The market we are targeting is characterised by:

- High banking penetration

- 99% of low-value transactions made in cash

- 11% of the population has access to financial institution loans

- Lower rates of town-to-village money transfer

- USD 6.9 billion in annual diaspora remittances

Building on a launch that took place soon after the introduction of GSM, our proposition is built on:

- Solving the cash payment problem

- Offering advanced services from inception

- Promoting digital channels via our Super App from inception

We are able to scale our M-PESA operations by building on the foundations of:

- Customer acquisition: 4.5 million registered M-PESA customers

- Agent and merchant eco-system: 63,000 merchants,

over 70 supermarket outlets, and 26,000 agents - Partnerships: 12 banks, three e-commerce international money transfer platforms, 12 partners and three corridors

Our M-PESA brand offering is based on:

| Technology platform | Agile delivery |

|---|---|

|

Six active squads:

|

Our M-PESA approach

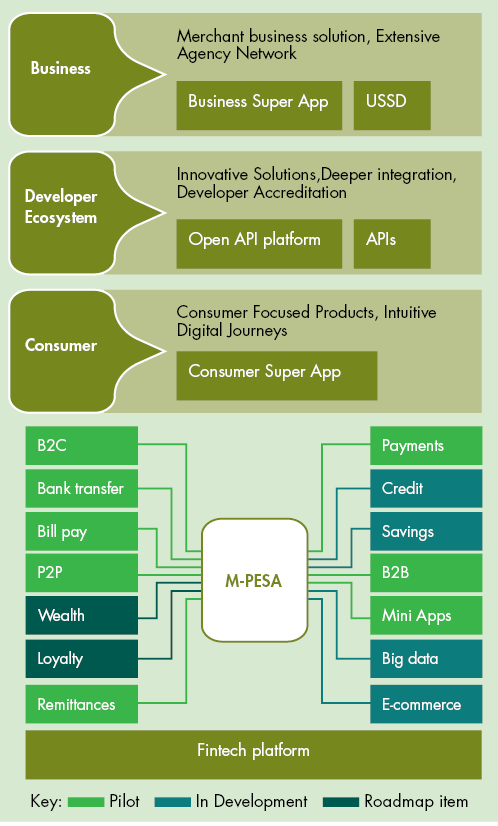

We have leveraged on our experience to build a complete three-sided ecosystem from inception, as opposed to the incremental approach we have employed in other markets.

We leverage this approach on our partnerships with local banks, our more than 100 international money transfer corridors, and e-commerce and government payments channels.

For more on the performance Safaricom Ethiopia click here.

Agile

Our operating model is predicated on three pillars of the Safaricom agile culture:

- Operational efficiency

- Digital first, maximising value-for-money

- Reducing IT costs through in-sourcing via in-house talent

- Capex

- Low Average return per user (ARPU) market

- NOPEX: operating savings start at the design-phase of the network build

- Infrastructure Sharing

- Our people

- Lean and agile organisation

- Focused talent recruitment and skills building

Looking ahead

In the short- to medium-term, we will be entering the scaling phase of our operation in Ethiopia, in which we will be ready to execute, implement and target:

- Customer-per-site to benchmark level

- Infrastructure rollout of more than 4,000 sites

- Untapped fixed, enterprise and wholesale markets

- ARPU of USD 2.00

- M-PESA platform growth leveraging our best-in-class toolbox

Also in the short- to medium-term we believe we can target 4,000 to 6,000 customers per site, from our current level of 2,000. This will lead to far greater opportunities value extraction, while at the same time enabling monetisation of voice.

We will be also be targeting the monetisation of M-PESA, building on the strong foundation we have already achieved. With the ongoing growth in coverage, and we see the maximisation of the fundamental opportunities that offerings present in a market comprising a large population weighted towards aspirational youth.

While regulatory challenges remain in the short- to medium-term, we believe in the long term that best global practice will be guiding principle, enabling the wide potential of the market to be fully realised.

With management changes having already taken place during the year under review, there has also been a significant reduction of expat employees. This trend will remain an important feature in the medium- to long-term as we move towards increasing the transfer of knowledge and skills to local people.