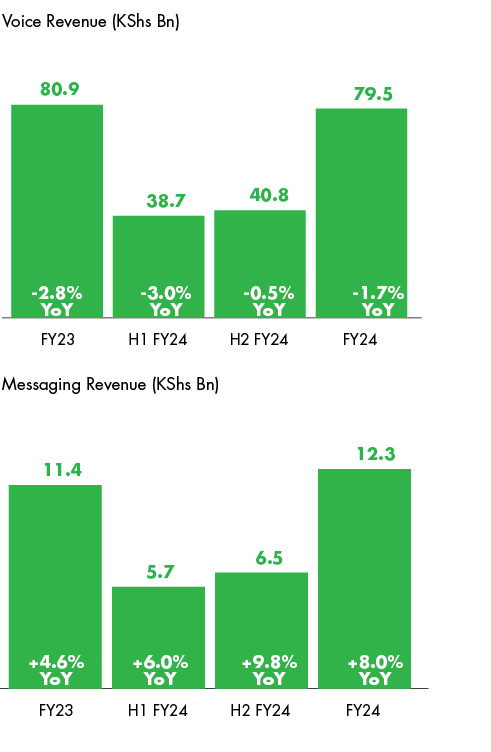

Voice and Messaging

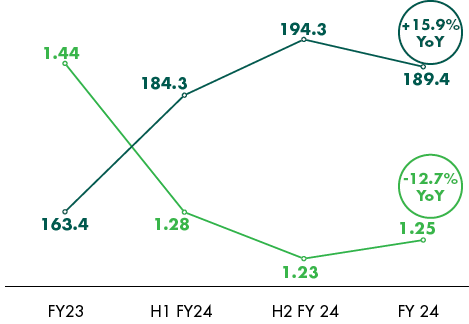

Voice revenue declined by 1.7% YoY to KShs 79.51Bn reflecting the global impact of the downward trend of voice service. We continue to offer better integrated and segmented propositions through our Customer Value Management (CVM) initiatives to drive affordability and usage. During the period, rate per min declined 12.7% YoY to KShs 1.25 while minutes of use per subscriber rose 15.9% YoY to 189.41 minutes. Messaging grew 8.0% YoY to KShs 12.28Bn supported by 8.0% growth in ARPU to KShs 47.33. Voice and messaging revenue are now 28.1% of service revenue.

We are leveraging on largely the call completion innovations to our customers – what we call ‘Okoa Jahazi’, reverse calling options and the 3-sec free call to enable our customers to establish a call at least for 3 seconds for free. There over 2Mn customers using reverse calls, over 800k customers using the 3 secs free call and over 1Mn customers using the Fuliza Airtime plans. These initiatives are powering over 50% of voice usage. We have leveraged data analytics to win, retain and stretch value for our customers in the period.

Revenue

Usage and rate per min/message

Usage and Rate per min

![]()

Usage and Rate per min

![]()

Connectivity performance FY24**

Key factors driving performance of our Connectivity business

- Leveraging in CVM initiatives – to drive affordable 4G devices (a big opportunity to grow mobile data), expanding our enterprise portfolio focused on IoT solutions mainly through partnerships with industry leads, creating fintech solutions to empower SMEs/MSMEs which account for 70% of businesses in the country.

- Customer segmentation – Accelerated campaigns to drive customer engagement via segmentation initiative to serve our customers better.

- Accelerated 4G device penetration – We established the East Africa Device Assembly (EADAK) factory through a partnership to introduce cheaper 4G devices in the market within the year. We are scaling operations of this factory to ramp up production within the course of the year. For the 6 months since launch, we had sold +360k devices valued at KShs 21 billion.

- Delivering value beyond GSM – We are linking use cases for more value e.g., leveraging platforms and ecosystems to give offers to customers. We now have over 10Mn customers hooked on CVM and we still have a huge base to cover. We are also going to leverage mobile money to show value to GSM.

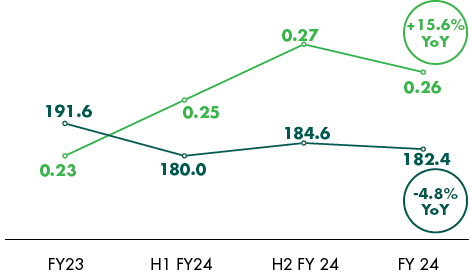

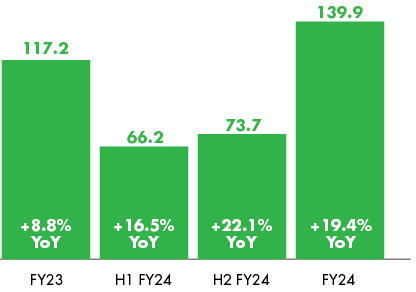

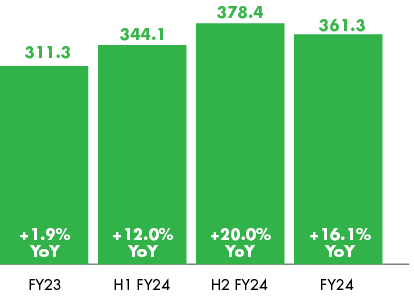

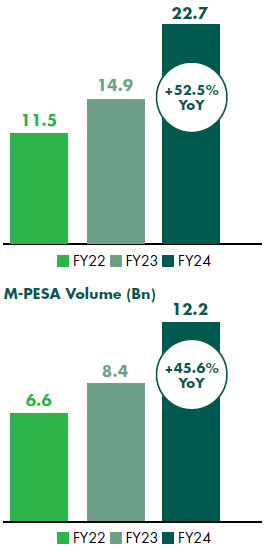

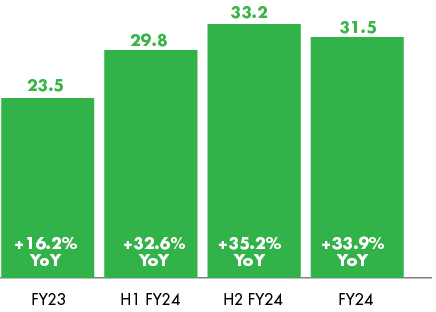

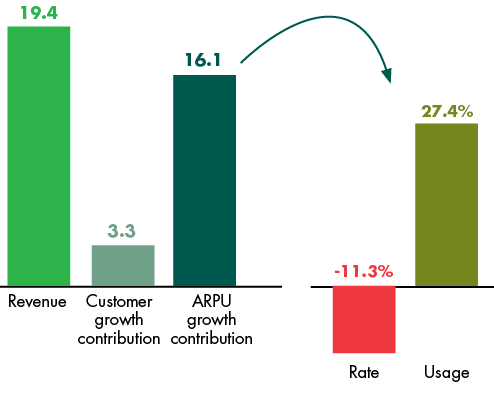

M-PESA remains our engine of growth and the centre of innovation in how we serve our customers. M-PESA revenue grew strongly by 19.4% YoY to KShs 139.91Bn driven by increased usage. Chargeable transactions per one-month active customers rose 33.9% YoY to 31.51Mn while ARPU grew 16.1% YoY to KShs 361.32. Total transaction value rose 9.6% YoY to KShs 40.24Trn while volumes grew 33.9% YoY to KShs 28.33Bn.

Revenue (KShs Bn)

ARPU (KShs)

M-PESA value and volume

M-PESA Value (KShs Trn)

Chargeable M-PESA value and volume

M-PESA Value (KShs Trn)

We believe that affordability delivered through non-chargeable transactions is driving growth in both value and volume for M-PESA, leading to a growth of 33.9% in chargeable transactions per customer per month for the year.

Chargeable Txns per one month active customers

M-PESA value & volume

![]()

M-PESA YoY growth

One-month active M-PESA customers grew 0.9% YoY to 32.41Mn. Lipa Na M-PESA active merchants grew 4.3% YoY to 633.01k while pochi tills stood at 632.68k as at the end of FY24. M-PESA now accounts for 42.2% of service revenue, further complementing traditional voice and messaging services.

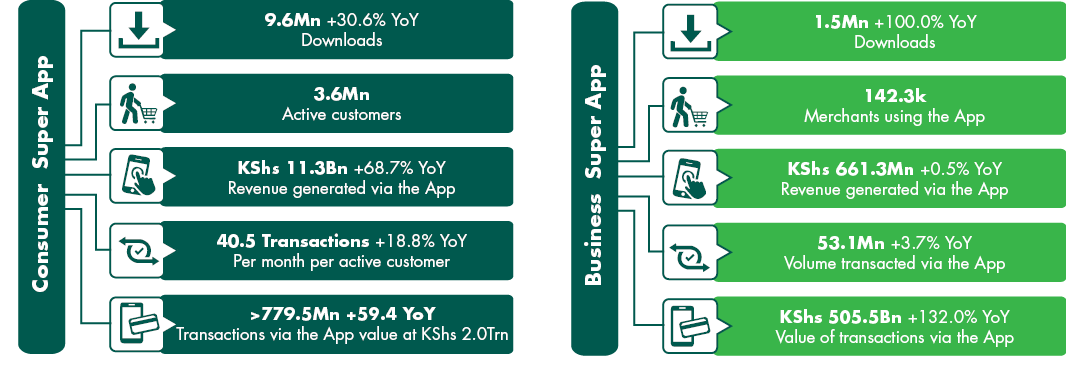

Positioning M-PESA as a lifestyle and business platform of choice

We continue to leverage on our digital platforms and solutions such as M-PESA Super App for an end-to-end excellent customer experience. We now have 9.6 million Consumer App sign-ins, 1.6 million active consumers and over 1.5 million downloads on the Business App. M-PESA now accounts for 42.2% of service revenue, further complementing traditional voice and messaging services.

Broadening M-PESA Services beyond payments

Scaling M-PESA Growth Through;

- Partnerships and Collaborations – Diversification of Bank Partnerships

- Continued Government Partnerships to power financial inclusion and social protection- Hustler Fund, Inua Jamii, e-subsidy

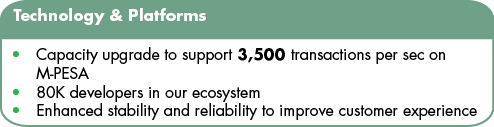

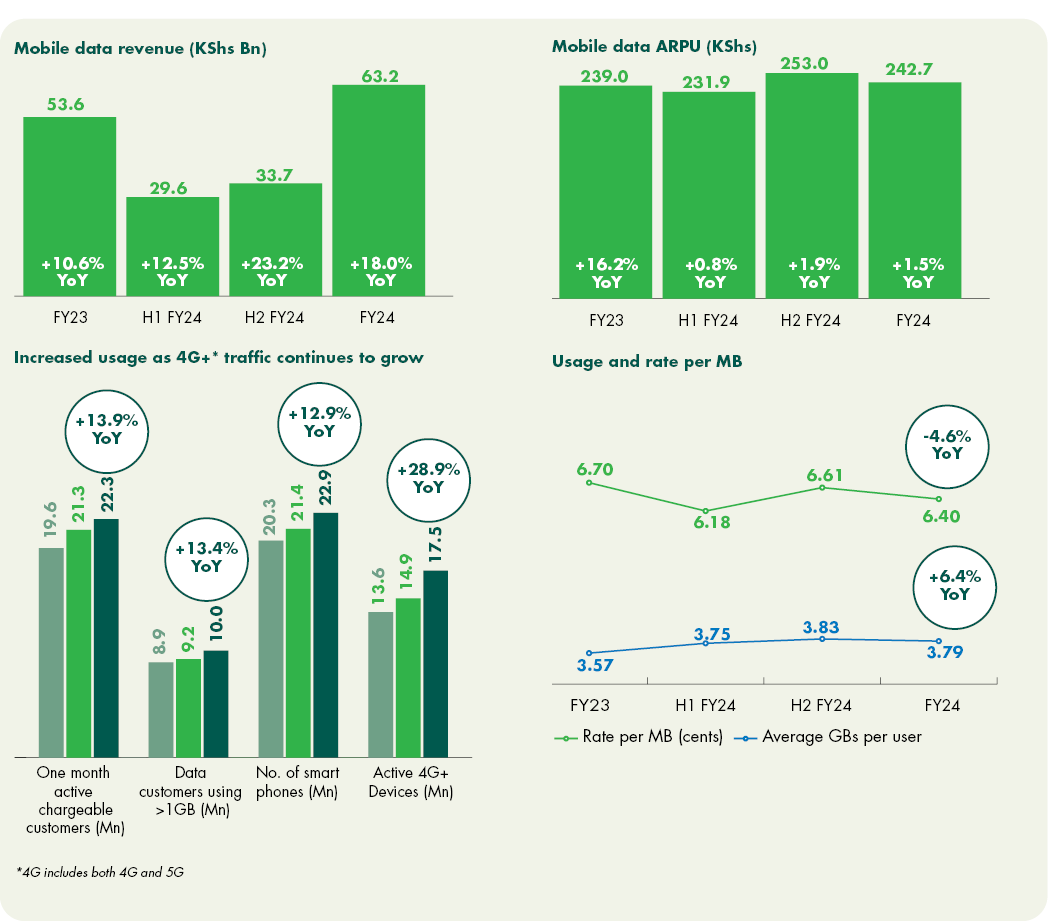

- Grew the number of developers from 64.5K to 79.9K the partner ecosystem- Innovative solutions, deeper integrations & developer accreditation through partnership with Moringa School

- 3rd Party Integrations through Open APIs saw an upgrade of the Daraja Platform enhancing stability, reliability, security, and optimised API services to improve customer experience, operational efficiency, and revenue generation. This also saw growth in number of integrations from 35.7K to 45.3K (the APIs are grouped as; Transaction APIs, Security APIs, Experience APIs – such as txn status check, Reversal etc) and The API contribution on transaction velocity increased from 17.18% in March 2023 to 20.49% as at end of March signaling a 3.31% YoY growth.

- Overdraft facility for businesses (Merchant OD) – On 4 May 2023, we launched merchant overdraft facility for businesses. Over 538,000 Businesses on Lipa Na M-PESA can access upto KShs 400,000 interest-free for 24 Hours to complete transactions in case of insufficient funds. The service will advance an overdraft of up to KShs 400,000 depending on the business’ limit. As at FY24 we had 44.8k borrowing customers while the value disbursed stood at KShs 32.5Bn and revenue at KShs 0.32Bn.

- Wealth management products on M-PESA – As at FY24 Assets Under Management (AUM) stood at KShs 1.85Bn. Total opt in stood at 722k with 119.3k active users. Revenue as at FY24 stood at KShs 13.4Mn.

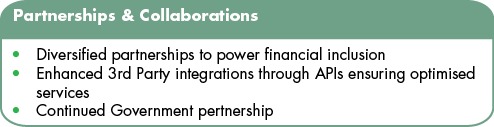

Mobile data revenue recorded a double-digit growth of 18.0% YoY to KShs 63.24Bn accounting for 19.2% of Service Revenue, while ARPU grew marginally by 1.5% YoY to KShs 242.71. We continue to leverage price transformation, transparency, and personalised offers through CVM initiatives to enhance affordability on our data offerings.

- Data usage per chargeable subscriber increased by 6.4% YoY to 3.79GB.

- Distinct bundle users grew 13.8% to 19.69Mn.

- Average rate per MB declined further by 4.6% YoY to 6.40 cents during the period.

We continue to drive the penetration of 4G-enabled mobile devices through our device financing program while providing the right content to encourage usage.

- The number of smart phones on our network grew by 12.9% YoY to 22.93Mn.

- 4G devices grew by 27.5% YoY to 16.85Mn with 49.7% using more than 1GB while

- 5G devices rose by 79.3% YoY to 669.71k.

Fixed service and Wholesale transit

We recorded great momentum on mobile data performance in the period which is attributed to integrated bundle propositions such as digitising our base as we drive 4G device penetration, driving more value since pricing is at the lowest currently.

Our focus now is to drive more value for our customers for the same price point (our average pay-as-you-go tariffs for data is at KShs 6.4cents per MB) which is largely in line with the market. This initiative has improved monetization for data and as we drive devices penetration further, we are going to realise even better performance for mobile data to ring fence the expected decline in voice, a trend seen globally for the traditional Telco services. Data from the Communications Authority of Kenya quarterly report to December 2023 shows that the average pay as you go tariffs for data for the industry is at KShs 4.59, KShs 1.19 for SMS and KShs 3.92 for voice per min.

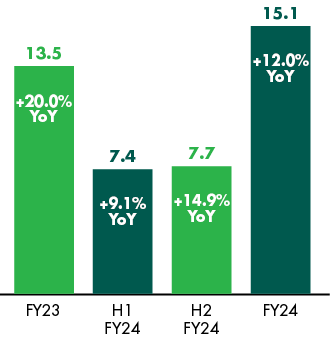

Fixed service and wholesale transit revenue

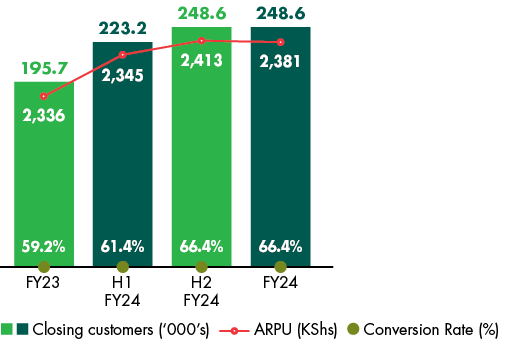

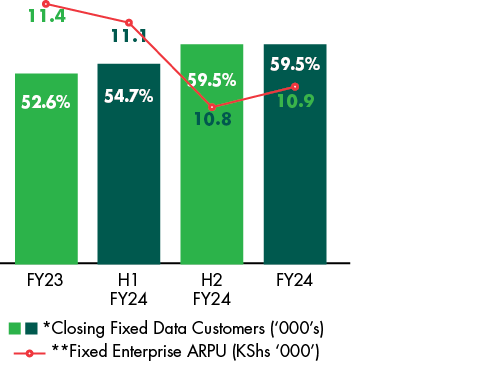

Fixed service and wholesale transit revenue grew by 12.0% YoY to KShs 15.11Bn supported by growth in consumer revenue which rose 31.1% to KShs 6.48Bn and 0.9% YoY growth in Enterprise revenue to KShs 8.63Bn. Our fixed data market share stood at 36.7% as at December 2023 as per Communications Authority of Kenya. Fibre to the home (FTTH) and fixed enterprise now account for 4.6% of service revenue.

FTTH customers grew 27.0% YoY to 248.57k. FTTH penetration rose to 66.4% with homes connected growing 34.9% YoY to 371.99k while homes passed increased by 20.3% YoY to 560.26k. Fixed Enterprise customers grew by 13.1% YoY to 59.46k.

Fixed Service Revenue (KShs Bn)

FTTH

Fixed Enterprise

During the year under review, our complex operating environment continued to necessitate close examination of addressable opportunities.

For more on our operating environment, click here.

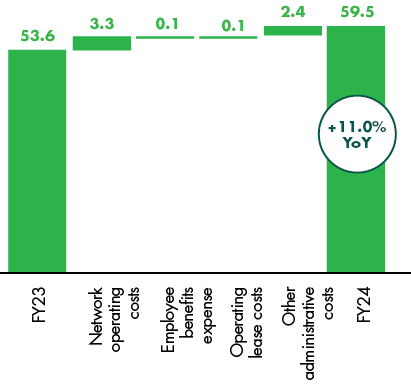

Our operating costs grew by 11.0% year on year majorly driven by increased network operating costs, lease costs and foreign exchange losses. The network operating costs’ growth was driven by rising fuel and electricity rates. Excluding the impact of the rising energy costs, our operating costs would have grown by 4.3%, which is below inflation.

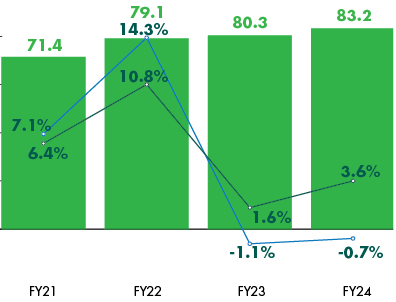

Direct costs declined 0.7% year on year driven by decreased handsets sales due to higher taxes imposes in the Finance Act 2022. Excluding handset costs, our direct costs grew by 3.6% primarily driven by growth in M-PESA commission in line with revenue growth.

We continue to look for opportunities to create efficiencies through sustainable initiatives that will lock in value into the future and cushion external macro impacts to the business.

Direct costs (KShs Bn)

Operating costs (KShs Bn)

In addition, we saw growing finance costs on the back of increased interest rates in the market during the year compounded by financing needs for our business in Ethiopia.

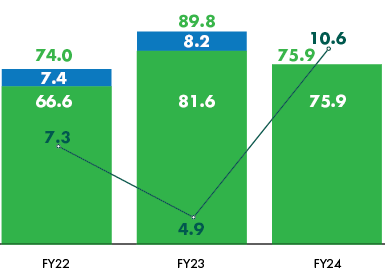

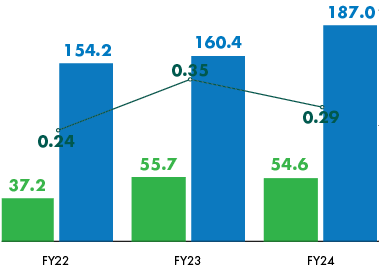

As at close of the year, our debt position was at KShs 75.9 billion and our net debt position closed at KShs 54.6 billion. We have taken measures to reduce our FX exposure due to the depreciating currency.

During the period under review, we managed to pay off the dollar facility we had taken back in FY22 with respect to our Ethiopia investment minimizing FX related financial impact.

We, however, must deal with the challenge of managing the rising interest rates which has led to a 45.3% year on year increase in our finance costs. We have already started taking some deliberate steps on this, with the recent sustainability linked loan of KShs 15 billion. The rate for this loan is linked to our sustainability targets and will therefore be below market rates. Overall, our Net debt to EBITDA ratio is strong at 0.29 and compares favorably to global markets.

| Net Debt (KShs Bn) | FY22 | FY23 | FY24 |

|---|---|---|---|

| Cash & Cash equivalents | 28.1 | 18.3 | 21.3 |

| Short-term borrowings | (20.4) | (35.5) | (39.8) |

| Long-term borrowings | (44.9) | (38.5) | (36.1) |

| Net debt | (37.2) | (55.7) | (54.6) |

Debt (KShs Bn)

![]()

Net debt/EBITDA (KShs)

![]()

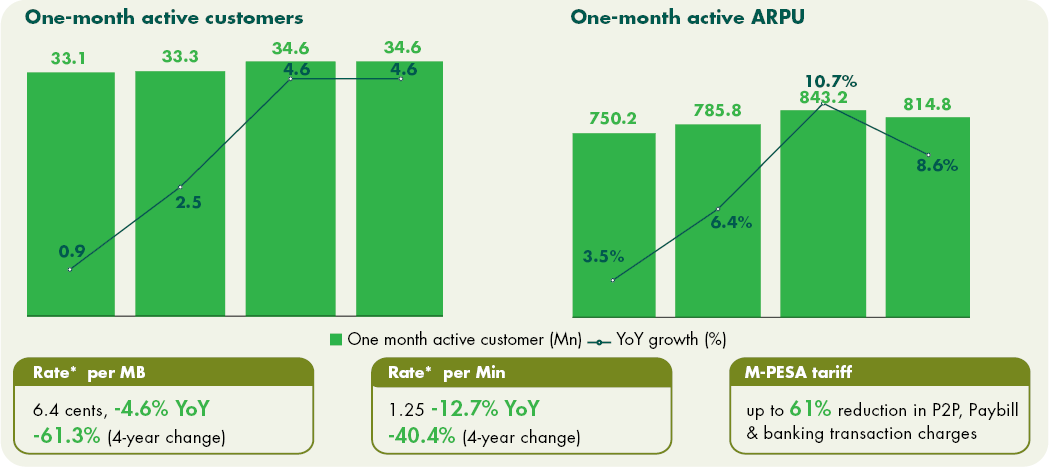

Moreover, we have been optimising pricing to drive affordably of our services whilst supporting our customers during the challenging macro environment.

- Our one-month active customer base has grown by 4.6% year on year to 34.6 million customers.

- We have been optimising our pricing too ensure that customers can still utilise our services and enjoy the value of being on our network in meeting their day-to-day needs.

- Our rate per MB has reduced by 61% over the last four years and in the period under review, we recorded the slowest decline by 4.6%.

- Our voice rates are down by 40.4% in the same period to a rate of KShs 1.25 per minute.

- We reintroduced fees for M-PESA transactions from last year and we took a deliberate decision to revise the tariff downwards by approximately 61% to ease the burden on our customers.

- These affordability initiatives have driven higher usage and therefore promoted ARPU growth of 8.6% to KShs 815 per one-month active customer.

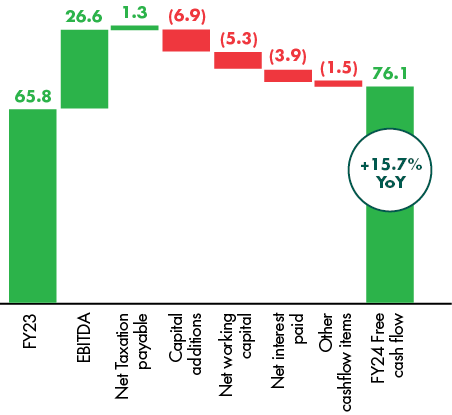

Cash Flow

Our free cashflow grew by 15.7% year on year to KShs 76.1 billion. This was majorly driven by growth in EBITDA. The good performance was able to fund the business needs in Capex, tax, working capital and interest payment obligations to still record a surplus.

Net income grew 13.7% to KShs 84.74Bn for Kenya supported by M-PESA, Mobile data and effective cost management initiatives in the period.