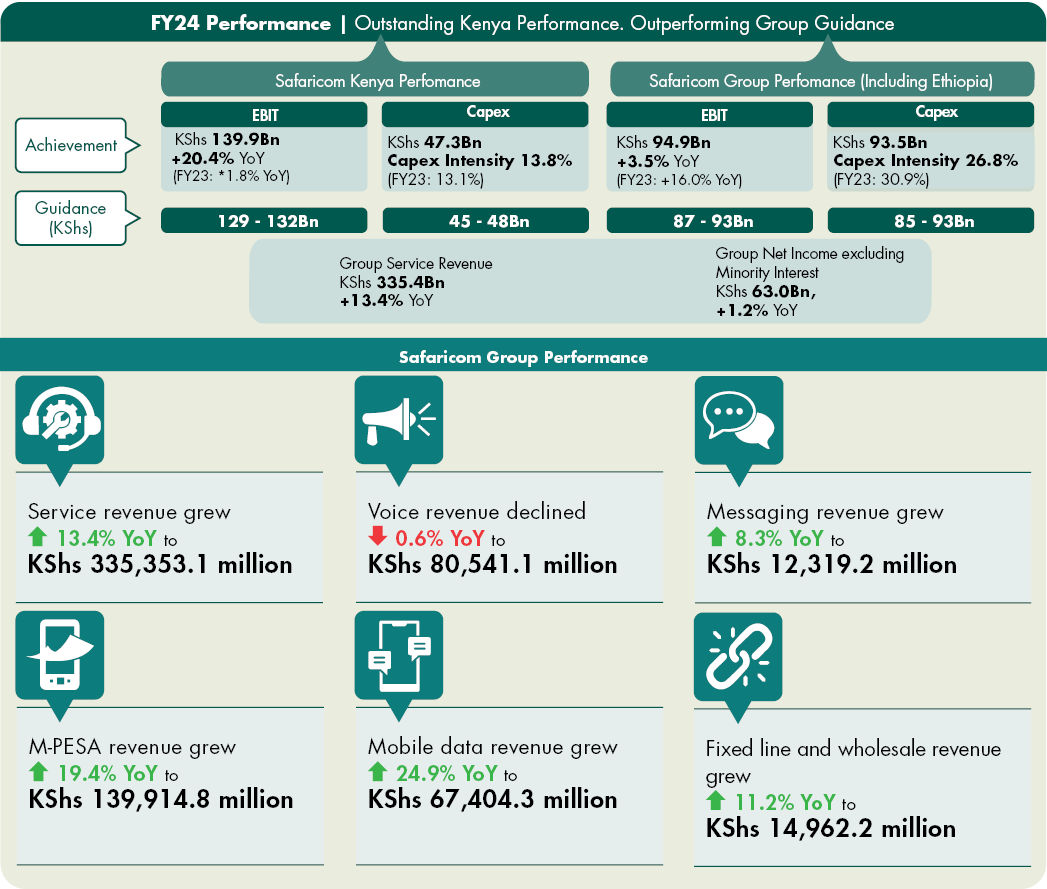

During the year under review, our Kenyan business recorded impressive results, with strong growth in M-PESA, mobile data, fixed service and wholesale transit revenue. We delivered double-digit growth in Service Revenue, EBITDA, EBIT, Net Income and Free Cashflow, with EBIT surpassing the $1 billion milestone. Our margins showcase operational excellence, with EBITDA and EBIT margins reaching record highs.

Our Performance in FY24

Overall, our strategic execution throughout our business segments delivered double-digit growth across all the financial metrics for our Kenyan business – EBIT, EBITDA, net income and free cash flow. This growth largely derived from M-PESA, and connectivity revenue, which includes voice, messaging, and mobile data. Although messaging and voice revenues continue to decline in line with global trends, growth in the new business verticals continue to supplement the decline.

We are pleased with the results delivered for FY24 despite the tough operating environment brought about by macroeconomic challenges. We continued to pursue our strategic goal for the year which was to scale technology solutions in order to be Africa’s leading purpose-led technology company by 2030.

As part of our strategic goals, we continued leveraging on technology and driving relevant products, services and solutions through innovation to meet our customer needs. During the year, we launched “Gomoka na Go Monthly” promotion in Kenya, ensuring that customers can enjoy more data for less, cushioning them against the current challenging economic times.

It has been one and half years since the commercial launch in Ethiopia, with FY24 being the first full year of operations. We are encouraged by the performance to date, confirming the great potential we see in the market. As the Ethiopia business gains scale, its positive impact on Group performance will be material.

These achievements deeply resonate with our purpose of transforming lives. By delivering innovative solutions and creating tangible value, we are impacting our communities positively. A heartfelt thank you to all our loyal customers and our colleagues for their invaluable contributions to this exceptional performance.

Group Performance Review

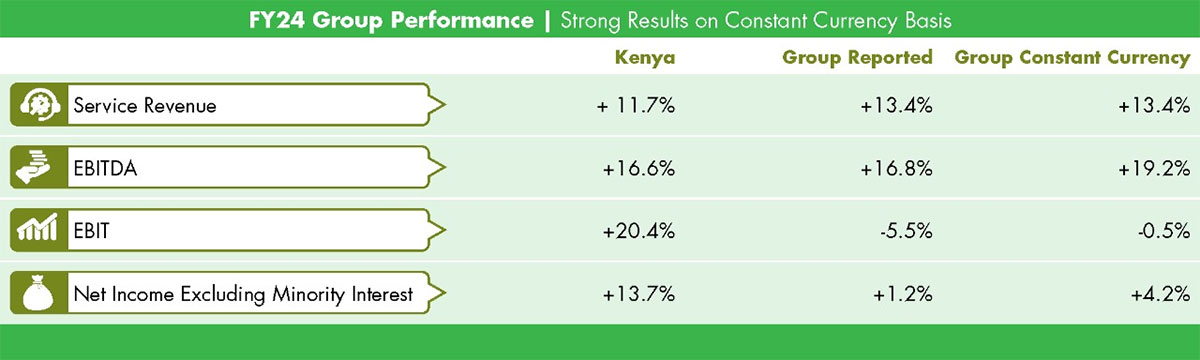

We are pleased with our performance in FY24 despite the tough operating environment compounded by rising inflation adversely affecting our customers disposable income. Our Group Service revenue grew 13.4% year on year (YoY) to KShs 335.35 Bn in FY24 mainly supported by M-PESA, Mobile Data and Fixed revenues.

Overall Group customers grew 6.8% YoY to 49.02Mn while one-month active customers grew by 9.1% YoY to 37.70Mn. Safaricom Kenya’s overall market share stood at 65.9% as at December 2023.

Group Net Income attributable to owners of the Company grew 1.2% YoY to KShs 62.99Bn.

Our Group capital expenditure in the period stood at KShs 93.5 billion, of which Safaricom Ethiopia accounted for 49% at KShs 46.2 billion.

On a constant currency basis, eliminating foreign exchange translation impact,

- EBITDA grew by 19.2% YoY,

- EBIT, almost flat with a drop of just 0.5% YoY

- And our Group net income excluding minority interest growing by 4.2% YoY, versus the reported growth rate of 1.2%, which is very encouraging.