OVERVIEW

Despite a challenging year for all businesses, we have made good progress on our strategic objectives, providing a sturdy foundation to build on as the global economy begins to recover from the COVID-19 pandemic.

Safaricom was able to adapt easily to the need for staff to work from home and this new workforce modality came with the advantage that it increased the demand for mobile payments and both fixed and mobile data. This softened the effect on revenue of the strict lockdowns in the first two quarters, especially for financial services.

Our top three strategic achievements during FY21 were:

- An improved NPS

- Increased broadband penetration (4G and Fibre-to-the-Home)

- Increased use of mobile money (M-PESA) for both personal and business use

![]()

Defending voice through use of Customer Value Management (CVM) platforms

Owing to our accelerated customer targeting efforts through the CVM platforms and Tunukiwa, we gained 4.5 percentage points on voice traffic share to 69.2%, voice outgoing minutes per subscriber grew 19.1% YoY and incoming minutes grew 16.2%. Voice and messaging are now 38.4% of our service revenue.

![]()

Democratising data through devices, network coverage and use cases

Devices

Smartphone uptake continues to increase, driven by the decline in prices through our Lipa Mdogo Mdogo campaign, enabling more people to gain 4G mobile internet connectivity for as little as KShs 20 per day and our use of data and analytics to create personalised credit scoring that has driven device financing uptake. Lipa Mdogo Mdogo has put a 4G smartphone in the hands of 200,000 Kenyans to date. This represents a growth of 39.8% YoY in 4G devices and will have been partially responsible for the 31.1% growth in data customers using more than 1GB.

We have also launched the M-PESA Africa Joint Venture, partnered with Google and Facebook for device financing.

Network coverage

During FY21 we accelerated the rollout of our 4G and home fibre networks and now provide broadband coverage to over 90% of the population. Our 4G coverage stands at 94% with 100% coverage expected by the end of the year. Our fibre penetration rate grew by 15.6 percentage points to 58.5% for the period, contributing to a growth of 31.5% in FTTH customers to 137,400.

According to an Ookla report in April, Safaricom remains the fastest and most consistent mobile provider in Kenya, with the highest 4G availability.

In March we were the first mobile operator in Kenya to launch a 5G network for both individual and enterprise customers in Nairobi, Kisumu, Kisii and Kakamega. This marked a major milestone for the country, since 5G will enable the rollout of high-speed internet more quickly than fixed-line services such as Home Fibre, while increasing broadband speeds far beyond 4G capabilities.

Use cases

We are working continually to expand the number of use cases for our products by targeting people’s passions and necessities, such as music, gaming and education. This has the effect of increasing uptake of 4G devices, which is a factor in growing our broadband internet product uptake and usage, increasing use of our financial services and other platforms, thereby increasing revenue and driving a cost optimisation journey to fuel new growth areas.

Our MobiPlay Challenge, an annual mobile phone gaming platform where gamers compete and accumulate points for daily or grand prizes, has played a part in accelerating the growth of online gaming in Kenya. Worldwide, online gaming has increased by 73% in the last year, making it one of the fastest growing sectors in the telecommunications economy.

![]()

Expand enterprise portfolio: IoT, ICT, FTTH/FTTB

Internet of Things (IoT)

LoT has become a necessity for many industries around the world. We are leveraging IoT to expand our enterprise portfolio. We have now offered relevant solutions to 726,000 IoT customers, representing a growth of 5.7% YoY.

IoT is connectivity agnostic, be it Narrow Band IoT (NB-IoT), GSM including the recently launched 5G, Wi-Fi, Bluetooth Low Energy and others, therefore enabling multiple applications ranging from industrial applications for large enterprises and the public sector to asset management offerings for small- and medium-sized business customers in the retail, hospitality and transport sectors. Several IoT products and services have already been developed and deployed that include

- Vehicle Telematics to serve fleet managers and insurance companies to better monitor and understand the movement and performance of their vehicles

- Asset Tracking: Connected Coolers is an asset management solution that has been successfully deployed for Kenya Breweries Limited, with a value proposition that supports their ‘Cold Serve’ strategy, ensuring their assets are used for the purpose of offering their products countrywide at the desired temperature, and Smart Keg, whose value proposition is to increase the number of turns, thus not only reducing asset loss but also increasing sales. Asset tracking is also being required to track assets in the oil and gas industry (specifically Liquid Petroleum Gas)

- Smart Utility Metering for both the water and power sectors, whose value proposition is loss reduction, which in both cases would positively impact resource utilisation, with downstream benefits to customers and the community at large

Information and Communications Technology (ICT)

Leveraging technology is a vital aspect of Safaricom’s growth strategy. Our aim is to be the technology partner of choice for businesses. Safaricom experienced positive movement of the network and IT systems in FY21, driven by completion of key upgrades and activities that led to stability and great customer experience, especially during the festive season. With our network coverage currently at 94% of the country, this especially has been driving our ICT agenda. Investment in 4G and 3G capacity upgrades improved user experience in both voice and data.

Our milestones this year were:

- 4G accelerated rollout to match 2G coverage at 94%

- Launch of 5G network

- Digital Academy second cohort to upskill the workforce

- M-PESA Super App

- Lipa Mdogo Mdogo device financing supported 4G and LTE uptake to drive network efficiencies and provide better customer experience

- Deployment of Anti Money Laundering (AML) platform to reduce fraud

- IoT platform enabling digitisation in key verticals

- Launch of new MySafaricom app

- Hackathons to drive innovation

- Chaos engineering introduced as part of operations’ stability processes. Set up of Service Operations Centre for monitoring IT services

- Growth of our software engineering practice including launch of new Agile squads/tribes

- Consent management for data privacy

The benefits of implementing technology-driven processes outweigh the costs of initial investment by improving our agility and our customers’ satisfaction.

Technology was at the heart of Safaricom’s resilience to the pandemic, enabling the largest call centre in the region to transition to working from home. Cloud-based productivity tools were already being used prior to the pandemic, including several key operations support and business support systems providing ubiquitous access in line with our security configurations. We have entered into a strategic engagement with Amazon Web Services, where we are a support partner, enabling other enterprises to migrate to cloud computing.

Safaricom’s existing digital channels (website, MySafaricom app, Zuri chatbot and USSD) also facilitated good communication with customers during the lockdown periods, providing 24/7 support to supplement the contact centre.

During the year, our pilot technology initiatives included e-SIM, Open Compute, content and media and 5G technology, positioning Safaricom as a technology innovator. The female representation in Technology stands at 25%.

Our ICT goals for the coming year are:

- Automation to simplify and improve customer journeys and improve internal operations

- To grow customer interaction on digital channels

- Use artificial intelligence (AI) to improve operational efficiency

- Expand the software engineering practice

- Create an enabling and insights-driven organisation

FTTH/FTTB

Our fibre rollout continues at speed to connect enterprises and households to stable and quick fibre networks, driven by the high requirements of working and learning from home. We have now laid 10,080km of fibre, which has enabled us to extend our reach, as mentioned above.

FTTB customers and revenues have been on a growth trajectory after the decrease earlier in the year as offices closed and people worked from home. However, since August we have seen increased activity as the economy reopened. The fixed business growth has also been accelerated by LTE for the areas where we don’t have FTTH coverage.

In March, we permanently adjusted the bandwidth for our Home Fibre customers, extending the offer given when the COVID-19 pandemic started. This effectively means that Home Fibre customers get about double the bandwidth they have paid for, while Diamond Package customers get more than double the speed at 250%. Under the adjusted packages, customers on the Gold and Diamond Packages enjoy the Secure Net services in their packages.

![]()

Win in FTTH/FTTB as a converged business

The convergence of FTTH and FTTB forms part of our broader strategy to expand our enterprise portfolio and will be an area of focus in the future, as our fibre footprint grows.

![]()

Create a fintech anchored ‘platform of choice’ for empowerment of SMEs/MSMEs

As part of our vision to create a fintech-anchored ecosystem that is the platform of choice for SMEs, we launched the transaction M-PESA till for our merchants that allows them to do more on the till. Our one-month active Lipa na M-PESA tills grew by almost 75% YoY to around 302,000. This now contributes more than KShs 40 million per month in revenue.

For the MSMEs we are accelerating the Pochi la Biashara product that allows these MSMEs to separate their business and personal funds on M-PESA. We have onboarded 935,000 Pochi la Biashara merchants and now have 34,000 active Pochi merchants and 145,000 active Pochi customers.

On the GSM front we have launched Shiriki, targeting the connectivity needs for the MSMEs and for the long term we are working to launch a lead generator to create a discovery platform for onboarding SMEs.

![]()

Expand the core financial services into new geographies

Our joint acquisition of M-PESA with Vodacom in 2020 gave us full control of the M-PESA brand, enabling us to consolidate support and platform development. We have launched the M-PESA Africa Joint Venture, partnered with Google and Facebook for device financing. As part of the objective to consider opportunities beyond Kenya’s borders, Safaricom and its consortium partners were awarded one of the two full service mobile telecommunications licences advertised by the Ethiopian Communication Authority (read more on page 40).

![]()

Next financial services: wealth management, savings, insurance, credit

In line with our promise to transform lives, we are in a development phase to launch truly mobile-centric solutions for wealth management and insurance subject to regulatory approvals. In this way, we will be shifting financial services towards inclusive finance, helping customers manage liquidity, risk and investment while creating a stronger focus on customer experience.

M-Shwari now incorporates options to lock in funds and earn better interest than a basic savings account. Using big data and artificial intelligence we have built credit-scoring algorithms that allow us to lend to customers based on their ability to pay.

Fuliza has remained our most popular loan product during FY21, with a 61.3% YoY growth in revenue to KShs 4.5 billion and more than 100% growth in daily active Fuliza customers, now standing at 1.4 million.

The average value of M-Shwari loans in FY21 increased by 26.3% to KShs 5,575.0, leading to a revenue increase of 15.5% to KShs 2.2 billion.

KCB-M-PESA maintained a healthy 100.3% repayment versus disbursal rate although revenue and one-month active customers fell by around a third during the period under review. This is balanced out by the increases seen in the M-Shwari and Fuliza services over the same period.

![]()

Smart lifestyle channel: M-PESA App

M-PESA continues to be a market leader offering diverse opportunities for customers. We have seen our M-PESA agents growing by 43.1% YoY during this period, as consumers looked for ways to avoid face-to-face interactions to protect their health.

In January we launched an M-PESA Bill Management service. This innovation targets schools, landlords, utilities and other businesses with repeat payments, offering a platform where they can present and receive pending payments from customers, and issue electronic receipts. For M-PESA customers, the service offers a single point where they can view all their bills, receive reminders and automate payment of bills. With automatic bill tracking and reconciliation, the service saves customers from having to queue to make payments in person, reducing COVID-19 health risks.

In February we partnered with Forward Travelers to offer an M-PESA fare collection solution to commuters in Nairobi. The service is powered by Simple Fare, a mobile and financial integration technology developed by Netcen Interactives that enables commuters to pay fares through Lipa Na M-PESA, with the payment immediately reflecting to the bus crew’s phones.

In March we partnered with the Higher Education Loans Board (HELB) to roll out a smart mobile payment solution for students of tertiary institutions to access and use their loans and bursaries. The solution aids HELB to promote responsible spending with the funds locked for specific allocations, such as tuition or library fees only accessible to the specific Paybill account of the recipient’s university or TVET institution. The student’s upkeep allowance can now also be transferred into the student’s M-PESA wallet for everyday use. The solution also reduces queues during registration as students can now pay through their mobile phones, reducing COVID-19 health risks.

![]()

Integrated business solution: Business App and payment aggregation platform

In June we launched the Lipa na M-PESA business app for smartphones for more than 170,000 merchants using the service. Dubbed M-PESA for Business, the app empowers business owners to access real-time statements, export statements and track their business performance on the go. Through the app, entrepreneurs can withdraw funds from Lipa na M-PESA to their M-PESA accounts, bank accounts or at an agent. In addition, business owners with an M-PESA business till can now use the app to send money to other M-PESA customers, including paying wages and supplies and making payments to other businesses.

In October we launched Pochi la Biashara (‘business wallet’), which enables micro and small business owners to separate their own M-PESA wallets from their business transactions. This innovation prevents reversal of payments without the approval of the business owner, as this unethical practice by some of their customers had become a threat to their survival. It also prevents the business owner from seeing the customer’s personal number, providing privacy to the customer.

![]()

Universal payment network: enhanced merchant interoperability and enable e-commerce and cross-border payments (M-PESA Global)

In FY21, M-PESA Global’s one-month active customer base grew by 49.1% to over 823,000 and revenue grew 54.5% to KShs 2.01 billion.

Our strategy to focus on and win in select digital ecosystems centres on our DigiFarm programme and our M-TIBA product.

Not surprisingly, M-TIBA has been a critical element of providing healthcare to ordinary Kenyans throughout the COVID-19 pandemic. Health insurance used to be seen as challenging to do at scale and at a low cost and managing multiple providers, brokers and agents was seen as too complex. When the pandemic struck, there was a major incentive for the whole healthcare sector to go cashless and quickly roll out mobile and digital services. M-TIBA was there as a proven payment, data and claims platform. The platform now manages over 3,000 providers and multiple insurers and is the only platform that allows a client to know the exact amount they have spent on a visit.

M-TIBA is helping insurers reduce the cost of scheme management by between 15% and 20%, meaning they can now concentrate on developing new customer-centric digital products for the mass market. In September 2020 M-TIBA’s work was applauded by Fortune Magazine for its reach to 4.7 million people since its launch in 2015.

![]()

Scale DigiFarm in a commercially sustainable way

In FY21 the number of active DigiFarm customers grew by 45% to almost 63,000 farmers, a little ahead of our business plan. This resulted in 62% revenue growth to KShs 154 million, which was 23% ahead of plan, and a reduced NPL exposure by 36 percentage points from 74% to 38% due to our enhanced model. We were able to secure a KShs 35 million NPL risk guarantee from FSD Kenya. Owing to our in-house product development resulting in faster turnaround, we project savings of KShs 78 million in FY22.

An impact study showed a 200% increase in farmer livelihoods on DigiFarm, reflected in the NPS, which improved from 48 to 53.

![]()

Healthcare inclusion through digital healthcare services

Healthcare has been an obvious area of need in Kenya in the past year. Aside from the continuation of the 24/7 COVID-19 Information Centre, which is run in partnership with Kenya’s Ministry of Health, we have been able to improve healthcare inclusion through our digital healthcare services.

In April, Safaricom partnered with Nakuru County to improve health services for over 100,000 people through an integrated electronic medical records programme called Afya Moja. Afya Moja is a simple, mobile-based digital health passport that receives and securely stores patient information. It allows users to access a copy of their own health information and the ability to share it with trusted health providers. It allows doctors, with consent, to access patients’ medical backgrounds and therefore respond effectively to their needs.

An initial eight hospitals will benefit from this partnership including PGH Nakuru Level 5 Hospital, Naivasha Sub-County Hospital, Molo Sub-County Hospital and Keringet Sub-County Hospital. Other hospitals in the pilot are: Soin-Mogotio Sub-County Hospital, Kiptangwany; Health Centre, Mirugi Kariuki Sub-County Hospital and Gilgil Healthcare Medical Centre. Afya Moja will be rolled out in different counties in the coming months, leading to a full adoption countrywide.

![]()

Enabling access to online learning

We extended free access to digital educational content for primary and secondary school students into September 2020 following the extended closure of learning institutions. The content, which was approved by the Kenya Institute of Curriculum Development, had been free to access from April 2020. More than 10 million education bundles were redeemed to access e-learning platforms, while over 1.8 million learners accessed the SMS-based Shupavu291 platform by Eneza Education.

![]()

Drive cost optimisation to fuel growth in new areas

In FY21, our cost optimisation drive resulted in savings of KShs 6.9 billion that can now be used to fuel growth in new areas. These savings were achieved through smart procurement, automation, digitisation and operating model transformation.

![]()

Smart procurement, automation, digitisation and operating model transformation

Through this cost leadership pillar of our strategy, we were able to yield cost savings that helped alleviate the pressure on EBITDA margin. We achieved an opex reduction of 3.2% YoY and made KShs 6.9 billion savings in FY21.

Smart procurement

We are rolling out the cost leadership programme to drive productivity and efficiency within the organisation to fund the growth and expansion of agenda items. Our cost optimisation programme has been driven by three main areas:

- Cost avoidance: Reviewing our activities around marketing, travel, accommodation and utilities in light of the COVID-19 pandemic

- Cost efficiencies: Reviewing network contracts and existing facilities for optimisation

- Procurement: Changing delivery incoterms, changing shipping mode from air to sea and rate volume negotiations on various contracts

Digital First

- All divisions embarked on digital initiatives in FY21, delivering KShs 1.6 billion savings and KShs 3.3 billion digital revenues. The initiatives included customers using the mySafaricom app and Zuri chat bot as a safe replacement for in-person visits to help prevent the spread of COVID-19 virus.

- See Keeping the Spirit of Safaricom alive even with remote working on page 81 for further information.

Highlights of our Digital First drive this year were:

- 57% to 66% increase YoY in unassisted contacts through agile ways of working

- 207 daily manhour savings from increased usage of digital channels by our customers

- Toll-free information centre handling queries on COVID-19 and escalating public enquiries to Ministry of Health:

15 dedicated agents

40 million queries addressed via USSD

2.7 million responses via interactive voice response system

479,000 calls answered

| Key outcomes from Digital First | ||

| Objectives | ||

| Cost savings | Digital revenue | Digital NPS |

| Key priorities | ||

|

|

|

| FY21 outcomes | ||

| KShs 1.6 billion digital cost savings | KShs 3.3 billion digital revenue | Improved transactional NPS |

Operating model transformation

Platforms

We continue to revamp and scale up digital assets. Key priorities to drive up revenue included promoting higher adoption of digital assets, better use of analytics and higher usage of digital media. In FY21, KShs 3.34 billion revenue was generated via our digital initiatives.

Processes

Digitising processes across all functions continues to drive cost savings and service improvements.

People

Our mission is to establish a future-fit talent and agile organisation through shaping an effective and efficient agile organisation, with a plan to complete rollout in FY22.

We embody the Spirit of Safaricom by ensuring our staff live our purpose and spirit. Customer Obsession, Purpose, Innovation and Collaboration have been identified as key pillars in driving strategic milestones, along with consistent application of our language, rituals, symbols and stories.

To guarantee critical talent and future skills, our skills development strategy is underpinned by the 6Bs: Buy, Build, Borrow, Bounce, Bot and Bind.

In line with our vision to be a technology company by 2025, we have prioritised digital skills (i.e. big data analytics and science, AI, IoT, RPA 9 robotics process automation) and agile fundamentals under agile leadership.

We have also been encouraging each staff member to acquire one more skill, a key differentiator on our journey towards becoming a purpose-led technology company. The #1MoreSkill initiative has been a key driver of our new strategy towards an agile organisation with a focus on customer obsession.

See People and organisation on page 80 for further information.

Performance

Our performance is governed through our monthly digital steering group. This ensures the execution of the digital strategy through leadership, digital KPIs, impact measurement and data privacy regulation compliance.

ENHANCING OUR FOUNDATION ENABLERS

Customer engagement

- Improved customer experience (NPS)

- Reduced M-PESA fraud cases

- Uptake of customer DIY solutions

Data and analytics

- Credit scoring models that have helped to lower non-performing loans

- CVM Model that has increased personalised offerings

- Workforce planning forecasting model to predict and plan for workforce requirements across three call centres 60 days in advance

Network and IT

- Increased mobile and fibre network rollout

- Improved network and systems uptime/resilience

- Trial of new technologies: IoT and 5G

- Capacity support with increased mobile/fibre data demand during onslaught of pandemic

- Digitisation and automation of internal processes

M&A and partnerships

Partnership with M-Gas

In January 2020, we launched a revolutionary prepaid gas service for Kenyan households in partnership with M-Gas. The innovation will empower millions of Kenyan homes to enjoy access to clean, affordable and reliable cooking gas, providing them with the flexibility of purchasing gas based on their needs and how much they can afford at a time. The programme tackles existing access barriers to clean cooking by eradicating the upfront cost required for a gas cylinder and gas cooker. Each M-Gas setup includes a gas cylinder and a two-burner gas cooker which is provided to customers at no upfront cost. The gas cylinder comes equipped with an innovative smart meter that shows how much gas a customer has paid for and how much they have remaining. Payments are made through M-PESA with the gas automatically disconnecting when a customer has completely consumed the paid amount.

Partnership with Amazon Web Services

In February 2020 we entered a strategic partnership with Amazon Web Services (AWS) to facilitate the region’s ability to grow successful businesses through leveraging the depth and breadth of AWS Cloud Services, which provide easy access to emerging technologies such as big data, IoT, machine learning and artificial intelligence. We chose to partner with AWS because it offers customers the broadest and deepest cloud platform. This agreement will allow us to accelerate our efforts to enable digital transformation in Kenya.

Spark Fund – reviewing the portfolio

Safaricom Spark Fund invests in start-ups in the late-seed, early growth stage. To date we have invested USD6 million in six start-ups: Sendy, Ajua, Eneza, iProcure, Lynk, and Farmdrive.

- Sendy continues to be one of the leading logistics providers across Kenya and has since expanded into Uganda. They launched Sendy Go to facilitate deliveries directly to consumers in partnership with supermarket chains as a response to COVID-19 and Kiota, a platform to enable retailers to make orders directly from manufacturers

- Ajua is building an integrated customer experience platform for Africa enabling businesses to connect with consumers in real-time in highly fragmented markets. Over 4 million users have interacted with their platform to date, with a presence in Kenya and Nigeria. During the COVID-19 period they launched Stay Alive and Thrive business webinars to guide their clients in navigating the pandemic

- Eneza has over 5 million lifetime users in Kenya, with more than 50 million messages sent to date on the platform. It entered into an agreement with Safaricom to open up Shupavu 291 to all learners in the country from April 2020 as a response to COVID-19 and has since expanded into Cote D’Ivoire, Ghana and Rwanda

- iProcure provides access to quality, affordable inputs and seeks to impact more than 7 million smallholder farmers. It currently works with more than 3,000 agrovets across the different counties in Kenya and has since expanded into Uganda

- Lynk was part of the Safe Hands Kenya coalition, taking the lead in providing handwashing supplies and installation and maintenance of handwash stations to limit exposure to COVID-19 in informal settlements. Of the workers on the Lynk platform, 86% have reported increased income

Shupavu 291 Partnership with Eneza Education

In 2020 Safaricom partnered with UNESCO and Eneza Education to implement a digital mentorship programme for high school students interested in Science, Technology, Engineering and Mathematics (STEM). The programme involved working with role models and mentors to provide students with information on STEM subjects to enable them make informed career choices. The programme leveraged Eneza’s existing Ask a Teacher platform on Shupavu 291, giving students access to mentors and information on STEM subjects via Safaricom’s SMS service.

People and Organisation

Support for remote working staff during the pandemic period

Safaricom’s workforce is its lifeblood and therefore the transition to 70% of the staff (80% of call centre staff) working remotely required expenditure and new ways of communicating with employees and developing their skills.

We directly supported our staff with access to medical cover including COVID-19 testing to ensure their health and spent over KShs 0.25 billion on PPE and protective measures to ensure their safety. We introduced a virtual process for purchasing electronic airtime to minimise human interaction at dealer and agent points. To ensure organisational stability, we renewed expiring contracts for more than 600 staff.

We kept up regular communication with all staff, including live forums with periodic updates, SMS, Zoom meetings and video messages; we conducted regular monitoring surveys; and we performed an awareness check every Monday and Friday, where employees received a message and were required to respond.

We provided 77% of staff with working tools and skills including laptops, seats and online training courses and e-classes to keep skills sharp. By year end, we had held 22 webinars with over 5,000 participants on various psychosocial topics.

Keeping the Spirit of Safaricom alive even with remote working

Before COVID-19 struck, the Safaricom call centres were a hive of activity as hundreds of staff converged in one space. While the pandemic demanded social distancing, our customer care engagement had to go on, but isolation would negatively impact the Spirit of Safaricom.

When the pandemic struck, the Information Technology Department needed to minimise disruption of critical functions as they transitioned staff to work from home. A solution had to be found for the 2,000 call centre agents who normally worked from desktops. Sourcing laptops urgently proved difficult due to closed borders so the team equipped agents to work remotely using a Virtual Desktop Infrastructure Over Internet Solution using the cloud. This meant agents could use different devices without depending on a computer or laptop.

The call centre agents were sent step-by-step self-help guides for different systems to help manage the transition to remote working in case of challenges. When necessary, they could call the service desk. Constant communication was maintained through existing staff communication channels and frequently asked questions compiled and distributed. Through various collaboration tools such as Abby Chatbot that significantly brought down the number of inquiries by enabling employees to do routine tasks such as resetting and unlocking passwords; Microsoft Teams , Yammer and Zoom have allowed employees to continue remotely communicating with each other and keep the Spirit of Safaricom alive.

These collaboration tools enabled the staff to maintain their close connection and keep the Spirit of Safaricom alive, despite their distance. This has meant that our customers have not noticed any change in service. We remain

customer-obsessed and have not dropped on any service level agreements.

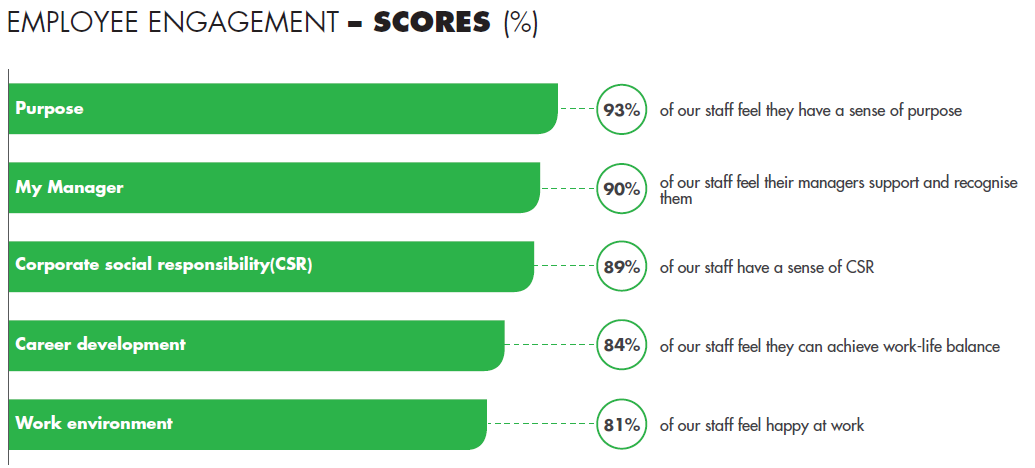

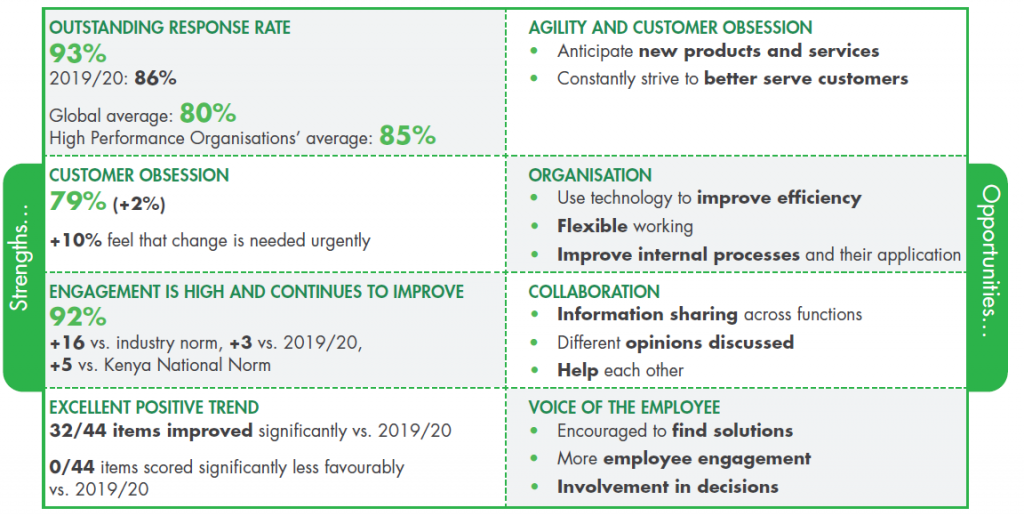

Increased employee engagement as evidenced by feedback from staff surveys

2021 key highlights

Launch of agile organisation and culture

In line with our strategy, we have started revising our ways of working in pursuit of an ‘agile’ approach that brings decision-making closer to customer-facing employees and to the customers themselves. This has been reflected in the period under review by the Group’s organisational restructure into agile and innovative ‘tribes’ and ‘squads’, the launch of the #1MoreSkill initiative to encourage our staff to expand their skills, including developing agile leadership, and has seen an increase from 57% to 66% in unassisted contacts.