This is also the year in which we were awarded the telecommunications licence in Ethiopia and consolidated the subsidiary fully into the Group’s performance in FY2022. While there were no revenues arising from Ethiopia in the year, we nevertheless spent KShs 10.4 billion in Capex and incurred KShs 5.1 billion in operating costs for the Ethiopian operating company.

Inflationary pressures remained elevated at 7.9% as at June 2022, up from 7.1% in May 2022, heading above the CBK upper limit of 7.5%. Concerns about rising food and fuel prices remain high, as these commodities, major contributors to the inflation basket, are expected to put more pressure on the consumer wallet. Geopolitical conflict, especially with regard to the Russia-Ukraine war, has disrupted supply chains and capital flows, and has been driving up prices of commodities, constraining consumer spending/wallet and reducing purchasing power.

The Kenyan Shilling saw a depreciation trend during 2020 and 2021 and this continued into 2022, with the currency depreciating by 4.3% against the US Dollar as at 7 July 2022. The poor performance of the Shilling is mainly attributable to increased Dollar demand by energy and general importers, with Kenya largely being a net importer.

In addition, global oil prices rose during the year under review, attributable to persisting supply-chain constraints and following global geopolitical tensions. This, coupled with the opening of economies globally, resulting in demand outpacing fuel supply, further inflated the country’s import bill and consequently weakened the Shilling. For more on our operating environment, click here.

There a number of regulatory changes that occurred during the year under review, impacting on our ability to deliver value. These changes included the following:

- New directives issued by the regulator in revising Mobile Termination Rates (MTR), presenting a challenge to our voice business in the future. If this review is implemented there would be both a direct and indirect impact on our revenues. Safaricom therefore launched an official appeal at the Communications and Multimedia Appeals Tribunal due to concerns about the procedure undertaken by the regulator to adopt the new rates. This matter is still with the tribunal as at the time of publishing this report.

- Excise duty adjustments on telco products and services, which resulted in increment from 15% to 20% from 1 July 2021, weighed down mobile data performance in H1 FY2022 with growth slowing down to 6.3% YoY but recovery was seen in the second half. These adjustments also slowed down industry momentum.

- Ongoing implementation of changes in the subscriber registration process caused customer growth to slow down.

- Reinstatement on corporate tax to 30%- In FY2020, the government lowered the tax rate to 25% to support businesses during a demanding period owing to the COVID-19 pandemic. However, this was revised back to 30% in 2021, with the effective tax rate in 2021 thus reverting to pre-Covid-19 levels. We saw the impact of this on our bottom line where our tax expense grew by 39.1% to KShs 34.7 billion.

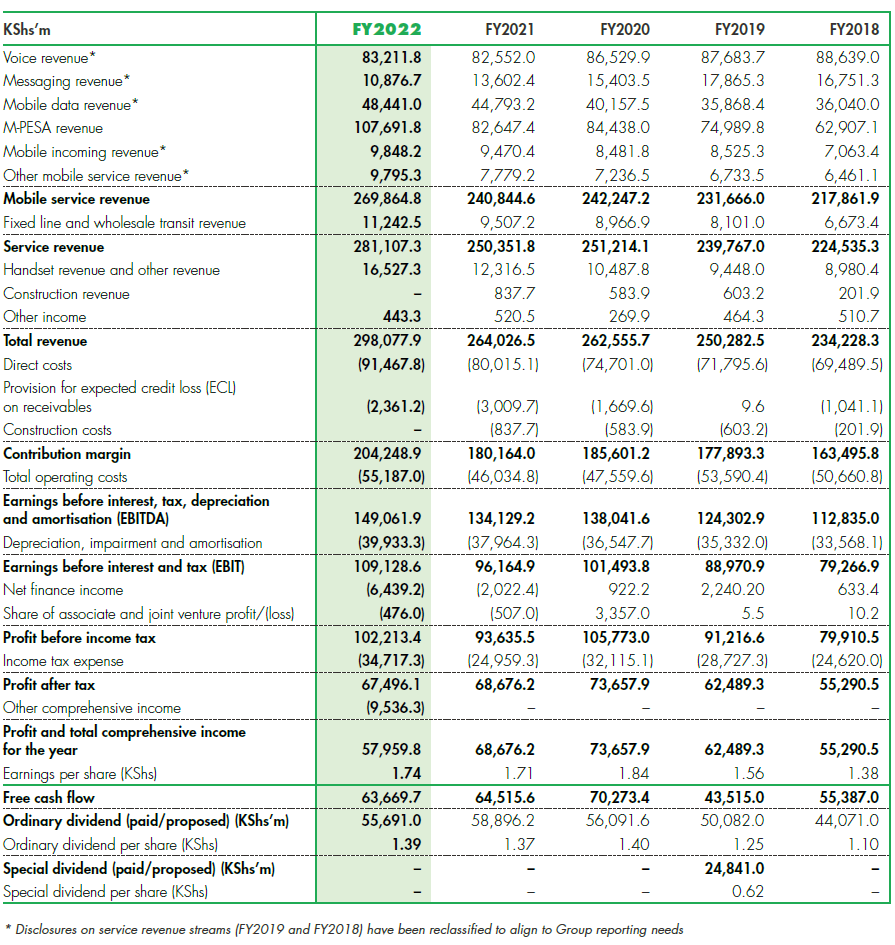

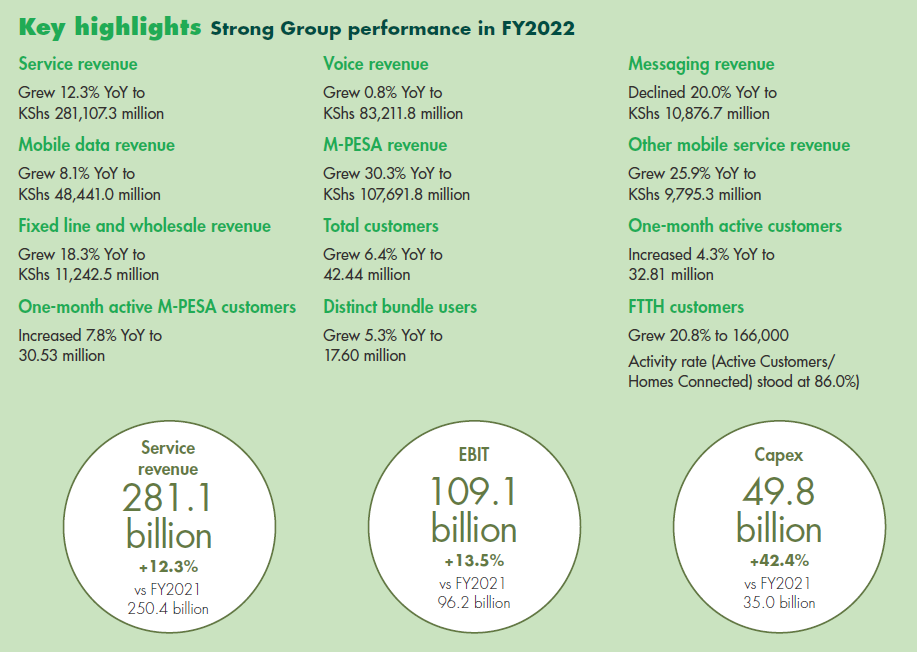

We are pleased with the strong set of results delivered in the year attributed to strong execution of our five-year strategy despite the challenging operating environment, characterised by the global COVID-19 pandemic and heightened regulatory risk for our industry. Service revenue grew 12.3% YoY to KShs 281.1 billion in FY2022, supported by M-PESA, Mobile Data recovery and Fixed Data growth. Customer growth slowed down in the period due to the ongoing implementation of changes in subscriber registration acquisition channels in the year. Despite this, overall customers grew 6.4% YoY to 42.44 million while one-month active customers grew 4.3% YoY to 32.81 million.

We continue to leverage on our purpose-driven business model and products that combines the power of mobile technology and innovation, to Transform Lives. Thanks to our customer offerings, our mobile subscriptions stood at 42 million as at 31 March 2022 while our Voice traffic share stood at 67.8% as per the March 2022 Communications Authority Industry Statistics quarterly report.

Voice revenue rose marginally by 0.8% YoY to KShs 83.21 billion attributed to increased Customer Value Management (CVM) initiatives enabling us to offer differentiated value propositions and personalised offers to our customers. Messaging revenue declined 20.0% to KShs 10.88 billion in the year in line with global industry trends as customers migrate to newer technologies. Voice and messaging revenue now account for 33.5% of Service Revenue.

Mobile data revenue recovered strongly in H2 FY2022 growing 10.0% YoY to 24.81 billion, 6.3% in H1 FY2022 to KShs 23.63 billion and 8.1% YoY in FY2022 to KShs 48.44 billion, supported by our CVM initiatives driving personalised offers to our customers. Data performance in H1 FY2022 was weighed down by absorbed excise duty adjustments from August 2021 which slowed down industry momentum and price rationalisation efforts.

Average rate per MB declined further by 31.2% YoY to KShs 8.88 cents while usage per chargeable data subscriber grew 60.5% YoY to 2.3GB. Mobile Data ARPU increased 10.4% to KShs 205.73. The launch of “Mwelekeo Ni Internet” campaign launched in November 2021 introduced affordable data offers and new use cases effectively driving affordability and usage.

Active 4G devices on our network rose 29.3% YoY to 10.95 million of which 51.3% are 4G handsets using more than 1GB. Data customers using more than 1GB in our network grew 26.5% YoY to 7.7 million. Mobile data now accounts for 17.2% of Service Revenue. 4G population coverage now stands at 97% and smartphones on our network grew 10.2% to 18.5 million.

We remain committed to investing in a superior network quality for our customers and deepening mobile internet penetration through enhancing network coverage, increasing 4G handset penetration and driving affordability of data. CVM initiatives have continued to unlock latent potential in usage and growth as well as drive smartphone penetration through our device financing programme.

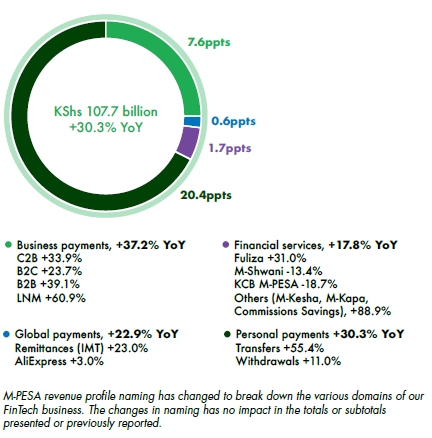

M-PESA revenue rebounded strongly as we celebrated 15 years in the market, recording a 30.3% YoY growth to KShs 107.69 billion. This was supported by resumption to charging of previously zero-rated transactions beginning January 2021. Increased usage continues to fuel growth as one-month active M-PESA ARPU rose 18.9% YoY to KShs 305.37 while chargeable transactions per month per customer grew 16.6% YoY to 20.25 transactions.

One-month active M-PESA customers crossed the 30 million mark in the year growing 7.8% YoY to 30.53 million. Velocity in the ecosystem continues to grow driven by our FinTech solutions including payments, lending and savings and international remittances.

Total value of M-PESA transactions grew 34.0% YoY to KShs 29.55 trillion while volume of transactions grew 34.9% YoY to 15.75 billion. M-PESA wallet-to-bank and bank-to-M-PESA wallet transactions continue to be free and these account for 18.9% of the total value of M-PESA transactions and 3.2% of total volumes.

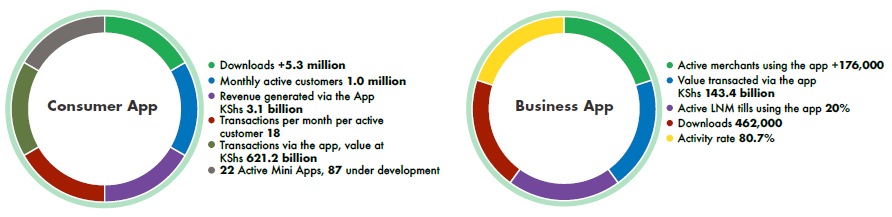

M-PESA is now the biggest revenue contributor accounting for 38.3% of service revenue while voice contributed 29.6%. During the year, we launched the M-PESA Super App for customers and M-PESA Business App with Mini-Apps functionalities to power digital consumer lifestyles and empower businesses. Downloads for the Super App stood at 5.3 million while Business App downloads were 462,000 as at year end.

We recorded double-digit growth in fixed data driven by increased demand for home fibre due to work from home, a trend that has become normalised as companies adopt hybrid ways of working. Our fixed data market share stood at 35.8% as at March 2022 followed by Wananchi Group at 28.1% and Jamii Telecommunications at 20.4% as per the Q3 (January–March 2022) CA Quarterly Statistics report.

Fixed service and wholesale transit revenue grew 18.3% YoY to KShs 11.24 billion driven by increased activity and penetration of Fibre to the Home (FTTH) and growth in Enterprise fixed data revenue. The growth was supported by 16.9% increase in Enterprise revenue to KShs 7.05 billion as well as 20.6% growth in Consumer revenue to KShs 4.19 billion. FTTH customers grew 20.8% YoY to 165.98k. Fixed Enterprise customers grew 24.1% YoY to 48.31k, of which 58.9% account for LTE customers and grew 33.2% YoY to 28.47k. FTTH penetration now stands at 52.9%, homes connected stood at 193.1k while homes passed were 364.98k as at 31 March 2022.

Our transformation into a technology company is well on track and our focus in FY2023 is to accelerate new growth areas to complement our organic growth strategy. On a small base, we are encouraged by the impressive growth recorded by these growth areas including IoT, ICT, Content aggregation and DigiFarm among others.

DigiFarm generated revenues of KShs 0.4 billion which more than doubled compared to prior year driven by increase in sales. Our IoT business which majorly serves the enterprise clients also grew their revenue by 64.5% driven by new connections which grew 67% to close at 1.2 million. Content revenue on the other hand recorded KShs 0.5 billion in revenues from video streaming services after launch of the Baze platform, gaming subscriptions and educational content. Our ICT (cloud and hosting services) revenue stood at KShs 0.4 billion and continues to be an area of growth with great potential.

We are committed to delivering diversified and differentiated offerings to our customers so as to meet their constantly evolving digital needs and further strengthening and growing our relationships with them. The SME and MSME segments remain a key contributor to business activity and growth of our economy. We are enhancing our service offerings to these segments and will continue offering technology driven solutions to the markets we serve so as to become the number one provider of technology solutions in our markets.

We continued with sustained investment in our network and systems to support capacity upgrades and user experience. Our Group capital additions for the period increased by 42.4% to KShs 49.8 billion, with the Ethiopia operations portion being KShs 10.4 billion. The Ethiopia capex split included:

- KShs 8.3 billion for network

- KShs 0.9 billion for IT

- KShs 1.2 billion for other capital expenses

We revamped our approach in capital allocation in line with our strategic pillar of accelerating new growth areas. This will assist us in focusing on fuelling more innovations and solutions as we transform into a purpose-led technology company.

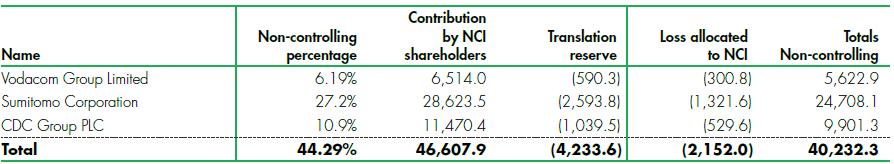

FY2022 is the financial year we ventured into our first cross border investment – Ethiopia. Safaricom PLC in partnership with Vodacom Group, Sumitomo and CDC partnered to invest in Ethiopia. Safaricom PLC and Vodacom Group through the Vodafamily Ethiopia Holding Company Limited (a private limited company incorporated under the laws of England and Wales, United Kingdom), Sumitomo and CDC incorporated the Global Partnership for Ethiopia (GPE) B.V. (a private limited company incorporated in the Netherlands), as the investment vehicle to Ethiopia with the respective shareholding into the company being Vodafamily Ethiopia Holding 61.9% (Safaricom PLC 55.71%, Vodacom Group 6.19%), Sumitomo Corporation 27.2% and CDC Group PLC 10.9%. The intention was to bid for one of the telecommunications licences in Ethiopia. On 26 April 2021, the GPE submitted a response to the Request for Proposals (the “RFP”) by the Government of Ethiopia (the “GoE”) that was issued by the Ethiopian Communications Authority (the “ECA”).

On 24 May 2021, the ECA formally notified the GPE of its decision to award it one of the two telecommunication licences that were available in the bid process. Licence fee paid was USD 850 million to Government of Ethiopia. In addition, a transaction fee of USD 4 million was paid to the International Finance corporation (IFC). The total cost was distributed proportionate to each consortium partner shareholding in GPE.

GPE thereafter incorporated a fully-owned subsidiary in Ethiopia – STE and the certificate of operation was issued on 6 July 2021 as per the requirements of Ethiopian regulation. The indirect shareholding of Safaricom PLC in STE is 55.71%. STE’s primary purpose is to hold and operate a full-service telecommunications licence granted to GPE by the Federal Republic of Ethiopia. The subsidiary was established within the current financial reporting period and has been consolidated in the Group’s 31 March 2022 financial statements.

Below is the contribution for non-controlling interest (NCI) arising from their ownership in GPE and STE:

See more on Safaricom Ethiopia here.

Being the first year after setting up operations in Ethiopia, we consolidated the entity 100% in our financial performance. While there was no revenue generated in year one, we invested capital in setting up operations in readiness for launch this year as well as incurred operating expenses and took up debt financing to fund these activities during the period.

The OpCo incurred KShs 5.11 billion in operating costs and there being no revenue, incurred a loss of KShs 4.86 billion. We also spent KShs 10.4 billion in Capex.

The summarised financial information of Vodafamily Ethiopia Holding Limited Consolidated is provided on page 245 of the financial statements.

Impact of Ethiopia consolidation in year one on:

- Debt position and financing costs

To support the payment of licence fees for the telecommunications license awarded to the Safaricom-led consortium by the Government of Ethiopia in 2021, we undertook a one-year bridge facility of USD 400 million to finance this venture. During the year, the bridge facility was converted into a five-year long term facility of USD 120 million and a KShs 31.1 billion (USD 280 million KShs equivalent) seven-year with two years moratorium on principal repayment. The new facility was done through a syndication process where both local and international banks participated in. Our net debt position therefore closed the year at KShs 34.53 billion. This therefore resulted in KShs 4.66 billion incremental financing costs for Safaricom Ethiopia and was fully consolidated in the books of Safaricom PLC Group. - Net income

Safaricom Kenya net income grew by 12.1% to KShs 77.01 billion, excluding financing costs related to Ethiopia, and supported by growth in EBIT. This was partly weighed down by higher taxes after the reversion of corporate tax rates to 30% from 25% in 2020.

On a consolidated basis including our Ethiopian operations, our net income (PAT) grew by 1.4% to KShs 69.65 billion, excluding Ethiopia loss attributable to minority interest.

During the year, an interim dividend of KShs 0.64 per Ordinary share amounting to KShs 25.64 billion (2021: KShs 18.03 billion) was declared. At the AGM to be held on 29 July 2022, a final dividend in respect of the year ended 31 March 2022 of KShs 0.75 per ordinary Share amounting to a total of KShs 30.04 billion is to be proposed for approval. This brings the total dividend for the year to KShs 55.69 billion (2021: KShs 54.89 billion) which represents KShs 1.39 per share in respect of the year ended 31 March 2022 (2021: KShs 1.37 per share).

We remain committed to delivering a consistent return to our investors. I believe we are well positioned to deliver on this promise as we pivot into the next phase of growth. We are pleased with the improving macro-economic environment and the economic tailwinds realised in the year supporting the market’s recovery and consumer spend, however, we remain cautious of the increasing inflationary pressure seen after year end in the country.

Despite heightened regulatory risk in the year, we are hopeful that the regulatory environment will be predictable and will continue to encourage investment in a critical industry for the benefit of the country and Kenyans. We also remain mindful of the increasing geopolitical risks and the export-import supply chain disruption arising thereof, affecting global oil prices as well as the increasing political risks ahead of the August General Elections in Kenya.

In view of this, for FY2023 we expect:

- Group performance including Ethiopia

Group EBIT to be in the range of KShs 87 to 93 billion; and

Capex to be in the range of KShs 100 to 108 billion. - For Safaricom Kenya excluding Ethiopia, we expect:

EBIT to be in the range of KShs 120 to 123 billion and;

Capex to fall within KShs 40 to 43 billion.

Guidance for Safaricom PLC Kenya (excluding Ethiopia) does not include any changes in the regulatory environment

(MTR determination pending the ongoing appeal) and the unforeseen impact from the Russia-Ukraine conflict if it persists.

In the short- to medium-term, we will be expanding our financial services offerings to cover wealth management, insurance and credit. We will also be seeking to redefine customer engagement with high quality, seamless and personalised experiences.

In addition, with the growth of global trade and international remittances we will focus on introducing innovative products to support global online payments and transfers. We will also be leveraging partnerships to grow mobile money channels and diversify their revenues – all through an increased range of FinTech innovations which will further enhance financial inclusion.

My appreciation goes to the Board of Directors for their great steer through out the year.

I would like to also thank my team for their exceptional input and commitment during the year, as well as all my colleagues across the Group whose hard work and unstinting support in executing our strategy, has helped deliver the excellent results that we have shown.

Our enduring industry leadership in coverage, capacity, and innovation, are the result of slightly over two decades of steadfast support from our customers, many of whom have been with us since day one. Thank you to all our customers.

I would also like to thank all our stakeholders, and in particular our shareholders and investors for the loyalty, trust and confidence they have shown in Safaricom, its strategy and operations. Their support continues to add great value to the Group.

Dilip Pal

Chief Finance Officer

Strategic performance review

Assessing and monitoring our performance constitutes an important part of our strategy execution. During the year under review, we mapped our activities, innovations, products, services and initiatives against the strategic goals associated with the four pillars of our strategy.