In our Ethiopian operations, we are pleased with the success that the business has achieved over a relatively short time. Our focus in Ethiopia, which remains on scaling operations for that country’s digital future, has been instrumental in driving our growth. We anticipate that we will continue to build on this momentum in the medium- to short-term.

For more on our Ethiopian operations, click here.

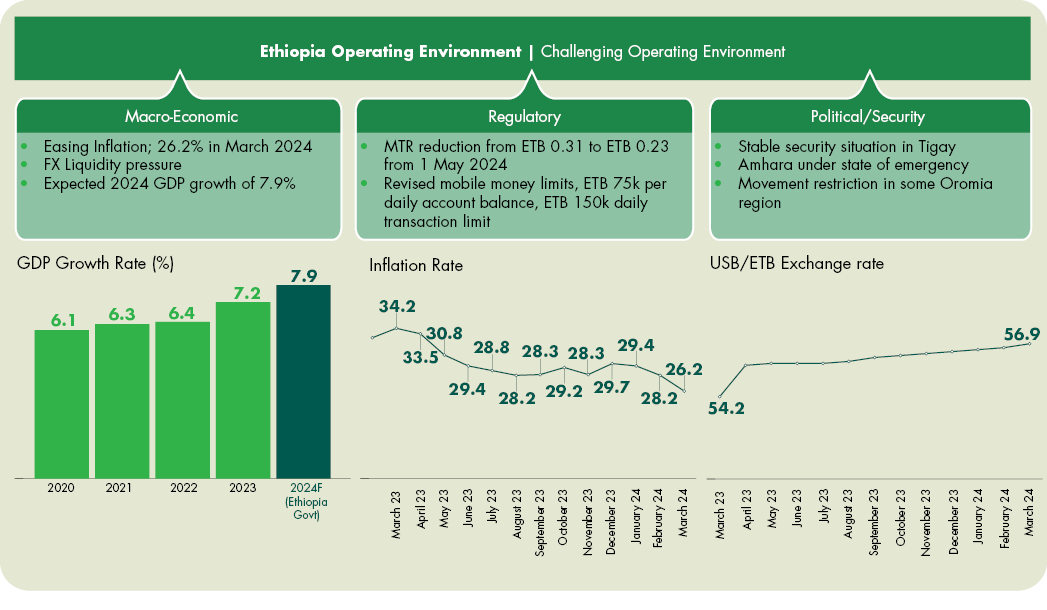

Inflation: The annual inflation rate in Ethiopia fell for the second straight month to hit 26.2% in March 2024, the lowest since June 2021, easing from 28.2% in the prior month and 34.2% in March 2023. Prices slowed down a bit for both food (29% vs 31.6% in February 2024) and non-food products (22% vs 23.5%). On a monthly basis, consumer prices jumped by 4% in March, the most in a year, after a 1% increase in the prior month.

Political/Security: The state of emergency in the Amhara region is still in effect.

Currency Performance: The Ethiopia Birr (ETB) depreciated by 1.3% in the first quarter of 2024 to 56.86 ETB in addition to a depreciation of 4.8% in 2023. To address the foreign currency shortage, the government implemented several measures in September 2022 intended to improve access to dollars. The National Bank of Ethiopia (NBE) banned the use of foreign currency in local transactions while reducing the number of days that a returning resident can keep foreign cash from 90 to 30 days. In addition, the Bank also relaxed restrictions on how much foreign currency can be brought into the country.

GDP growth: Ethiopia is one of the fastest-growing economies in the region, with a 7.2% growth during the Ethiopian fiscal year (2022/2023). According to the Ethiopian government, the country’s economy is on track to achieve a projected 7.9% growth rate for the current Ethiopian 2023/2024 fiscal year, which began on 8 July 2023.

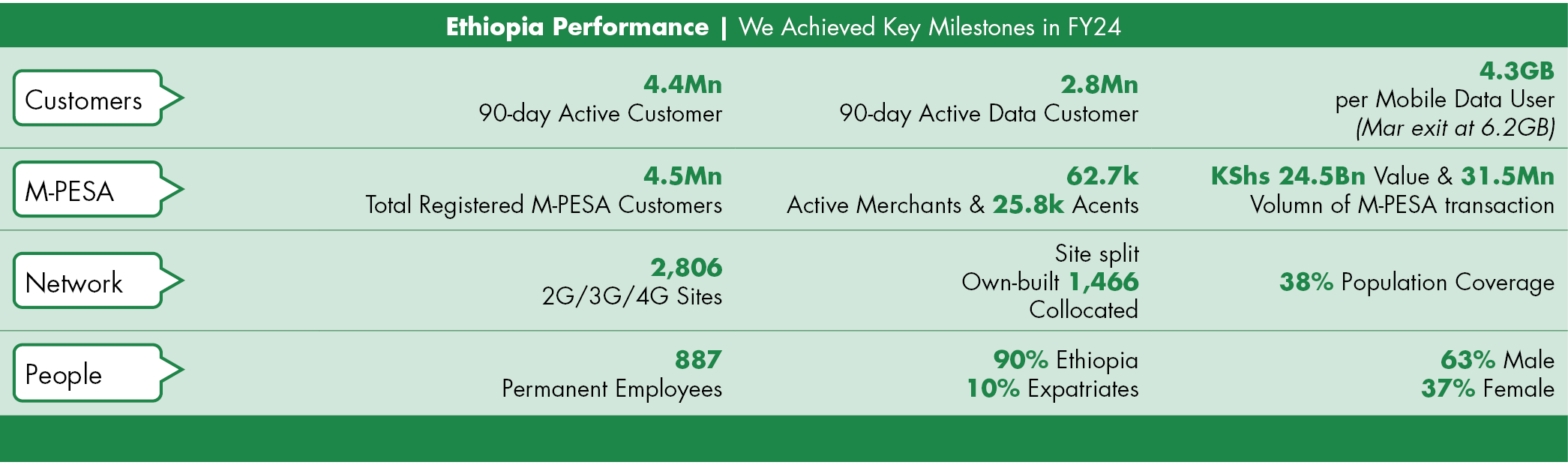

It has been 1 year and 7 months since the commercial launch in Ethiopia with FY24 being the first full year. We are encouraged by the performance to date, confirming the great potential that we see in this market.

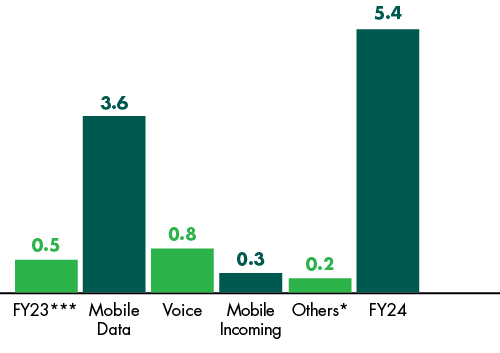

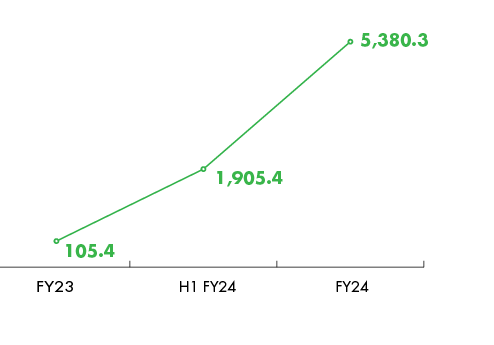

We generated a total of KShs 5.4 billion in service revenue. Ethiopia revenue growth contributed 13% of the Group service revenue growth in the year under review.

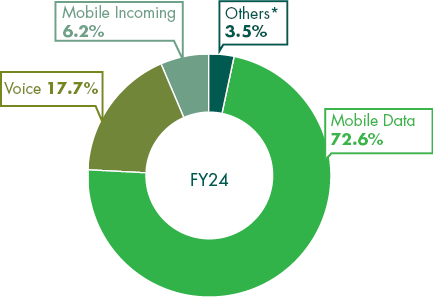

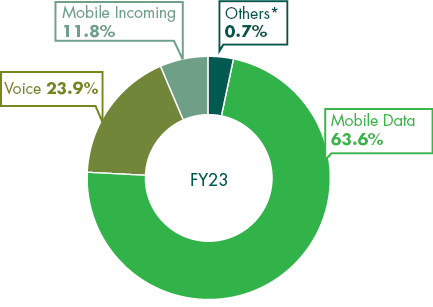

Mobile data revenue continues to account for a significant portion of the business at 72.6% of Service Revenue reconfirming our commitment to build the best data network in Ethiopia. Our superior data network that has gained mileage as being reliable and stable, has been a key value proposition to our customers.

We are encouraged by the acceleration we have seen on the ground and are committed to our journey of transforming lives in Ethiopia.

Contribution to Service Revenue Growth (KShs Bn)**

*Others – M-PESA Revenue, Messaging Revenue, Fixed Line Wholesale & Transit Revenue and Other Mobile Service Revenue

** Exclusive of IAS29

***7 months of commercial operations

Revenue Service

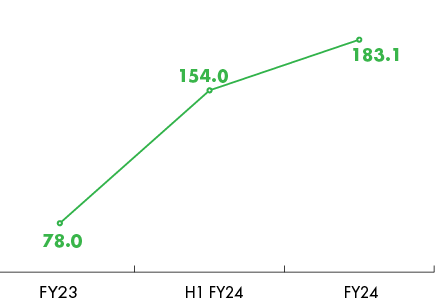

One-Month Active ARPU

Voice and Messaging

Voice revenue stood at KShs 1,029.4 million, driven by growing numbers of customers as we continue to increase our site roll-out. The year under review saw:

- One-month-active voice customers more than double to 3.06 million

- Minutes of use (MoU) per subscriber rose 27.4% to 70.57

- Messaging revenue closed the year at KShs 42.3 million

- 1.1 million 30-day-active SMS customers

- SMS per subscriber at 11.6

M-PESA

M-PESA was launched in Q2 with revenue standing at KShs 87.3 million by year-end, with:

- 4.51 million registered customers

- 25.76k M-PESA agents onboarded during the period

- Volume transacted at 31.5 million

- Value transacted at KShs 24.5 billion

Mobile Data

Mobile Data revenue stood at KShs 4,168.1 million, supported by increased usage as:

- ARPU grew to KShs 215.20.

- Active customers doubled to 1.99 million

- Data usage per subscriber grew strongly to 4.32GB, driven by accelerated post-launch customer onboarding and site roll-out

Medium term Outlook and Funding for Safaricom Ethiopia

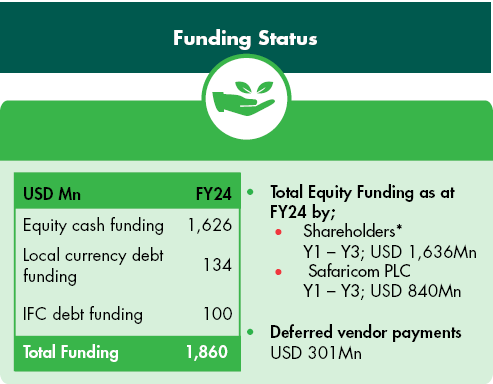

As at the end of the financial year, the consortium members had injected a total of 1.6 billion dollars, of which Safaricom’s share is 840 million dollars. Additionally, IFC extended a loan facility to Safaricom Ethiopia of 100 million dollars. In addition, the business availed local debt equivalent to 134 million dollars.

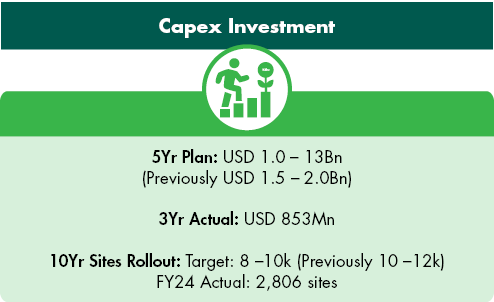

CAPEX and revised medium term guidance for Ethiopia

We have reassessed our medium-term outlook considering our revamped commercial growth approach.

Our 5yr Capex spend in this peak investment period to FY26 is projected to be between 1.0 – 1.3 billion dollars, a reduction from the earlier forecast of 1.5 billion to 2.0 billion dollars. We have already spent 853 million dollars in the 3 years to date and we anticipate that we shall not exceed 1.3 billion dollars in the next two years.

In FY24, Ethiopia Capex spend was KShs 46.2 billion, which is 17.1% year on year lower, supported sites roll out and other infrastructure required to support commercial momentum and expand coverage for the business.

Our sites, which currently stand at 2,806 sites, were targeted to reach approximately 10K–12K sites by Yr 10. We are revising this to 8K–10K sites, and we believe this will be sufficient to achieve the desired coverage obligations and support a ubiquitous network to drive scale.

Hyperinflation

It is important to note that Ethiopia has been declared a hyperinflationary economy by the International Accounting Standards Board (IASB) as of 31 December 2022. The key considerations include the three-year cumulative inflation rate if it approaches or exceeds 100%. In this regard, the International Monetary Fund’s World Economic Outlook (IMF WEO) forecast a three-year cumulative inflation rate exceeding 100%.

In compliance with IFRS reporting, we have assessed our actual Ethiopia performance and incorporated the hyperinflationary adjustments at Group consolidated level as applicable. We recognise that in a period of inflation, an entity holding an excess of monetary assets over monetary liabilities loses purchasing power, while an entity with higher monetary liabilities than monetary assets gains purchasing power. With this context in mind, Safaricom Ethiopia has more monetary liabilities than monetary assets, due to the significant vendor financing liabilities. This, therefore results in a net monetary gain, and we will adjust accordingly year-on-year.

The gain in monetary position as a result of translating the financial statements as at 31 March 2024 was KShs 22.36 billion (2023: KShs 10.38 billion). We have reported a net positive impact of KShs 7.4 billion, mostly driven by the hyperinflationary monetary gain of KShs 22.4 billion. This has been consolidated in the Group’s overall performance.

*For more on our Ethiopian operations, click here and for further details refer to Note 23 in the audited financial statements.