Financial services

Our financial services tribe forms an important part of our financial and intellectual capitals, and with its innovative products and services, has evolved to become far more than a provider of payments platforms. It is a fundamental component of our vision-aligned strategic transformation to becoming a purpose-led technology company, whose aim is to transform lives.

Founded on this strategic orientation, is our commitment to innovate on the basis of the insights we strive to gain about our customers, their needs and requirements, as well as the rapidly changing digital world, in which opportunities abound.

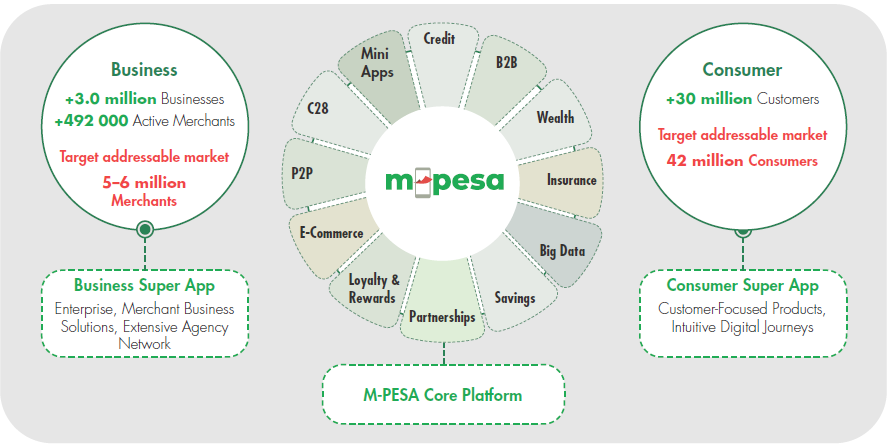

Our driving force during the year under review has been the ongoing strategic imperative to turbocharge a two-sided ecosystem that takes into account, on the one hand, the lifestyle preferences and needs of our consumers, and on the other, the requirements of our business customers as they seek more efficient, productive and simple financial platforms for growing their enterprises.

In addition, we were the first department to fully adopt the Agile operating model, a bold step that will facilitate our role in the transformation of the Group into a technology company. For more on Agile, click here.

Moreover, there is no platform that more encapsulates this approach and strategic orientation, than

This notwithstanding,

The two-sided ecosystem supports our capacity to create, develop and implement solutions that empower our business customers, while at the same time powering consumer lifestyle and e-commerce.

This aspect of

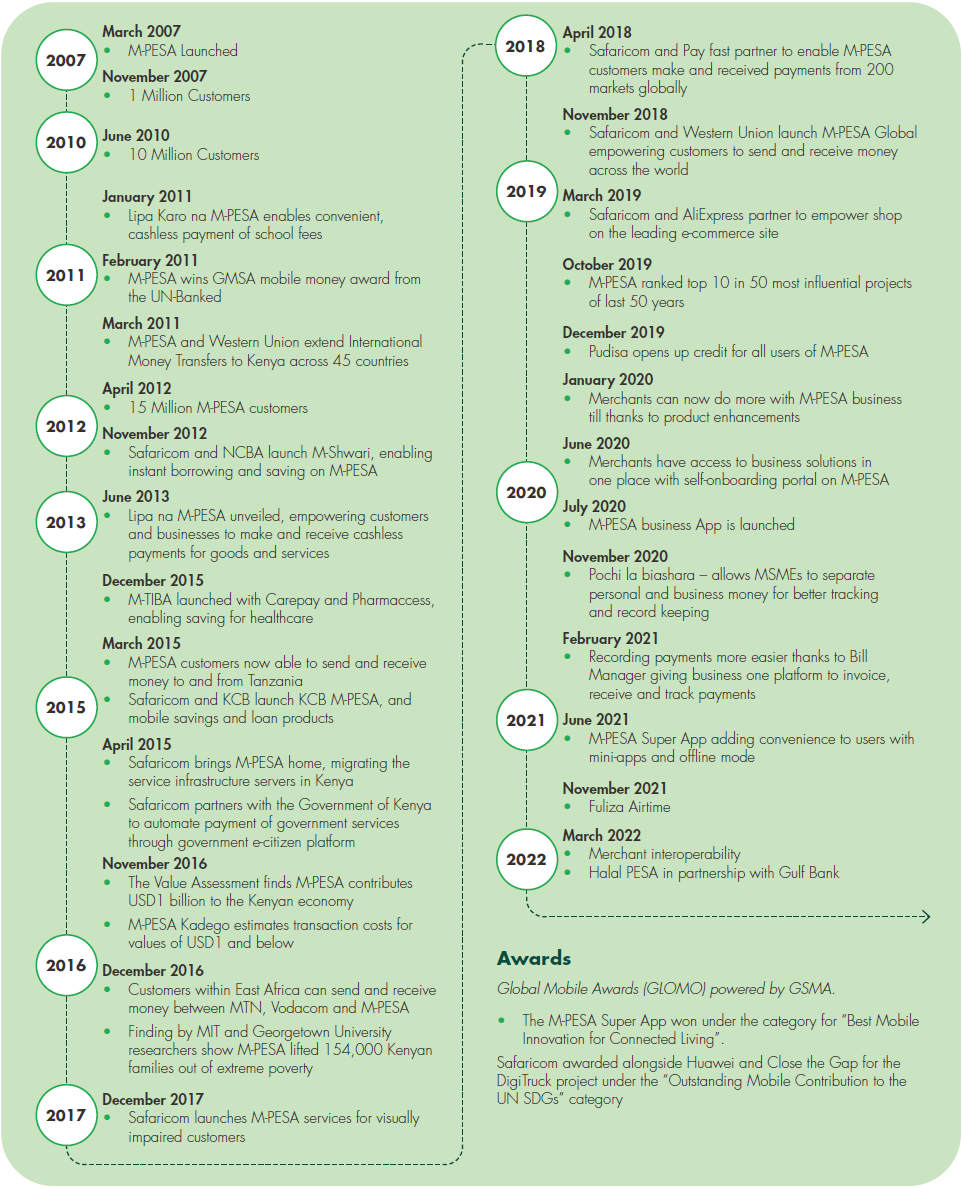

During the year under review, we celebrated the 15th anniversary of the introduction of

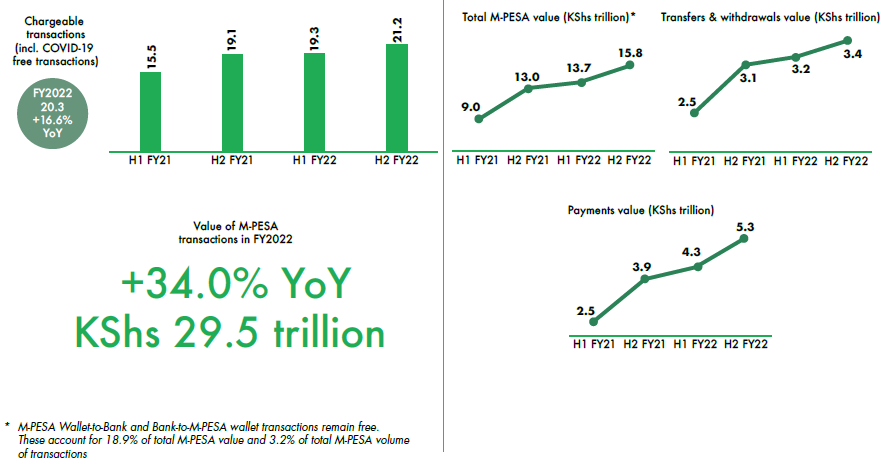

With its over 30 million monthly active customers, more than 3.2 million businesses, and over 42,000 developers engaged in ongoing development within the Super Apps, some 50 million transactions per day, and a velocity of funds exceeding KShs 2 trillion monthly,

Our strategy during the year under review has been to turbocharge

To this end we have been exploring new ways of providing these kinds of services, and examining the requisite partnerships while duly examining the regulatory and technical requirements that will enable the platform’s growth into a true lifestyle and financial health tool.

Part of this is maximising both

The mini app programme is a key component of our ecosystem, as it effectively enables us to function as a play-store. All major marketplace suppliers and producers have a presence on it, representing a diverse cross-section of every segment in the economy. We are then able to offer marketing of their output to our vast customer base, while relieving businesses of any concern about their own enterprise apps, which we can publish on ours – a mutually beneficial arrangement. We have 22 mini apps fully integrated on the

Moreover, we can extend the potential to include bespoke service solutions in both private and governmental sectors. This ability to move upstream with regard to businesses, while still offering the options of a payment channel, constitutes an inbuilt protection against competition.

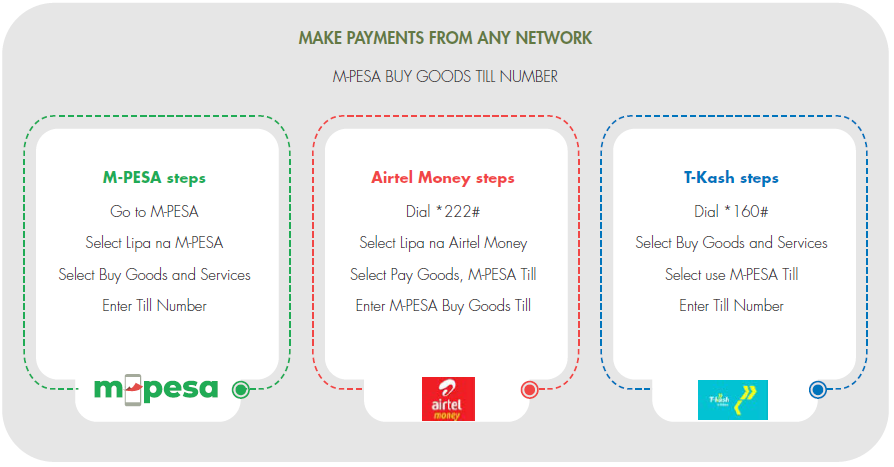

In addition, we have opened up the area of interoperability, allowing Kenyans to make mobile money payments through Lipa na

- Trust

- Security

- Usefulness

- Choice

- Innovation

In the short- to medium-term, we will continue to improve our tech stack, accelerating our new growth areas underpinned by the concept of financial health. As part of this, we will be looking to expanding strategic partnerships, while at the same time ensuring that our Agile operating model is properly entrenched.

We anticipate that new modalities such as blockchain and software as a service (SaaS) will become more prevalent in our thinking and innovation, as we maximise our presence in Africa through the exploration of data and AI as enablers.