During the year under review, we continued to make a significant contribution in the Kenyan economy within the overall financial services landscape where we retain a strong and influential presence, with our M-PESA mobile money platform accounting for just over 60% of transactions.

We are proud that we continue to be licensed by the Central Bank of Kenya (CBK) as a payment service provider, and that we have achieved card security certification under the PCI DSS (Payment Card Industry Data Security Standard) to optimise the security and protect cardholders against misuse of their personal information, this provides us with an opportunity to offer financial services across the globe.

Moreover, in the area of financial inclusion we continued to work closely with government, with the aim of not only enabling financial access for our customers, but also fostering and promoting their financial wellness.

Technology usage

In the field of technology, we continued to work with developers, increasing their number from around 70,000 in FY2023 to reach over 79,900 in our ecosystem in the year under review. This aligns well with our mini-app strategy, which has seen the amount of mini-apps increasing to around 80, across all key sectors, from travel and transportation to healthcare and insurance. We also seek to broaden access through our work with the CBK and others on developing a QR standard for Kenya.

We enhanced capacity through upgrades to enable us provide better services to customers.

Use of emerging technologies such as Big Data & AI saw us offer personalised services through smart customer value management (CVM) system, fraud detection and prevention as well as offering credit capabilities.

Working with government

In partnership with government, we were able to support an estimated 3 million vulnerable elderly Kenyans with the disbursement of the monthly Social Security payments and also provide lending and savings to both individuals and groups an enabler for Financial Inclusion. We also continued to facilitate the disbursement of fertiliser subsidies, a key enabler of agricultural development.

Strategic Partnerships to Spur Innovation

We launched the Spark Accelerator Fund, an M-PESA Africa collaboration with Sumitomo, completing the integration of key FinTech platforms.

We continued to work with Financial Institutions, Fund Managers and other Fintechs to offer differentiated products and value added services to our consumers such as Buy Now Pay Later, Investments (Mali).

Our strategic focus – FY2024

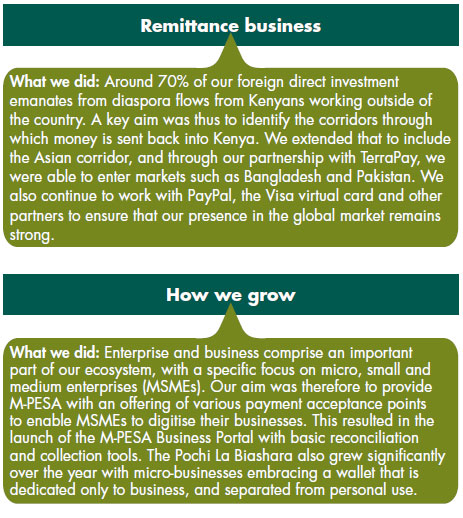

The central strategic focus in our operations for the year under review was to scale our activities beyond payments. As a mobile network operator (MNO), we are responsible for over 90% of mobile payments. Our aim was to maintain this market share, but also to enter additional complementary spaces within the financial services sector implementing several strategic focus areas:

Our key challenges

The macro environment* in which we operated during the year under review, formed the background to some of the challenges we faced. This environment included:

- Slowed GDP growth, negatively impacting consumer spending ability

- High inflation, affecting disposable income

- Introduction of the housing levy

- Increases in:

- Taxation rate

- Forex rates, particularly the US dollar which saw a 26.8% depreciation of the Kenya shilling

- Fuel prices

- Payments excise duty

- Interest rates

- Increase in controls and compliance requirements following the grey-listing of Kenya

- Data privacy regulations coming into force

Against this landscape, we identified key opportunities to:

- Enhance security to counter the increasing incidence of fraud and money-laundering

- Embed greater usage of artificial intelligence (AI) and big data analytics to enable wider personalisation and offering value to our customers

- Scale our global partnerships such as those with MasterCard, Visa, Apple and Google.

*For more on the environment in which we operate, click here.

Campaigns

During the year under review we conducted several focused campaigns in partnerships with banks and insurance companies on the theme of financial literacy, the most notable of which was with Old Mutual together with the Ministry of Education to create a financial literacy curriculum. We worked with teachers to develop tools for youth empowerment on budgeting, savings and responsible borrowing.

Other campaigns dealt with:

- Consumer engagement, through our loyalty programme Bonga, with the aim of a cash back component that would encourage savings to make bill payments. Additionally,

we ran several Stretch and reward, Cross Sell Campaign

& Winback Campaigns. - Fraud prevention and awareness – An always ON campaign to raise customer awareness.

- Micro-services

This technology allows us to integrate increasing numbers of services on our platform to provide a more comprehensive solution for our customers.

M-PESA performance

M-PESA recorded its best-ever performance in the year under review, showing exceptional growth in revenue by 19.4%, reflecting:

- Member payments as the largest contributor at just over 90%

- Consumer payments accounting for 64.6% of total revenue

- Global payments growing by 20.0%

- 1.2 million monthly active medium-sized businesses

- Over 32 million active customers

- 42,000 integrations into our ecosystem

- 9.6% and 33.9% growth in value and volume of transactions YoY

- 52.5% increase in value of chargeable transactions – especially noteworthy, as 44% of transactions are currently free, comprising all those transactions below the value of:

- KShs 100 for consumers

- KShs 200 for businesses

- All 30-day-active customers using the platform for 16 days a month, up from 14 days YoY

- 1.4 million card applications, with 800,000 cards created YTD

- KShs 7 billion transacted in global payments

- 35% growth in annual remittances, with an increase in active customers growing from just under 1 million in FY2023 to around 1.5 million

Looking ahead

In the short- to medium-term we see significant opportunity for growth in the global and international remittances space. Additionally, accelerating growth in the areas of lending where we shall continue providing consumers with short-term credit facilities. Our strategic intent will be to utilise M-PESA as a platform to scale these business aspects.

We also see a key focus on the savings and investments side with an aim to democratise this area through partnerships with regulators and industry players where consumers will be able to access saving and investment instruments such as Treasury Bonds, Stock Trading, Unit Trusts. We would like to bring down the savings threshold to less than KShs 100, to enable us to cover the majority of the Kenyan population. Insurance and in particular, retail insurance, will be a focus as we endeavour to provide embedded insurance in our credit products but also scale in other insurance offerings.

In the medium- to long-term we envisage maximising opportunities in the use of Big Data & AI, which has already delivered success in our customer value management (CVM) system, by enabling us to personalise customer experiences and offer relevant financial products. Additionally, use of Micro-services, which is a technology, allows us to integrate increasing numbers of services on our platform to provide a more comprehensive solution for our customers.

In the public sector we will seek to continue government partnerships as it seeks to roll out digital identification, a key enabler in tackling anti-money-laundering (AML) and know-your-customer (KYC) issues.

Cybersecurity and Fraud will continue to pose a significant risk and will require ongoing vigilance, technology enhancements and ensuring a worry-free experience for the customer. Data privacy will become increasingly important and efforts to adhere to the laid-out regulations will continue in the new year.

Macro-economics will remain an important factor in all our considerations, with issues such as taxation and currency stability always able to exert financial pressure on our customers.